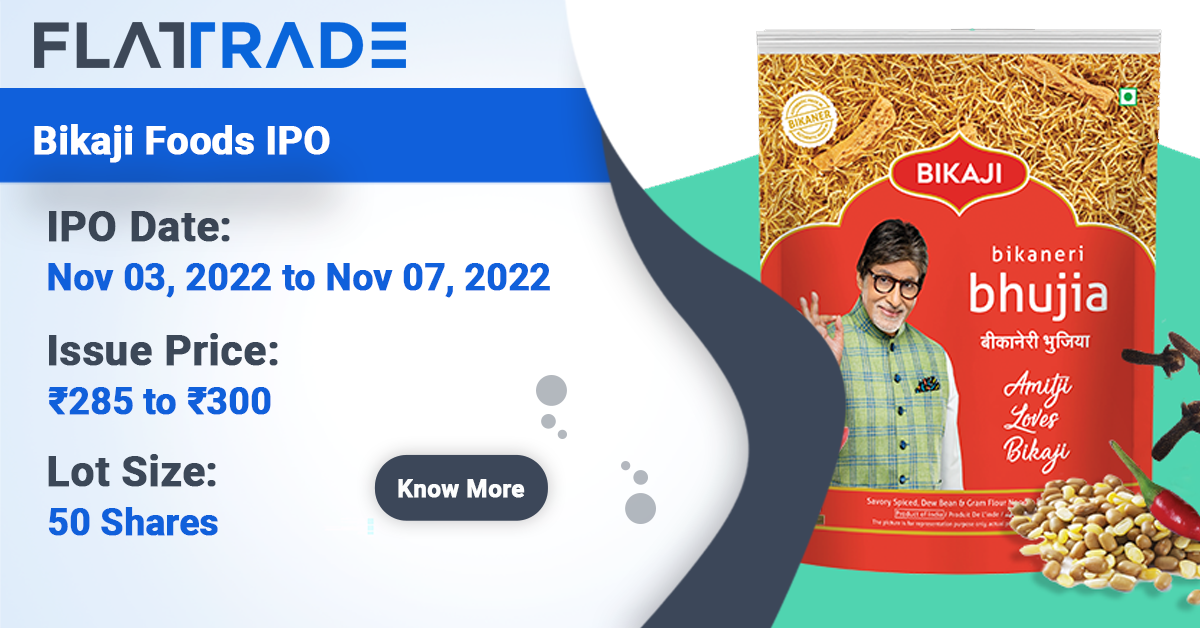

Bikaji Foods International Limited is one of the largest snacks manufacturer in India. The FMCG company plans to raise Rs 881.22 crore through an initial public offering. The subscription for the IPO will open on November 3 and close on November 7. The price band is fixed at Rs 285-300 per equity share. The face value of an equity share is set at Re 1 apiece.

For the employees of the company, 2.5 lakh shares have been reserved. Further, the employees of the company will get a discount of Rs 15 per equity share to the final issue price.

Company Summary

Bikaji Foods International Limited is the third largest ethnic snacks company in India with an international footprint, selling Indian snacks and sweets, and it is the second fastest growing company in the Indian organised snacks market. The company’s product range includes six principal categories: bhujia, namkeen, packaged sweets, papad, western snacks as well as other snacks which primarily include gift packs (assortment), frozen food, mathri range and cookies. In the three months ended June 30, 2022, the company had sold more than 300 products under the Bikaji brand.

The company has operations across 23 states and four union territories as of June 30, 2022. The company has developed a large pan-India distribution network by establishing six depots, 38 superstockists, 416 direct and 1,956 indirect distributors that work with their superstockists, located across various states and union territories. In the three months ended June 30, 2022, the company has exported their products to 21 international countries, including countries in North America, Europe, Middle East, Africa, and Asia Pacific.

The company has seven operational manufacturing facilities, with four facilities located in Bikaner (Rajasthan), one in Guwahati (Assam), one facility in Tumakuru (Karnataka) and Muzaffarpur (Bihar). In addition, the company has entered into an agreement on a non-exclusive basis with a contract manufacturing unit in Kolkata.

In Fiscal 2022, the company was the largest manufacturer of Bikaneri bhujia with annual production of 29,380 tonnes, and it was the second largest manufacturer of handmade papad with an annual production capacity of 9,000 tonnes. Bikaji was also the third largest player in the organised sweets market with annual capacity of 24,000 tonnes for packaged rasgulla, 23,040 tonnes for soan papdi and 12,000 tonnes for gulab jamun.

Company Strengths

- Well-established brand with pan-India recognition.

- Diversified product portfolio focused on various consumer segments and markets.

- Strategically located and state-of-the-art manufacturing facilities with strict quality standards.

- Extensive pan-India and global distribution network including reputed retail chains and growing e-commerce sales.

- Significant multi-product export sales.

- Consistent track record of financial performance.

- Experienced promoters and professional management team.

Company Financials

Period | 3MFY23 | FY22 | FY21 | FY20 |

Total Assets (Rs in crore) | 1,146.28 | 1,102.13 | 817.15 | 676.64 |

Total Revenue (Rs in crore) | 423.82 | 1,621.45 | 1,322.21 | 1,082.9 |

Profit After Tax (Rs in crore) | 15.7 | 76.03 | 90.34 | 56.37 |

Net Worth (Rs in crore) | 834.8 | 819.26 | 604.1 | 529.16 |

EBITDA (Rs in crore) | 30.79 | 139.54 | 144.76 | 94.6 |

EBITDA Margin (%) | 7.35 | 8.66 | 11.04 | 8.8 |

ROE (%) | 1.94 | 9.5 | 14.89 | 10.65 |

ROCE (%) | 2.63 | 13.89 | 20.88 | 12.79 |

Purpose of the IPO

- The company plans to achieve the benefits of listing its equity shares on NSE and BSE, and carry out the Offer for Sale of up to 2,93,73,984 equity shares by the selling shareholders, who will be entitled to the entire proceeds of the offer after deducting the offer expenses.

- The company expects the listing of its equity shares will enhance their visibility and brand image. Further, the listing is expected to provide liquidity to its shareholders as well as a public market for its equity shares.

Company Promoters

Shiv Ratan Agarwal, Deepak Agarwal, Shiv Ratan Agarwal (HUF) and Deepak Agarwal (HUF) are the promoters of the company.

IPO Details

IPO Subscription Open Date | November 3 |

IPO Subscription Close Date | November 7 |

Face Value | Re 1 per equity share |

Price | Rs 285 to Rs 300 per equity share |

Lot Size | 50 Shares |

Issue Size | 2,93,73,984 shares aggregating up to Rs 881.22 crore |

Offer For Sale | 2,93,73,984 shares aggregating up to Rs 881.22 crore |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 50 | Rs 15,000 |

Retail (Maximum) | 13 | 650 | Rs 1,95,000 |

Small HNI (Minimum) | 14 | 700 | Rs 2,10,000 |

Large HNI (Minimum) | 67 | 3,350 | Rs 10,05,000 |

Allotment Details

Timeline | Date |

Allotment of shares | November 11 |

Initiation of refunds | November 14 |

Credit of shares to demat account | November 15 |

Listing Date | November 16 |

To know your allotment, click here