Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.13% lower at 18,231.50, signalling that Dalal Street was headed for a negative start on Wednesday.

Most Asian shares were trading higher ahead of the US Federal Reserve’s policy decision due later in the day. Japan’s Nikkei 225 index inched up 0.02%. Topix was up 0.25%. The Hang Seng index dropped 0.39% and the CSI 300 index was up 0.24%.

The Indian rupee appreciated by 9 paise to 82.70 against the US dollar on Tuesday.

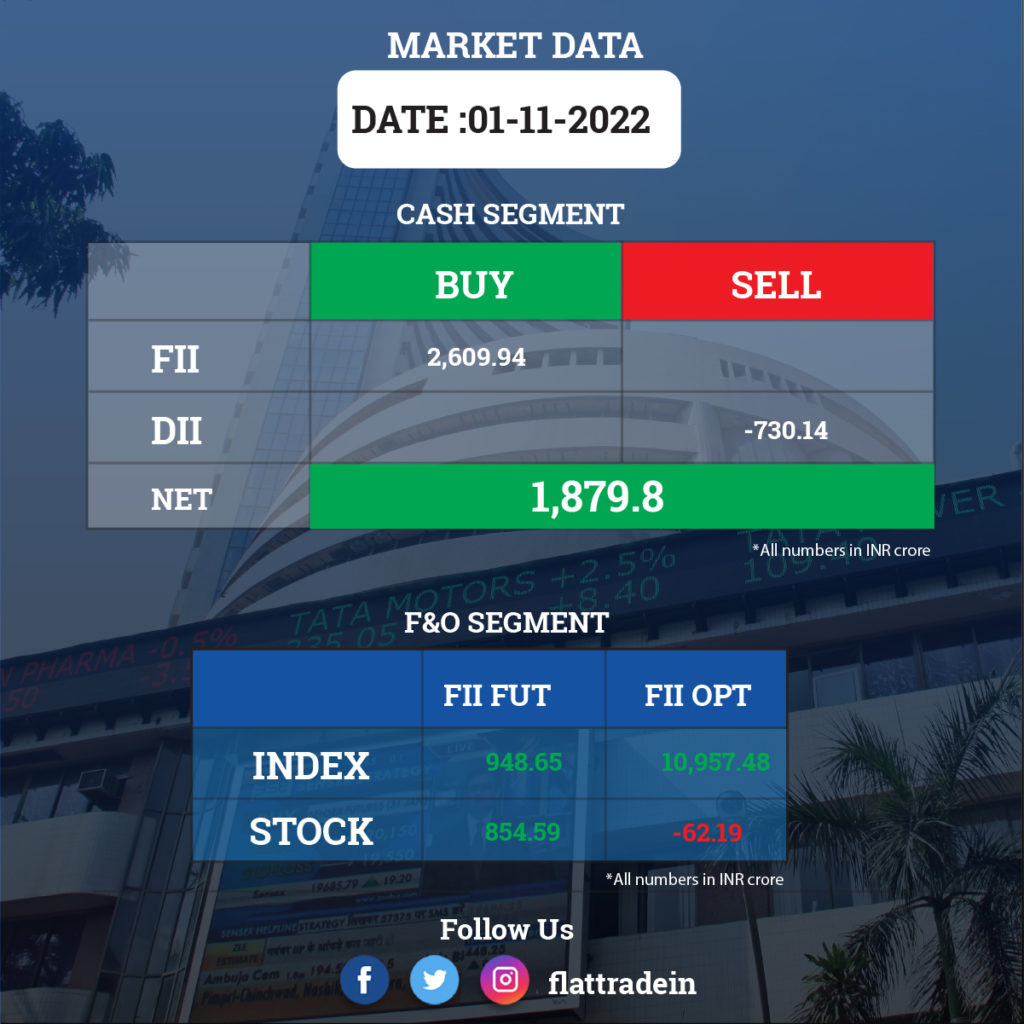

FII/DII Trading Data

Upcoming Results

Adani Transmission, M&M Financial Services, Dalmia Bharat, EIH, GATI, Gravita India, JK Paper, Kajaria Ceramics, KSB, Mahindra Holidays & Resorts India, MTAR Technologies, Procter & Gamble Hygiene & Health Care, Redington, SIS, and Triveni Turbine will report their quarterly earnings on November 2.

Stocks in News Today

Tech Mahindra: The IT services company reported a 4% decline in consolidated profit after tax at Rs 1,285 crore in the September quarter. The company had reported a net profit of Rs 1,339 crore in the year-ago period. The company’s overall revenue rose 20.7% to Rs 13,129 crore in the second quarter of the current fiscal. In the same period a year ago, it stood at Rs 10,881 crore. It won new contracts worth $716 million for the September quarter as against $750 million in the year-ago period. The company has declared a special dividend of Rs 18 per share.

