In continuation of our discussion on reversal patterns, there is one more pattern called “Piercing” pattern. This piercing pattern is the opposite to “Dark-Cloud” pattern. So, the piercing pattern is a bottom reversal pattern, while dark-cloud pattern is a top reversal pattern.

When we say reversal, it means the price trend changes direction. This direction can be upwards or sideways for sometime. So, a downtrend need not immediately start moving in an upward direction. The price can also move sideways and the price action can take its course. Let us take a look at piercing pattern in detail.

Identifying a Piercing Pattern

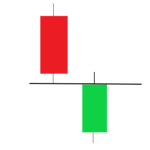

To identify piercing pattern, we have to take a look at two consecutive candlestick as a pair. In addition, the overall trend must be a downward trend. The 1st candlestick is a bearish candle with a red long body and the 2nd candlestick is a bullish green candle with its opening below the low of 1st bearish candle and the 2nd green bullish candle must close above 50% of the body of 1st bearish candle.

Similar to dark-cloud pattern, in the piercing pattern, the penetration of the the 2nd bullish candle must be significant. If the 2nd bullish candle does not close above 50% of the body of the 1st bearish candle, then the strength of the bulls is not strong enough for a bottom reversal to happen. Though, there can be some instances where the reversal may not happen.

*Click on the chart for an enlarged image

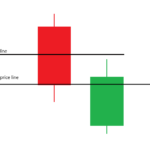

So, if there is a downtrend, and the 2nd bullish candle and 1st bearish candle are not able to form a piercing pattern, then it may signal the price is likely to fall further. In this scenario, there are three probable bearish patterns which indicate that the price will continue to decline.

The three bearish patterns is slightly similar to the ideal piercing pattern but differs only in the degree of penetration of the 2nd bullish candle through the 1st bearish candle and the opening of the 2nd candle is expected to be sharply below the low of the 1st candle. The three bearish patterns are as follows,

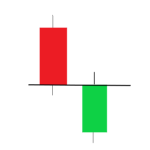

On-neck Pattern

The On-neck pattern is a small bullish candle opening sharply below the low of 1st bearish candle and closes near or exactly at the low of the 1st candle.

In-neck Pattern

The In-neck pattern is a small bullish candle opening sharply below the 1st bearish candle and closes near or exactly at the close of of the 1st candle, but above the low price of the 1st bearish candle.

*Click on the chart for an enlarged image

Thrusting pattern

The thrusting pattern is very similar to the ideal piercing pattern but the body of the 2nd bullish candle does not surpass 50% of the body of the 1st bearish candle. In thrusting pattern, the 2nd bullish candle will have a longer body but the closing price of the 2nd candle will not pierce through or surpass 50% of the body of the 1st candle.

All the above three patterns indicate that the price of the scrip is more likely to decline further, and the trader must know it is a good time to sell or short the scrip.

However, piercing pattern does not occur as frequently as compared to engulfing patterns. Since, piercing pattern is a bottom reversal pattern, the most important point to remember is to watch for the pattern after a downtrend. Otherwise, this pattern is not valid and there will be no reversal.