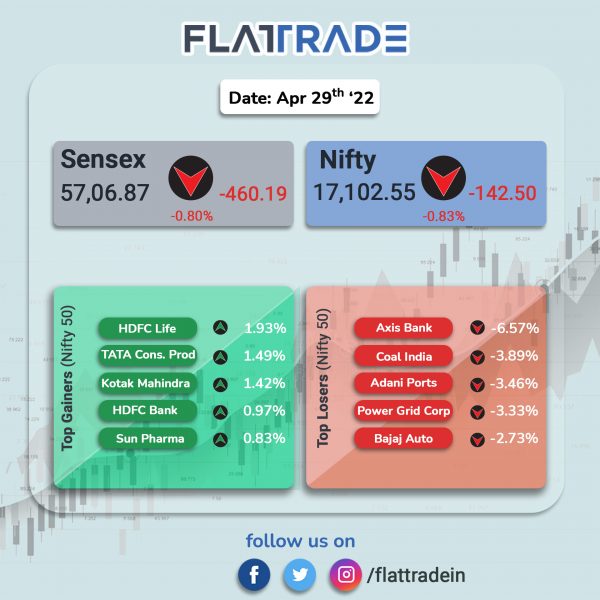

Benchmark indices pared all of its intraday gains to close 0.8% lower, dragged by heavyweights Reliance Industries, Axis Bank and Maruti Suzuki. In addition, investors booked profits at higher levels in the last hour of trade. The Sensex fell 0.8% and Nifty dropped 0.83%.

The Nifty Midcap 100 fell 0.84% and BSE SmallCap lost 0.58%.

Top losers among Nifty sector indices were PSU Bank [-1.67%], Energy [-1.56%], Realty [-1.19%], Auto [-1.02%] and Bank [-0.92%]. All indices closed in red.

Indian rupee inched up 5 paise to 76.42 against the US dollar on Friday.

Stock in News Today

Ultratech Cement: The company said that on a consolidated basis, its normalised net profit declined 18.52% to Rs 1,478 on 9.31% increase in net sales to Rs 15,557 crore in Q4 March 2022 over Q4 March 2021. Profit before interest, depreciation and tax fell 15.62% to Rs 3,165 crore in Q4 March 2022 as against Rs 3,751 crore in the corresponding period of the previous year. The board has recommended a dividend of Rs 38 per equity share.

Maruti Suzuki India (MSI): The automaker’s profit after tax (PAT) grew 57.7 per cent YoY to Rs 1,838.90 crore in Q4FY22 from Rs 1,166.10 crore in the year-ago period. Revenue rose 11.31% to Rs 26,740 crore in the said quarter from Rs 24,023 crore in the year-ago period. Sales volume for the quarter fell 0.7 per cent YoY to 488,830 units against 492,235 units in the same quarter last year. The EBIT margin stood at 7 per cent compared with 5.4 per cent in the year-ago quarter. The carmaker announced a dividend of Rs 60 per share, totalling Rs 1,813 crore.

Wipro Ltd: The IT company on Friday reported a consolidated net profit of Rs 3,087 crore for the quarter ended March 2022, up 4% from Rs 2,972 crore in the year-ago period. Revenue from operations, rose 28% to Rs 20,860 crore for the quarter under review. In dollar terms, the IT major’s revenue stood at $2.72 billion.

IndiaMart: The company’s consolidated net profit fell 18.2% QoQ to Rs 57.4 crore in Q4FY22 from Rs 70.2 crore in the year-ago period. The e-commerce’s consolidated revenue rose 7% QoQ at Rs 201.4 crore in the reported quarter from 188.1 crore in the corresponding quarter last fiscal. EBIT fell 28.4% QoQ to Rs 54.3 crore in Q4FY22 from Rs 75.8 crore in the year-ago period. Shares of the company opened gap-down but recovered to close at 0.48% higher on Friday.

Premier Explosives: The manufacturer of explosives received an order worth Rs 100.4 crore from an overseas entity. The order pertains to the supply of Rocket Motors. The order is expected to be delivered within 18 months. Shares of the company hit 5% upper circuit.

Motilal Oswal Financial Services: The company posted a consolidated revenue of Rs 1100 crore during the March quarter, a growth of 21% from the same period a year ago. Its net profit declined 45% YoY to Rs 299.80 crore due to a provision made by the company for ‘negative price settlement of crude oil derivative positions’ of clients, the company said.

Zomato: The company fell below its lower end of IPO price band (Rs 72 per equity share) in nine months since debut. Shares closed 2.84% lower at Rs 71.75 apiece on Friday.

Shoppers Stop: The retail clothing chain company fell 7.15% on Friday, a day after it reported losses in Q4FY22. Shoppers Stop reported a net consolidated loss of Rs 15.85 crore in the Q4FY22 as against a loss of Rs 23.71 crore in the corresponding quarter last year. Total income of the company in the fourth quarter of FY22 stood at Rs 734.73 crore as compared to Rs 704.70 in the year-ago period.

Gillette India: The company posted 34.4% decrease in standalone net profit to Rs 69.31 crore for quarter ended March 2022 as against Rs 105.66 crore in quarter ended March 2021. Revenue from operations stood at Rs 566.52 crore for the reproted quarter as against Rs 536.62 crore during the same period last year, registering a growth of 5.57%.