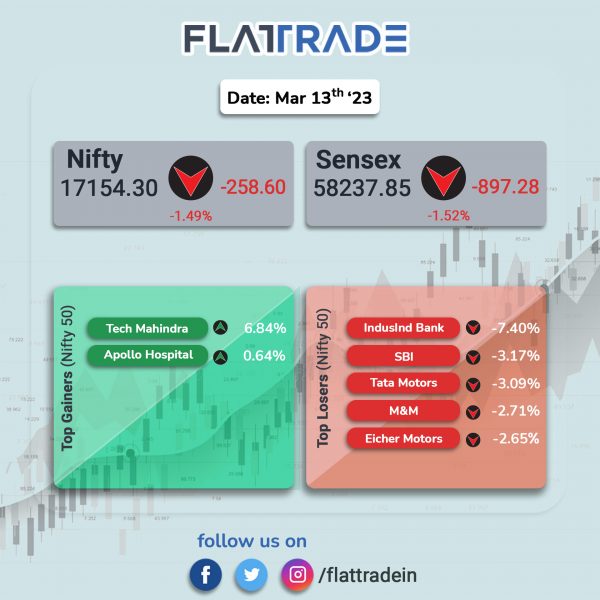

Dalal Street tanked as investors were cautious ahead of the country’s inflation data as well as amid the fallout of Silicon Valley Bank and its effect on Indian markets. The Sensex tumbled 1.52% and the Nifty plunged 1.49%.

In broader markets, the Nifty Midcap 100 index tanked 2% and the BSE Smallcap was down 2.08%.

Top losers were PSU Bank [-2.87%], Media [-2.51%], Private Bank [-2.44%], Bank [-2.27%] and Auto [-2.24%]. All Nifty sectoral indices closed in the red.

The Indian rupee fell 8 paise to 82.12 against the US dollar on Monday.

Stock in News Today

State Bank of India (SBI) and Capacite Infraprojects: Capacite Infraprojects said that the company has received sanction for non-fund based limits totalling to Rs 150 crore from State Bank of India which is also the consortium leader. The limits will help Capacite in realising their pending receivable in the form of retention monies and mobilisation advance from the existing on-going projects. Capacite further stated that it is also engaging with other consortium members for sanction of balance assessed limits adding that it is hopeful other consortium members will also take up their part of assessed limits shortly.

Tata Power: The company’s subsidiary — Tata Power Renewable Energy (TPREL) — signed a Power Purchase Agreement (PPA) with Tata Power Delhi Distribution (Tata Power-DDL), for 510 MW hybrid project. The project will save an average 1540 MUs of CO2 emissions annually for Tata PowerDDL, a joint venture between Tata Power and Government of Delhi, that supplies electricity to a populace of over 70 lakh in North Delhi. The PPA has the capacity bifurcation of 170 MW solar and 340 MW wind power.

One 97 Communications (Paytm): The fintech company’s credit business rose to Rs 4,158 crore ($503 million) in February 2023, up 254% YoY, with number of loans rising 86% to 40 lakh compared to last year. According to its monthly performance update, the company’s consumer base continued to expand, with average monthly transacting users (MTU) of 8.9 crore for the quarter-to-date, increasing 28% over February 2022. Gross Merchant Payment Volumes (GMV) for the quarter-to-date (January and February 2023) stood at Rs 2.34 lakh crore ($28.3 billion), at an on-year growth of 41%. Number of merchants paying subscription for payment devices like Soundbox has reached 64 lakh as of February 2023.

Shriram Finance: The financial services company is looking to raise as much as 200 billion rupees ($2.44 billion) to fund its growth in the next financial year starting April, Reuters reported citing a senior company official. The retail NBFC aims to grow its assets under management (AUM) by 15% in FY2024 to around 1.9 trillion rupees to 2 trillion rupees, Umesh Revankar, executive vice chairman of Shriram Finance, said. The company’s total AUM was Rs 1.77 trillion rupees as of December 31, 2022.

Life Insurance Corporation of India: LIC said that it has appointed, Siddhartha Mohanty, managing director of the company as interim chairman with effect from March 14. The term of Mangalam Ramasubramanian Kumar as chairman of LIC of India will be completed on March 13.

YES Bank: Shares of the lender plummeted nearly 13% in intraday trade after its lock-in period of three years, which was placed under the Reserve Bank of India (RBI’s) reconstruction scheme 2020, ended today. However, it recouped some of the losses to end 5.15% at Rs 15.65 apiece.

Reliance Capital (RCap): The Supreme Court has listed the plea of Torrent Group, a bidder of bankrupt firm Reliance Capital (RCap), challenging the National Company Law Appellate Tribunal (NCLAT) order to hold a second round of auction for RCap assets for hearing on March 20. The second round of auction will not take place now, further delaying the resolution process of RCAP. Earlier this month, the NCLAT order came on a petition filed by Vistra ITCL (India), which is one of the lenders of Reliance Capital, against NCLT order restricting further auction of the bankrupt firm. Following the NCLAT order, the lenders’ of RCap had decided to hold the second round of e-auction on March 20.

Spandana Sphoorty Financial: The company announced that its board approved the transfer of stressed loan portfolio to an asset reconstruction company (ARC) for Rs 133 crore. As on 31 December 2022, the company’s outstanding written-off portfolio stood at Rs 372.45 crore. The company received a binding bid from an ARC, amounting to Rs 133 crore, on security receipt consideration basis. The company said that it shall follow swiss challenge method for bidding and decision of sale shall be taken as per extant guidelines governing swiss challenge method and the relevant policy of the company.

Finolex Industries: The company announced that it has started commercial operations of PVC fittings at the manufacturing facility at Pune. The annual capacity of the facility is 12,000 MT and the capital expenditure towards the facility is approximately Rs 100 crore.

Nazara Technologies: The company said that its step down subsidiaries Kiddopia Inc and Mediawrkz Inc hold cash balances worth Rs 64 crore at Silicon Valley Bank (SVB).

Sula Vineyards: The chief financial officer of the company, Bittu Varghese, has resigned from his position to explore opportunities outside the company.

Godrej Properties: The realtor said that it has entered into a sale deed to acquire land parcel of approximately 28 acres in Bengaluru to develop a mixed-use project comprising apartments and supporting retail development. This project is located near Whitefield and in close proximity to major office spaces in Whitefield and Outer Ring Road.

Gujarat Mineral Development Corporation (GMDC): The company announced that it emerged as the highest bidder for two coal mines in Odisha in the recently concluded commercial coal block auction by the Ministry of Coal, Government of India. GMDC has won the bids for Odisha’s Burapahar block in Sundargarh District, having a geological reserve of 548 million tonne and the Baitarani (West) block in Angul District, a geological reserve of 1,152 million tonne. With these developments, the company said that its additional 21 MTPA would be fuelling the nation’s energy demand, further consolidating its position as the leading mining player in the sector.

Alembic Pharma: The drug maker announced that the USFDA has successfully completed the inspection for its derma facility located at Karakhadi, Gujarat without any observations. The inspection was conducted from March 6 to 10, 2023.