Adani Ports and Special Economic Zone: The company’s consolidated profit jumped by 65.5% YoY to Rs 1,738 crore for the quarter ended September FY23, supported by top line, operating income and lower tax cost. Revenue surged 33% YoY to Rs 5,211 crore for the quarter. Cargo for the quarter stood at 86.6 MMT, a 15% YoY growth. The company’s quarterly cargo volume rose 15% on year to 86.6 million tonnes.

LIC Housing Finance: The housing finance company clocked a 23% YoY growth in standalone profit at Rs 305 crore for the quarter ended September FY23. Revenue from operations for the quarter grew by 8% to Rs 5,085 crore compared to the year-ago period. Net interest income (NII) declined by 0.8% to Rs 1,163 crore in the reporting quarter from Rs 1,173 crore a year ago. Its net interest margin also moderated to 1.8% in Q2FY23 from 2% a year ago.

Voltas: The company posted a consolidated loss of Rs 6 crore for the quarter ended September FY23, against a profit of Rs 104 crore for the same period last year, impacted by the provision made on an overseas project. Total income for the quarter at Rs 1,833 crore rose by 5.5% compared to the year-ago period.

Kansai Nerolac Paints: The company has recorded a 27.42% year-on-year increase in consolidated profit at Rs 111.2 crore for the quarter ended September FY23, supported by higher operating income. Revenue from operations grew by 19% YoY to Rs 1,931 crore for the quarter. The quarter witnessed good demand in automotive paints with the easing of the supply chain challenges, but demand in decorative paints was subdued due to extended rains.

Karnataka Bank: The bank recorded a 228% year-on-year growth in standalone profit at Rs 412 crore for the quarter ended September FY23 as there was a write-back of provisions and contingencies of Rs 14 crore in Q2FY23. Net interest income grew by 26% YoY to Rs 803 crore for the quarter.

Hero MotoCorp: The company sold 4.54 lakh motorcycles and scooters in October 2022, a 17% decline compared to 5.47 lakh units sold in the year-ago period. In the current financial year, it sold 32.72 lakh units, higher by 8.7% compared to 30.11 lakh units sold in the same period last year.

Veranda Learning Solutions: The company has terminated its acquisition of T.I.M.E. Veranda had entered into a share purchase agreement (SPA) for the acquisition of 100% shareholding of Hyderabad-based firm T.I.M.E (Advanced Educational Activities Pvt Ltd) in April 2022. The transactions could not be completed within the prescribed time. Accordingly, the SPA has now been terminated by the parties.

Eicher Motors: The company sold 82,235 units of Royal Enfield in October 2022, a rise of 86% compared to 44,133 units sold in the same month last year. Exports stood at 5,707 units of Royal Enfield in October 2022, up 62% YoY.

Macrotech Developers: The realty firm reported a consolidated net loss of Rs 933 crore for the quarter ended September due to provisions made for loan given to its British arm for development of projects. It had reported a net profit of Rs 223.36 crore in the year-ago period. The company’s total income also fell to Rs 1,761.23 crore in the second quarter of this fiscal year from Rs 2,137.76 crore in the corresponding period of the previous year.

Tejas Networks: The Tata Group company will invest over Rs 750 crore under design-led Production Linked Incentive (PLI) scheme for manufacturing of telecom and networking products, the company said. The Department of Telecom granted approval to 42 companies, including 28 MSMEs, under the scheme for telecom and networking products, entailing total committed investment of Rs 4,115 crore by the firms.

Varun Beverages: The company reported a 53.34% jump in consolidated profit after tax at Rs 395.48 crore for the September quarter, helped by revenue growth and transition to lower tax rate in India. The company, which follows January-December financial year, had posted a profit after tax of Rs 257.90 crore in the July-September quarter of 2021. Its revenue from operations in the reported quarter stood at Rs 3,248.30 crore, up 33.10% as compared to Rs 2,440.43 crore in the year-ago period.

ABB India: The company said that it has inaugurated its first smart instrumentation factory in Bengaluru for mass production of measurement and analytical devices. The new plant will manufacture field devices such as pressure and temperature transmitters, IP convertors and electromagnetic flowmeters for a wide variety of industries, including power, oil and gas, pharmaceutical, water and other segments.

TVS Motor Company: The Chennai-based manufacturer has registered a growth of 2% with sales increasing from 355,033 units in October 2021 to 360,288 units in October 2022. Domestic two-wheeler sales registered growth of 7% increasing from 258,777 units in October 2021 to 275,934 units in October 2022. The company’s total exports registered sales of 82,816 units in October 2022 as against sales of 95,191 units in October 2021. Two-wheeler exports registered sales of 68,696 units in October 2022 as against 82,736 units in October 2021.