What is Technical Analysis?

Technical analysis is a method of studying price charts to understand market trends.

Instead of analysing company profits or balance sheets, technical analysis focuses on:

- Price trends

- Chart patterns

- Volume and momentum

- Moving averages

- Support and resistance levels

In simple terms, it studies what price is doing, not why it is doing it.

It helps traders decide when to enter, exit, or stay out.

Why is Technical Analysis Important?

Markets constantly move between:

- Uptrends

- Downtrends

- Sideways phases

Technical analysis helps traders:

- Identify the prevailing trend

- Find better entry and exit points

- Manage risk through structure

- Reduce emotional decisions

It is widely used in intraday trading, swing trading, F&O trading, and short-term investing.

Technical analysis does not predict the future. It helps you prepare for possibilities.

Key Concepts of Technical Analysis

1. Candlestick Charts

Candlesticks show:

- Open

- Close

- High

- Low

If price closes higher than it opens → Green candle (bullish)

If price closes lower → Red candle (bearish)

Patterns formed by candlesticks may signal potential reversals or continuations.

2. Trend

A trend is the overall direction of price.

- Uptrend → Higher highs and higher lows

- Downtrend → Lower highs and lower lows

- Sideways → Price moves within a range

Trend is the foundation of most trading decisions.

3. Support and Resistance

Support is a price level where buying demand may prevent further decline.

Resistance is a level where selling pressure may pause an upmove.

Think of support as a floor and resistance as a ceiling.

Breakouts above resistance or below support can lead to stronger moves, especially with high volume.

4. Indicators

Indicators are mathematical tools based on price and volume.

Common ones include:

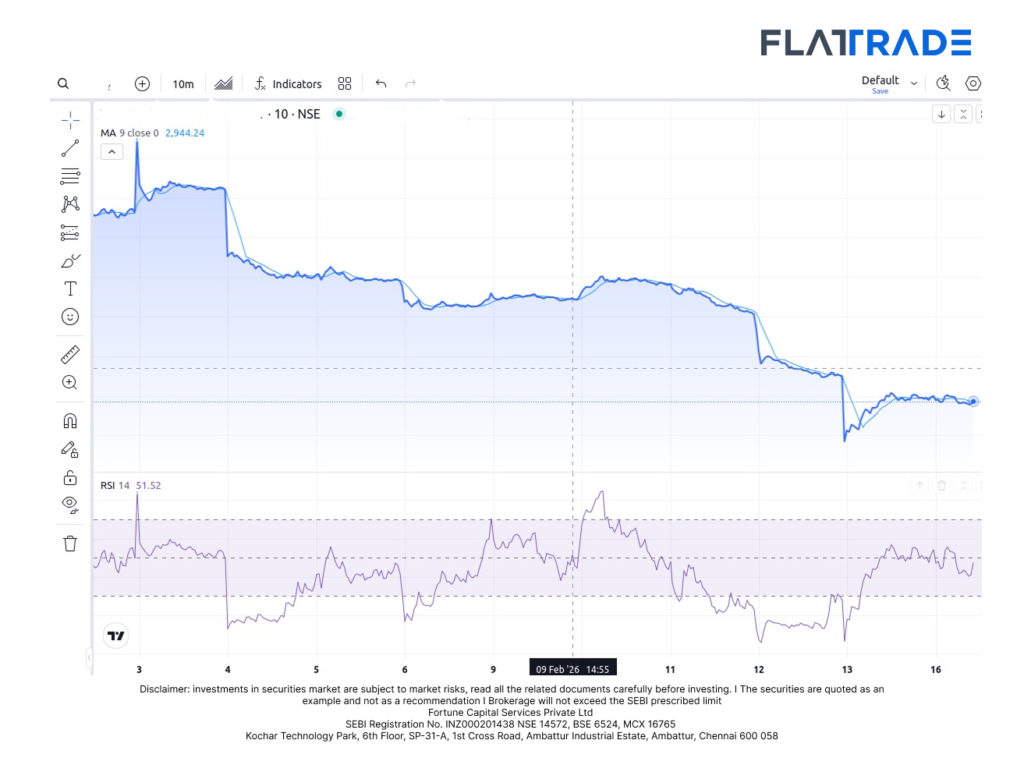

- Moving Average (MA) – Identifies trend direction

- RSI – Indicates overbought or oversold conditions

- MACD – Signals momentum shifts

- Bollinger Bands – Measures volatility

- Volume indicators – Confirm strength of moves

Indicators should support your analysis, not replace it.

Explore Technical Analysis on Flattrade

Flattrade offers advanced charting tools that make analysis practical and efficient.

You can:

- Select your preferred timeframe

- Add indicators

- Draw support and resistance levels

- Plan entry, stop-loss, and target before placing a trade

Structured analysis + quick execution = disciplined trading.

Technical analysis is not about certainty. It is about probability and risk management.

Master the basics first. Complexity can come later.

With the right understanding and the right tools on Flattrade, traders can approach markets with clarity instead of guesswork.