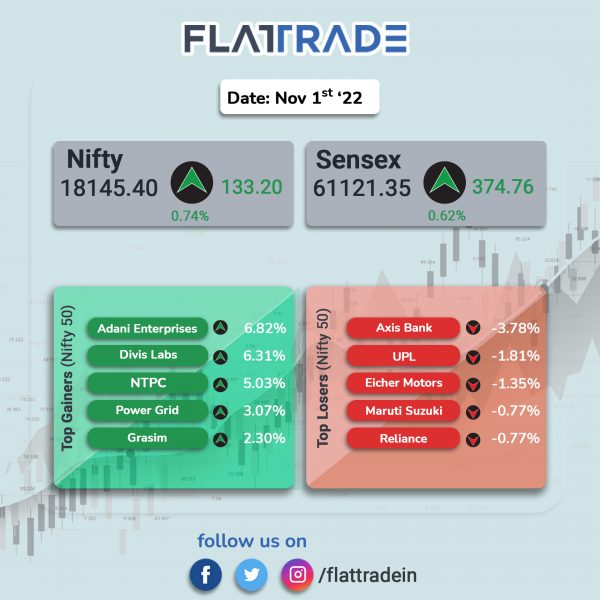

Benchmark equity indices ended higher, helped by gains in metal, pharma and technology stocks. The Sensex rose 0.62% and the Nifty gained 0.74%.

Broader markets mirrored headline indices. The Nifty Midcap 100 index rose 0.87% and the BSE Smallcap index increased 0.26%.

Top gainers among Nifty sectoral indices were Metal [2.38%], Pharma [2.12%], IT [1.89%], Realty [0.92%], Energy [0.85%]. Top losers were PSU Bank [-0.67%], Media [-0.27%] and Private Bank [-0.15%].

The Indian rupee appreciated by 9 paise to 82.70 against the US dollar on Tuesday.

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index stood at 55.3 in October 2022 compared to 55.1 in September. Meanwhile, gross GST revenue collected in October was Rs 1,51,718 crore. This is the second time the collections have cross the Rs 1.5 lakh crore mark after the highest ever collections in April.

Stock in News Today

Sun Pharmaceuticals: The drugmaker said its consolidated revenue was up 14% at Rs 10,952 crore in Q2FY23 from Rs 9,626 crore in the year-ago period. Net profit rose 11% to Rs 2,262 crore in the reported quarter as against Rs 2,047 crore in the year-ago period. EBITDA rose 18% to Rs 3,198 crore in Q2FY23 from Rs 2,706 crore in the same period last year. EBITDA margin stood at 29.2% as against 28.1% in the year-ago period.

Punjab National Bank (PNB): The state-owned lender reported a 62.8% drop in standalone net profit to Rs 411.3 crore for the quarter ended September 2022. It had posted a net profit of Rs 1,105.2 crore in the year-ago period. The bank’s net interest income (NII) grew by 30.2% to Rs 8,271 crore in the quarter under review from Rs 6,352.8 crore in the same period a year ago. Its total income increased to Rs 23,001.26 crore in the reported quarter as against Rs 21,262.32 in the period a year ago. The lender’s interest income also rose to Rs 20,154 crore from Rs 17,980 crore in the same quarter a year ago. Its net NPA declined to 3.80% in the quarter ended September 2022 as against 5.49% a year ago.

FSN E-Commerce (Nykaa): Shares of the company jumped 7% in intraday trade after it posted better-than-expected earnings. The company’s consolidated revenue rose 7% at Rs 1230.83 crore in Q2FY23 as against Rs 1148.42 crore in the preceding quarter. Net profit was up 4% to Rs 5.2 crore in Q2FY23 as against Rs 5.01 crore in Q1FY23. EBITDA jumped 33% to Rs 61.13 crore in the quarter under review as against Rs 46.05 crore in the first quarter of FY23.

Maruti Suzuki India (MSI): The automaker reported a 21% increase in total sales at 1,67,520 units in October. The company had sold a total of 1,38,335 units in the same month last year. Total domestic passenger vehicle sales were at 1,47,072 units in October as compared to 1,17,013 units in the year-ago month, up 26%. Exports in October stood at 20,448 units as compared to 21,322 units in the same month last year.

