Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.81% lower at 18,015, signalling that Dalal Street was headed for a negative start on Thursday.

Asian stocks slumped after the Fed Chair Jerome Powell said that the US central bank would raise interest rates more than previously anticipated, dampening risk appetite of investors. The Nikkei 225 index slipped 0.06%, while the Topix was up 0.10%. The Hang Seng tanked 2.21% and the CSI 300 index fell 0.54%.

The Indian rupee ended at 82.79, down 9 paise, against the US dollar on Wednesday.

The Federal Reserve pumped up its benchmark interest rate Wednesday by three-quarters of a point for a fourth straight time but hinted that it could soon reduce the size of its rate hikes. The Fed’s move raised its key short-term rate to a range of 3.75% to 4%, its highest level in 15 years.

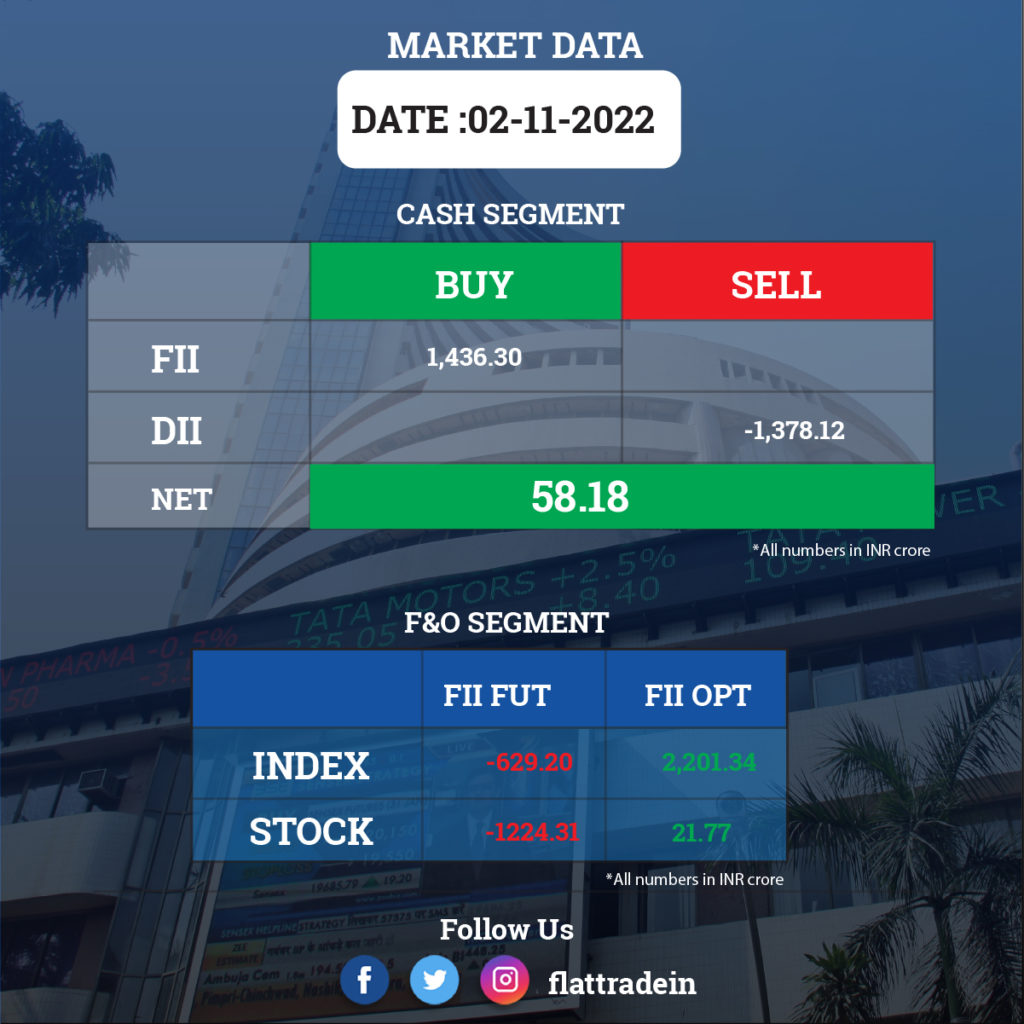

FII/DII Trading Data

Upcoming Results

Hero MotoCorp, Adani Enterprises, HDFC, Hindustan Petroleum Corporation, Adani Total Gas, Adani Wilmar, Vodafone Idea, Ajanta Pharma, Amara Raja Batteries, Bank of India, Blue Star, Coromandel International, Devyani International, Indian Bank, JK Lakshmi Cement, Raymond, SRF, and Welspun Corp will report their quarterly earnings on November 3.

Stocks in News Today

Adani Transmission: The company’s board has granted in-principle approval for issuance of non-convertible debentures worth up to Rs 1,500 crore. Meanwhile, the company reported a 32% drop in its consolidated net profit at Rs 194 crore in September quarter compared to year ago.

