HDB Financial Services IPO is a bookbuilt issue of ₹12,500.00 crore. It combines a fresh issue of 3.38 crore shares aggregating to ₹2500.00 crores and an offer for sale of 13.51 crore shares aggregating to ₹10,000.00 crores.

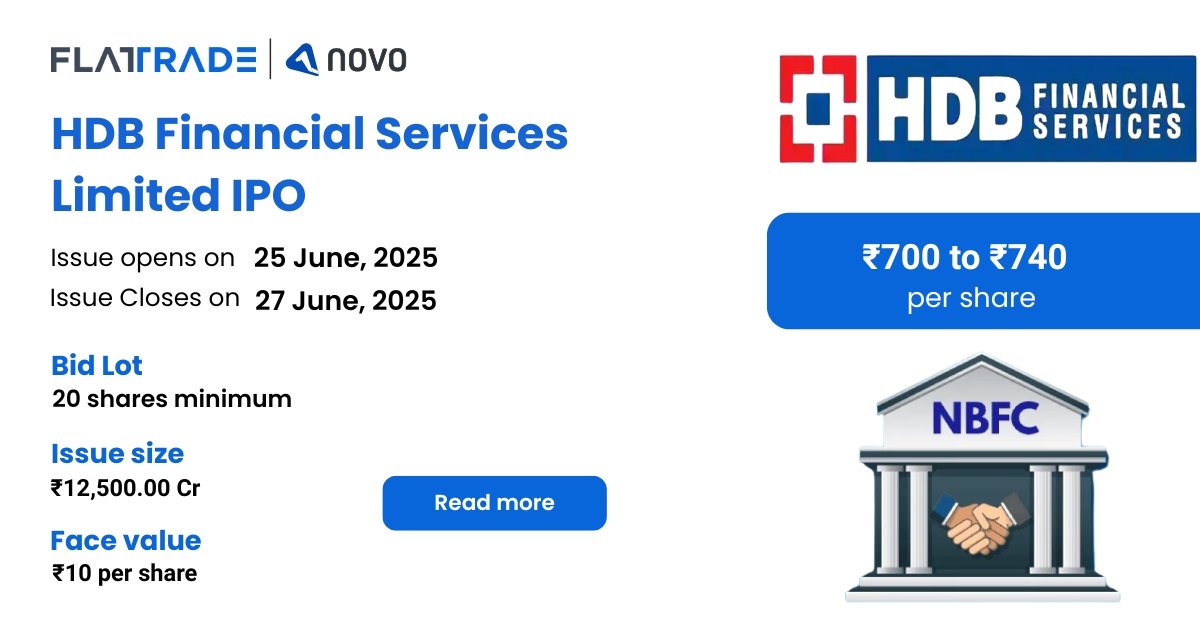

The IPO opens for subscription on June 25, 2025, and closes on June 27, 2025. The allotment is expected to be finalized on Monday, June 30, 2025. The price band for the IPO is set at ₹700 to ₹740 per share, and the minimum lot size for an application is 20 shares.

Company Summary

Incorporated in 2007, HDB Financial Services Limited is a retail-focused, non-banking financial company.

The company also offers business process outsourcing (“BPO”) services such as back-office support services, collection and sales support services to our Promoter, as well as fee-based products such as the distribution of insurance products primarily to the lending customers.

HDB Financial Services Limited’s omni-channel “phygital” distribution model combines a large branch network, in-house tele-calling teams, and various external distribution networks and channel partners.

As of March 31, 2025, over 80% of the branches are located outside the 20 largest cities in India. As of March 31, 2025, the company had a pan-India network of 1,771 branches in 1,170 towns and cities across 31 States and Union Territories, with over 80% of the branches located outside the 20 largest cities in India by population.

As of Fiscals 2025, 2024, and 2023, the company had a total of 60,432, 56,560, and 45,883 employees.

Business Verticals

- Enterprise Lending: The first business vertical launched in 2008. They offer a variety of secured and unsecured loans to MSME customers, as well as certain types of salaried employees, primarily through their branch network.

- Asset Finance: They offer financing options to customers for acquiring new and used commercial vehicles, construction equipment, and tractors, all of which are income-generating assets for their customers.

- Consumer Finance: They offer loans to individuals seeking to fulfil their personal or household needs.

Company Strengths

- Highly granular retail loan book, bolstered by a large and rapidly growing customer base with a focus on serving the underbanked customer segments.

- Large, diversified, and seasoned product portfolio with a sustainable track record of diversification, growth, and profitability through the cycles.

- Tailored sourcing supported by an omnichannel and digitally powered pan-India distribution network.

- Comprehensive systems and processes contribute to robust credit underwriting and strong collections.