Ashok Leyland: The commercial vehicles maker reported a 34% rise in total sales at 14,863 units in October 2022. The company had sold 11,079 units in the same month last year, Ashok Leyland said in a statement. Domestic sales rose to 13,860 units, from 10,043 units in the year-ago month, registering a growth of 38%. Exports were marginally down at 1,003 units, as compared to 1,036 units in October last year.

UPL: The company’s net profit rose 28.39% to Rs 814.00 crore in the quarter ended September 2022 as against Rs 634.00 crore during the quarter ended September 2021. Sales rose 18.36% to Rs 12,507 crore in the quarter ended September 2022 as against Rs 10,567 crore during the quarter ended September 2021.

Tata Motors: The automaker announced its monthly wholesale numbers for October. Total passenger vehicle sales rose 33% YoY to 45,423 units. Its total domestic sales increased 17% YoY to 76,537 units. Total sales of commercial vehicles fell 2% YoY to 32,912 units.

Wheels India: The company said its net profit fell 42% to Rs 11.9 crore in Q2FY23 from Rs 20.6 crore in the year-ago period. Revenue was up 22.2% at Rs 1,189.1 crore in the reported quarter as against Rs 973.1 crore in the year-ago period. EBITDA fell 16.3% YoY to Rs 56.3 cr in the quarter under review. EBITDA margin stood a at 4.7% in the reported quarter as against 6.9% in the same period last fiscal.

Dhanuka Agritech: The company reported a net profit of Rs 73 crore in Q2FY23, up 15.2% from Rs 63.4 crore in the year-ago period. Revenue increased 23.7% YoY to Rs 542.9 crore in Q2FY23 as against Rs 438.8 crore in the year-ago period. EBITDA was up 18.7% at Rs 97.5 crore in the quarter under review compared with Rs 82.2 crore in the year-ago period. EBITDA margin was flat at 18% compared with 18.7% in the year-ago period. Dhanuka Agritech board approved a buyback of up to 10 lakh shares at Rs 850 per equity share.

CMS Info Systems: The company registered a consolidated net profit of Rs 72.5 crore in Q2FY23, up 37.37% from Rs 52.79 crore in the year-ago period. Revenue rose 26.8% to Rs 471.6 crore in Q2FY23 from Rs 372 crore in the same period last fiscal. EBITDA jumped 42.6% YoY to Rs 134 crore in Q2FY23. EBITDA margin stood at 28.4% in the quarter under review as against 25.3% in the year-ago period.

Whirlpool India: The company’s net profit fell 48.3% to Rs 40.6 crore in Q2FY23 as against Rs 78.5 crore in the year-ago period. Revenue declined 7.4% to Rs 1,488.9 crore in Q2FY23 from Rs 1,607.1 crore in the same period last fiscal. EBITDA fell 30.6% to Rs 72.2 crore in the reported quarter as against Rs 104.1 crore in the year-ago period. EBITDA margin stood at 4.9% in the quarter under review as against 6.5% in the same period last fiscal.

Max Healthcare: The company’s consolidated revenue was up 10% at Rs 1,482 crore in Q2FY23 as against Rs 1,353 crore in the year-ago period. Net profit surged to Rs 511 crore in the reported quarter as against Rs 207 crore in the same period last fiscal. EBITDA rose 13% to Rs 410 crore in Q2FY23 from Rs 362 crore in the corresponding quarter last year.

Alembic Pharmaceuticals: The drugmaker has received its final approval from the US Food & Drug Administration for its Abbreviated New Drug Application for Glycopyrrolate injection. The drug had an estimated market size of $42 million year ended June. The drug is used before and during surgery to reduce salivary, and gastric secretions and to block reflexes during anesthesia.

Escorts Kubota: The company announced that its total tractor sales rose 7.2% YoY to 14,492 units in October 2022. Domestic tractor sales rose 8.6% YoY to 13,843 units in October 2022. Tractor exports declined 15.2% YoY to 649 units.

Bajaj Auto: The two-wheeler manufacturer said its total two-wheeler sales fell 13% YoY to 341,903 units in October 2022. Similarly, two-wheeler exports declined 29% to 135,772 units in October 2022. Sale of commercial vehicles increased 10% to 53,335 units.

Gateway Distriparks: The company will acquire 63.2 lakh shares (99.2% stake) in Kashipur Infrastructure and Freight Terminal Private Ltd. The purchase consideration for the acquisition is Rs 155.86 crore. The acquisition is likely to be completed within the third quarter of FY23.