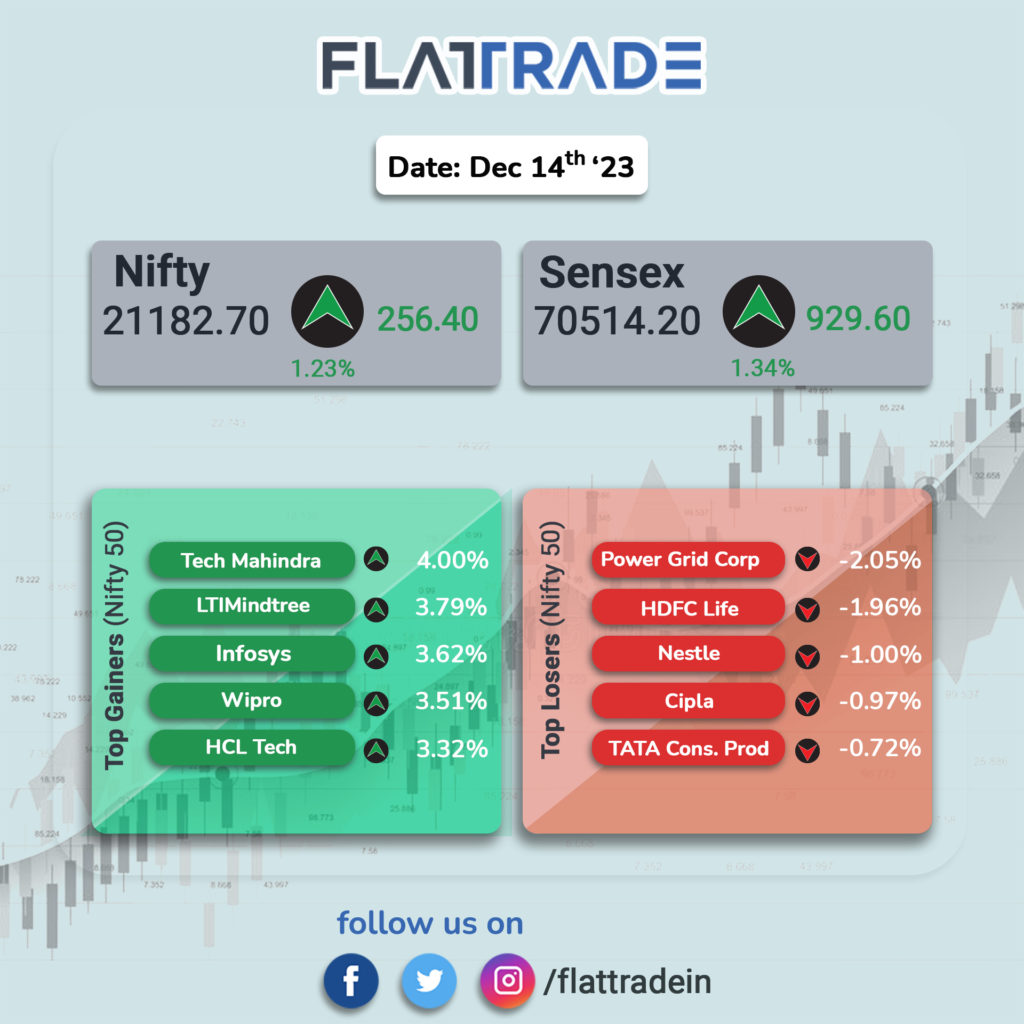

Dalal Street zoomed on the US FOMC meeting outcome. At close, Sensex was up 929.60 points or 1.34% at 70,514.20, and the Nifty was up 256.40 points or 1.23% at 21,182.70.

In broader markets,Nifty Midcap 100 and Nifty Smallcap 100 advanced 1.31 percent and 0.85 percent, respectively.

The Indian rupee dived 11 paise to Rs. 83.35 against the US dollar on Thursday.

Stock in News Today

Mastek: Shares of the company gained 7 percent on December 14 US Fed’s dovish pivot sent IT stocks soaring. With optimism about a sooner-than-expected improvement in the macroeconomic environment and interest rate cuts, analysts suggest that investors, particularly those with long-term perspectives, should redirect their attention to the IT sector.

Fusion Micro Finance: The company shares surged 6 percent after private equity firm Warburg Pincus pared its stake in the company, as 1.3 crore shares or 10 percent equity exchanged hands at Rs 599 per share, in a pre-open block window.

Vedanta: Shares gained 0.5 percent after the company said its board would consider and approve a second interim dividend for FY24 on December 18. The company had in May declared its first interim dividend of Rs 18.50 a share. Vedanta’s dividend outgo has gone up significantly in recent years. In FY23, Vedanta paid a total dividend of Rs 37,572 crore compared to Rs 16,689 crore in FY22 and Rs 3,519 crore in FY21.

HDFC Life Insurance Company: Shares fell 2 percent as the IRDAI proposed a higher surrender value on non-PAR products. The IRDAI has released a consultation paper that proposes a higher surrender value on non-PAR products. This will result in policyholders receiving a higher amount following lapses in their policies, which will likely hurt the margins of non-PAR products.

NBCC: Shares gained 3 percent after following the company’s announcement of securing a project management consultancy contract worth Rs 1,500 crore for the development of 1,469 warehouses and other infrastructure pertaining to the agriculture sector. The company also touched a new 52-week high in today’s session.

Gokul Agro Resources: Shares traded 3 percent higher after the firm’s Singapore subsidiary acquired a 25 percent stake in PT Riya Pasifik Nabati in Indonesia.

Max Financial: Shares traded over 3 percent lower after IRDAI proposed a higher surrender value on non-PAR products. The IRDAI has released a consultation paper that proposes a higher surrender value on non-PAR products. This will result in policyholders receiving a higher amount following lapses in their policies, which will likely hurt the margins of non-PAR products.

IRCTC: Shares of the company gained 2 percent after the railway major announced its plans for major expansion in the non-railway catering business across the country.

LTIMindtree: Shares of the Larsen and Toubro group company gained as much as 3.7 percent on December 14, a day after they traded in the red. The surge comes after the FED signaled the 2 percent inflation target could be achieved earlier than estimated.

HCL Tech: Shares of the company gained 3.2 percent napping its two-day gaining streak on the bourses. The surge comes after investors cheered Fed’s decision to keep the interest rates unchanged, and hinted that the 2 percent inflation target could be achieved before the initial estimates.