Company Financials

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 1,08,663.29 | 92,556.51 | 70,050.39 |

Revenue | 16,300.28 | 14,171.12 | 12,402.88 |

Profit After Tax | 2,175.92 | 2,460.84 | 1959.35 |

EBITDA | 9,512.37 | 8,314.13 | 6251.16 |

Net Worth | 14,936.5 | 12,802.76 | 10,436.09 |

Reserves and Surplus | 15,023.97 | 12,949.36 | 10,645.57 |

Total Borrowing | 87,397.77 | 74,330.67 | 54,865.31 |

Amount in ₹ Crore | |||

Objectives of IPO

Augmentation of the Company’s Tier–I Capital base to meet their Company’s future capital requirements, including onward lending under any of the Company’s business verticals, i.e,. Enterprise Lending, Asset Finance, and Consumer Finance.

Promoters of the company

HDFC Bank Limited is the promoter of the company .

IPO Details

IPO Date | June 25, 2025 to June 27, 2025 |

Listing Date | July 02, 2025 |

Face Value | ₹10 per share |

Price Band | ₹700 to ₹740 per share |

Lot size | 20 shares |

Total Issue size | 16,89,18,919 shares (aggregating up to ₹12,500.00 Cr) |

Fresh issue | 3,37,83,784 shares (aggregating up to ₹2500.00 Cr) |

Offer for Sale | 13,51,35,1 shares of ₹ 10 (aggregating up to ₹10,000.00 Cr) |

Issue type | Bookbuilding IPO |

Listing at | NSE, BSE |

Share Holding Pre Issue | 79,39,63,540 shares |

Share Holding Post Issue | 82,77,47,324 shares |

Lot Allocation details

Application | Lots | Shares | Amount |

Retail (Min) | 1 | 20 | ₹14,800 |

Retail (Max) | 13 | 260 | ₹1,92,400 |

S-HNI (Min) | 14 | 280 | ₹2,07,200 |

S-HNI (Max) | 67 | 1,340 | ₹9,91,600 |

B-HNI (Min) | 68 | 1,360 | ₹10,06,400 |

Category Reservation table

Application Category | Maximum Bidding Limits | Bidding at Cut-off Price Allowed |

Only RII | Up to Rs 2 lakhs | Yes |

Only sNII | Rs 2 lakhs to Rs 10 lakhs | No |

Only bNII | Rs 10 lakhs to NII Reservation Portion | No |

Only shareholder | Up to Rs 2 lakhs | Allowed only if bidding amount is upto 2 lakhs |

Only employee | Up to Rs 5 lakhs | Yes |

Employee + Shareholder | l Shareholder limit: Up to Rs 2 Lakhs l Employee limit: Up to Rs 5 Lakhs. (In certain cases, employees are given discount if bidding amount is upto Rs. 2 lakhs) | Yes |

Employee + Shareholder + RII/NII | l Shareholder limit: Up to Rs 2 Lakhs l Employee limit: Up to Rs 5 Lakhs (In certain cases, employees are given discount if bidding amount is upto Rs. 2 lakhs) l If applying as RII: Upto Rs. 2 lakhs l If applying as NII: sNII > Rs. 2 lakhs and upto Rs. 10 lakhs and bNII > Rs. 10 lakhs | Yes for shareholder/employee/RII |

Shareholder + RII/NII | l Shareholder limit: Upto Rs. 2 lakhs l If applying as RII: Upto Rs. 2 lakhs l If applying as NII: sNII > Rs. 2 lakhs and upto Rs. 10 lakhs and bNII > Rs. 10 lakhs | Yes for shareholder/RII |

Employee + RII/NII | l Employee limit: Up to Rs 5 Lakhs (In certain cases, employees are given discount if bidding amount is upto Rs. 2 lakhs) l If applying as RII: Upto Rs. 2 lakhs l If applying as NII: sNII > Rs. 2 lakhs and upto Rs. 10 lakhs and bNII > Rs. 10 lakhs | Yes for shareholder/RII |

Allotment schedule

Basis of Allotment | Mon, June 30, 2025 |

Initiation of Refunds | Tue, Jul 01, 2025 |

Credit of Shares to Demat | Tue, Jul 01, 2025 |

Tentative Listing Date | Wed, Jul 02, 2025 |

Cut-off time for UPI mandate confirmation | 5 PM on June 27, 2025 |

IPO Reservation

Investor Category | Shares Offered | Maximum Allottees |

QIB Shared Offered | 7,58,78,378 (44.92%) | NA |

NII (HNI) SHares Offered | 2,27,63,514 (13.48%) | NA |

bNII > ₹10L | 1,51,75,676 (8.98%) | 54,198 |

sNII < ₹10L | 75,87,838 (4.49%) | 27,099 |

Retail Shares Offered | 5,31,14,865 (31.44%) | 26,55,743 |

Employee Shares Offered | 2,70,270 (0.16%) | NA |

Shareholders Shares Offered | 1,68,91,892 (10.00%) | NA |

Total Shares Offered | 16,89,18,919 (100.00%) |

To check allotment, click here