POST-MARKET REPORT

Indian benchmark indices ended marginally lower in the volatile session on July 11, ahead of US inflation data due later in the day.

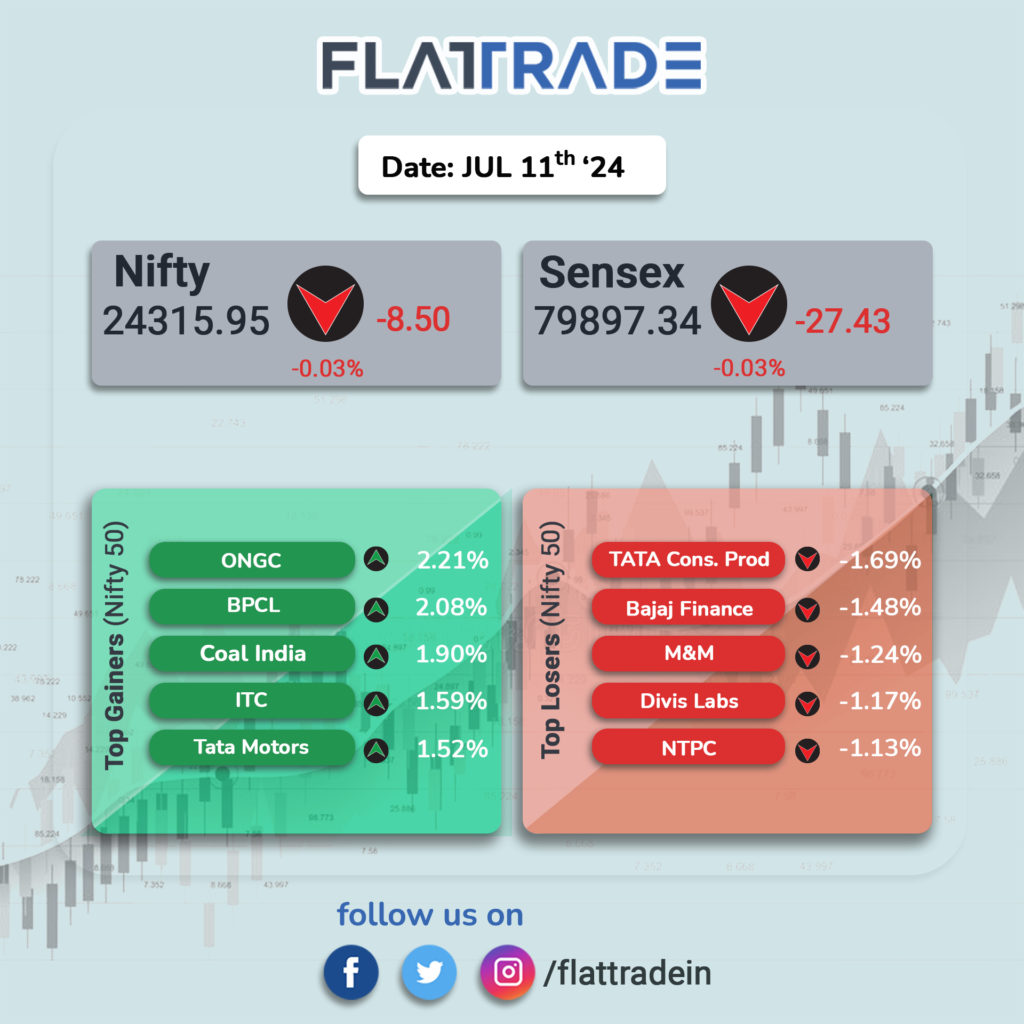

At close, the Sensex was down 27.43 points or 0.03 percent at 79,897.34, and the Nifty was down 8.50 points or 0.03 percent at 24,316.

Top Nifty gained were BPCL, Coal India, ONGC, ITC, and Tata Motors, while losers were Tata Consumer Products, Bajaj Finance, Divis Labs, M&M and NTPC.

Among sectors, the realty index was down 1.5 percent, and the pharma index fell 0.6 percent, while the media and oil & gas index were down 1 percent each.

The BSE midcap index rose 0.3 percent while the smallcap index added 0.6 percent.

STOCKS TODAY

Glenmark Life Sciences: Shares slumped as much as nearly 4 percent, a day after Glenmark Pharma’s board greenlit the company’s plans to offload a 7.84 percent stake in the former through an offer for sale.

Sun TV Network: As much as 1 percent equity of Sun TV Network was sold in a large deal worth Rs 280 crore on July 11. This sent shares of the company soaring 3.5 percent higher to a 52-week high of Rs 808.45.

Shalby: Shares advanced 6.6 percent to Rs 304 in the afternoon after the company announced a 30-year lease for running the Asha Parekh Hospital in Santacruz, Mumbai.

Ahluwalia Contracts (India): Shares rose 7 percent after securing an order worth Rs 893.48 crores from the Airports Authority of India (AAI) for the development of Lal Bahadur International Airport in Varanasi.

NELCO: Shares fell as much as 4 percent and hit an intraday low of Rs 865 after the company reported a year-on-year decline in its consolidated net profit and revenue for the quarter ended June.

YES Bank: Shares jumped over 7 percent after global rating agency Moody’s revised its outlook to ‘positive’ from ‘stable’ in hopes of improvement in the lender’s depositor base and lending franchise.

Ambuja Cements: Shares soared over 3 percent after brokerage firm Nomura double upgraded the cement manufacturer to a ‘buy’ rating, factoring in the company’s aggressive capacity expansion.