POST-MARKET REPORT

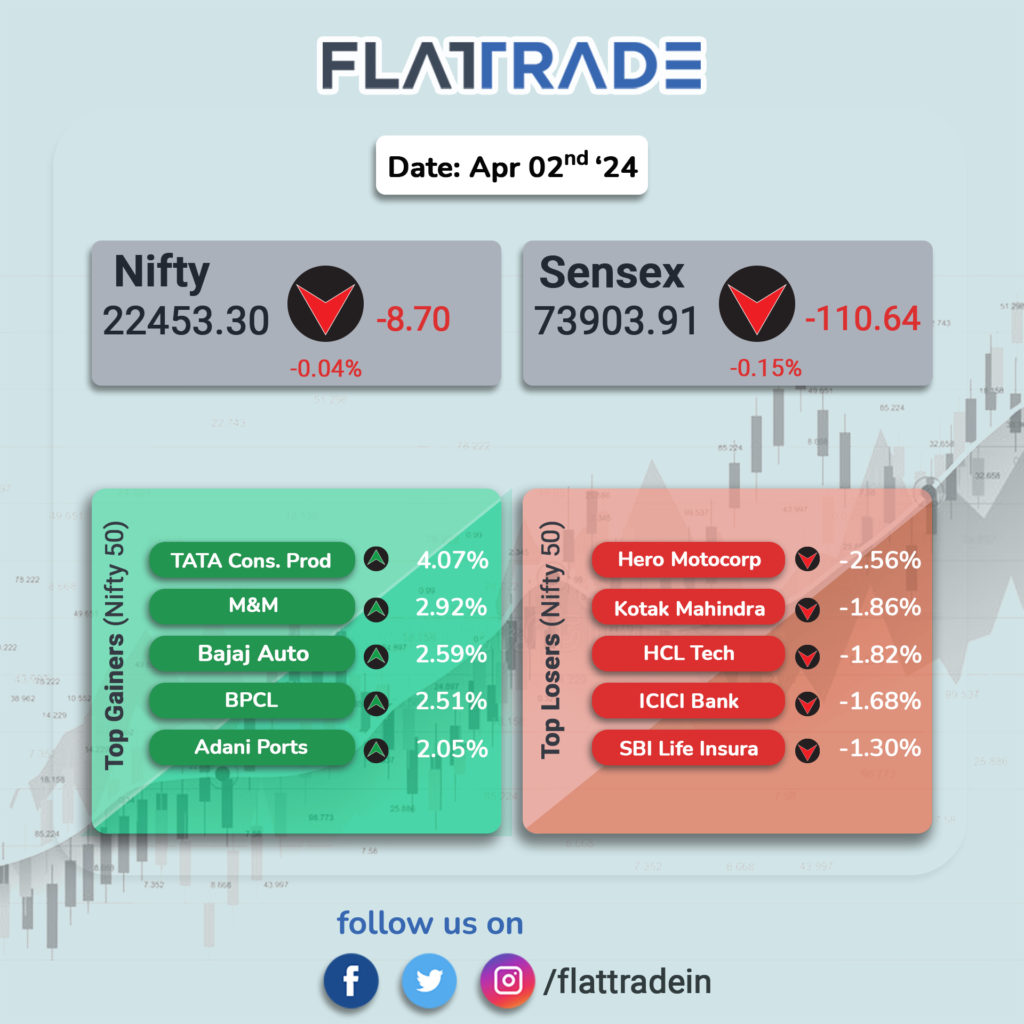

The Indian benchmark indices ended marginally lower on April 2. At close, the Sensex was down 110.64 points or 0.15 percent at 73,903.91, and the Nifty 8.70 points, or 0.04 percent, at 22,453.30.

Top Nifty losers were Hero MotoCorp, HCL Technologies, Kotak Mahindra Bank, ICICI Bank and SBI Life Insurance, while gainers included Tata Consumers Products, M&M, BPCL, Bajaj Auto and Adani Ports.

Among sectors, realty, metal, oil & gas, media, power, and auto were up 1-2 percent, while information technology and telecom indices were down 0.5 percent each.

Considering broader market indices, BSE midcap, and smallcap indices rose a percent each.

STOCKS TODAY

Godrej Properties: Godrej Properties, Prestige Estates, and other realty stocks gained after Morgan Stanley raised the target price of some of these scrips. Morgan Stanley upgraded Godrej Properties to “overweight” from “equal weight” and hiked the target price to Rs 2,500 from Rs 2,050 on pre-sales momentum.

CAMS: Shares of CAMS surged more than 6 percent after it was reported that the company will manage the issuance of all digital insurance policies. In an exchange filing on April 2, CAMS said the Insurance Regulatory and Development Authority of India (IRDAI) mandated the issuance of insurance policies in electronic form from April 1.

Choice International: The Choice International stock gained 3 percent after the company’s subsidiary secured a Rs 520-crore project. Choice Consultancy Services Pvt Ltd announced bagging a solar plant project from Jodhpur Vidyut Vitran Nigam in a joint venture with Solar91 Cleantech Pvt Ltd.

Voltas: Voltas and Havells gained a day after the Met Office issued warnings of a heatwave as a result of extreme weather conditions. IMD Director General Mrutyunjay Mohapatra said temperature is expected to be above normal in most parts of the country from April to June. “Ten-20 days of heatwaves are expected in different parts as against normal four-right days in April-June,” he said.

IREDA: Shares of IREDA jumped 5 percent to hit the upper circuit on April 2 following healthy quarterly business updates. IREDA recorded the highest number of loans sanctioned, coming in at Rs 37,354 crore for the financial year ended March 31, 2024. This was up 14.63 percent from Rs 32,587 crore last year.

Bharat Dynamics: Shares of Bharat Dynamics declined a percent a day after the ammunitions and missile systems manufacturer reported a 5.6 percent decline in its turnover. According to the defence manufacturer, the decline is due to the current geopolitical situation prevailing in Europe and the Middle East which has affected the supply chain of the company. Additionally, the company has reported a Rs 19,468-crore order book for FY2024.

UNO Minda: Shares of UNO Minda fell 0.62 percent after Honda Motorcycle & Scooter India (HMSI) made a global recall of bikes supplied by the company’s Haryana plant. HMSI recalled its bikes after spotting leakage of oil from the engine, caused by to dislodgement of the sealing plug cone out of the engine cover (recalled part). The recalled part was supplied by the company’s plant at Bawal, Haryana.