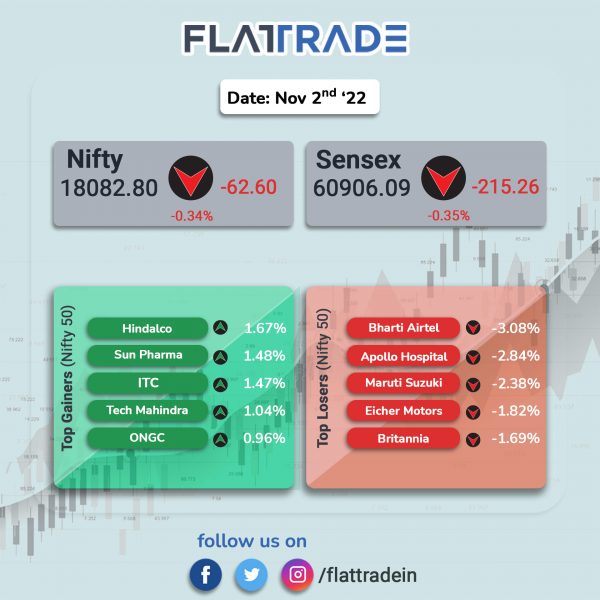

Benchmark stock indices ended lower ahead of the US central bank’s rate decision, dragged by losses in public sector banks, realty and auto stocks . The Sensex fell 0.35% and the Nifty 50 index was down 0.34%.

In broader markets, the Nifty Midcap 100 index edged down 0.08% and the BSE Smallcap index increased 0.23%.

Top losers among Nifty sectoral indices were PSU Bank [-0.8%], Realty [-0.8%], Auto [-0.74%], IT [-0.45%] and Bank [-0.35%]. Top gainers were Medai [0.85%], Metal [0.64%] and Pharma [0.48%].

The Indian rupee ended at 82.79, down 9 paise, against the US dollar on Wednesday.

Stock in News Today

Adani Transmission: The company said that its net profit was down 24.36% YoY to Rs 206.2 crore in Q2FY23 as against Rs 272.5 crore in the year-ago period. Revenue soared 32.6% to Rs 3,251.4 crore in Q2FY23 as against Rs 2,451.4 crore in the year-ago period. EBITDA increased 34.7% YoY to Rs 1,163.8 crore.

Bharti Airtel: The telco announced that it has crossed the 1 million unique 5G user mark on its network. The mobile service provider was able to achieve this milestone in less than 30 days of its commercial launch.

Mahindra Holidays: The company said its net profit fell 30.5% to Rs 41.39 crore in Q2FY23 from Rs 59.76 crore in the corresponding quarter last year. Revenue from operations rose 9.5% at Rs 598.4 crore in the reported quarter from Rs 546.4 crore in the year-ago period. EBITDA edged down 1.6% to Rs 116.5 crore in the quarter under review from Rs 118.4 crore in the year-ago period.

Firstsource: The company’s net profit surged 52.2% to Rs 129.4 crore in Q2FY23 from Rs 85 crore in the preceding quarter. Revenue rose 1% to Rs 1,487 crore as against Rs 1,472 crore in the previous quarter. EBITDA rose 5.5% to Rs 191 crore as against Rs 181 crore in the preceding quarter.

Kajaria Ceramics: The company’s revenue stood at Rs 1,077.76 crore for the quarter ended September 2022, up 10.7% from Rs. 973.55 crore in the year-ago quarter. The net profit came in at Rs. 69.86 crore in Q2FY23, down 39.85% from Rs 116.14 crore in the year-ago period. EBITDA stooda at Rs 137.04 crore in the reported quarter, down 26.95% from Rs 187.61 crore in the same period last year.

Ethanol Manufacturers and Oil Marketing Companies: The cabinet has approved mechanism for procurement of ethanol by public sector oil marketing companies (OMCs) under Ethanol Blended Petrol (EBP) Programme.

Grindwell Norton: The company’s net profit was up 26.3% to Rs 90.3 crore as against Rs 71.5 crore in the year-ago period. Its revenue was up 23.8% at Rs 634.6 crore in the quarter under review from Rs 512.6 crore in the corresponding quarter last fiscal. EBITDA rose 21.1% YoY to Rs 122.3 crore in the reported quarter.

Dalmia Bharat: The company posted a standalone net profit of Rs 11 crore in Q2FY23 compared to Rs 197 crore in Q2FY22, down 94.4%. Its revenue rose to Rs 2701 crore in Q2FY33 from Rs 2336 crore in Q2FY22. EBITDA slumped 43.8% to R 310 core in Q2FY23 from Rs 552 crore in Q2FY22.

Chambal Fertilisers & Chemicals: The company posted a 45.8% fall in consolidated net profit at Rs 274.27 crore in Q2FY23 from Rs 505.92 crore in Q2FY22. Revenue from operations jumped 91.7% to Rs 8,586.75 crore in Q2FY23 as against Rs 4,478.61 crore in the same quarter last year. The company stated that it has incurred a one time margin loss of Rs 237 crore on phosphatic and potassic (P&K) fertilisers, during Q2FY23 due to higher prices of imported fertilisers and volatile exchange rate.

Alembic Pharmaceuticals: The drug maker received the final approval from the US drug regulator (USFDA) for its abbreviated new drug application (ANDA) for Mesalamine extended-release capsules.

According to IQVIA, the capsules had an estimated market size of $133 million for twelve months ending June 2022.

Cholamandalam Investment and Finance: The company’s net profit declined 7.1% to Rs 563.41 in Q2FY23 as against Rs 606.54 crore in Q2FY22. However, Total Income jumped 22.42% to Rs 3,037.78 crore in quarter ended September 2022 compared with Rs 2481.54 crore in the same quarter a year ago. Vehicle Finance (VF) disbursements surged 38% YoY to Rs 8,502 crore in Q2FY23.

Sonata Software: The company announced the opening of its state-of-the art new development center at its Global Village campus in Bengaluru, India. The new center is spread across 58,000 sq ft, and it houses over 600 workstations.