Dalmia Bharat: The cement maker reported a 76.84% decline in consolidated net profit at Rs 47 crore for the quarter ended September. The company had posted a net profit of Rs 203 crore during the July-September quarter a year ago. Its revenue from operations increased 15.11% to Rs 2,971 crore in the second quarter of the current fiscal. In the year-ago period, the same stood at Rs 2,581 crore. Dalmia Bharat’s total expenses rose nearly 29% to Rs 2,980 crore in the latest quarter under review. Sales volume increased 13.72 per cent in the September quarter to 5.8 Million Tonnes (MT) compared to the year-ago period.

JK Paper: The company reported more than two-fold increase in consolidated net profit at Rs 326.93 crore in the second quarter of FY23, helped by higher sales volume and enhanced sales realisation. The company had logged a net profit of Rs 118.38 crore in the July-September period a year ago. Its revenue from operations went up 72.34% to Rs 1,722.63 crore. It stood at Rs 999.51 crore in the corresponding quarter last year. JK Paper’s total expenses were at Rs 1,207.40 crore, up 49.6% in the September quarter.

Mahindra & Mahindra Financial Services: The company reported over 55% decline in its net profit at Rs 492 crore in the quarter ended September 2022. It had posted a net profit of Rs 1,103 crore in the year-ago period. Total income increased 3% to Rs 3,029 crore during the quarter under review against Rs 2,951 crore during the corresponding quarter last year.

Vodafone Idea: The company has announced new set of postpaid plans that will bundle in more data and SMS quota along with OTT services such as Netflix and Amazon Prime, as it aims to get a larger share of postpaid customers. There are four Vi Max plans — Rs 401, Rs 501, Rs 701 and Rs 1101. The Vi Max plan will offer discounts on Flight and Hotel bookings through MakeMyTrip.

Marico: The FMCG has expanded its plant-based protein portfolio with the launch of Saffola Soya Bhurji — a protein-rich snack that can be prepared in just 5 minutes, according to the company. With this launch, Marico aims to strengthen its foothold in both the healthy foods and ready-to-cook segment in India with products that cater to the needs of consumers.

L&T Technology Services Ltd (LTTS): The IT services company has inaugurated an engineering research and development centre in Toronto where it plans to hire 100 engineers in the next 18-24 months. “The ER&D centre is expected to become a focal point to hire local talent and further bolster the region’s reputation as a hub for engineering and innovation,” the company said. The Toronto centre is the third nearshore global design centre opened in two quarters.

Wipro: The IT services company has launched a new financial services consulting capability in India named Capco.

Triveni Turbine Ltd (TTL): The company said its board has approved Rs 190 crore share buyback through the tender offer route. The buyback price for the offer has been decided at Rs 350 per share. The company will buy up to 54,28,571 equity shares at a price of Rs 350 per equity share for an aggregate amount not exceeding Rs 190 crore subject to the approval of shareholders, according to its regulatory filing. The record date for the buyback will be announced in the coming days. The company said its consolidated revenue rose 42% YoY to Rs 293 crore in Q2FY23 from Rs 206 crore in the year-ago period. The company’s consolidated net profit fell 73% to Rs 46.21 crore in Q2FY23 as against Rs 173.76 crore in the year-ago period. EBITDA was up 39% YoY to Rs 55.66 crore in Q2FY23.

Relaxo Footwears: The company’s consolidated revenue fell 6% YoY to Rs 670 crore in Q2FY23 as against Rs 714 crore in the year-ago period. The company’s net profit fell 68% to Rs 22.4 crore in Q2FY23 as against Rs 68.69 crore in the same period last fiscal. EBITDA fell 49% to Rs 59.43 crore in the reported quarter from Rs 116.82 crore in Q2FY22.

MTAR Technologies: The defence company has recorded a 30% year-on-year increase in consolidated profit at Rs 24.7 crore for the quarter ended September FY23, driven by higher sales. Revenue jumped 38.2% to Rs 126.2 crore compared to the year-ago period.

Nelcast: The company has reported a 262 percent year-on-year increase in consolidated profit at Rs 12.15 crore for the quarter ended September FY23, supported by topline as well as operating performance. Revenue at Rs 328.52 crore for the quarter increased by 37.4 percent compared to the year-ago period.

SIS: The company has reported a 1.4 percent year-on-year decline in consolidated profit at Rs 67.4 crore for the quarter ended September FY23, impacted by weak operating performance and margin compression. Revenue for the quarter increased by 14 percent YoY to Rs 2,768 crore, while EBITDA at Rs 109.8 crore fell by 10.8 percent for the quarter YoY.

Jindal Stainless: The company has reported a significant 63 percent YoY decline in consolidated profit at Rs 151.84 crore for the quarter ended September FY23, impacted by higher inventory, power & fuel cost, and other expenses. Revenue grew by 11.5 percent YoY to Rs 5,604 crore for the quarter.

Rail Vikas Nigam: Life Insurance Corporation of India has offloaded a 2.02 percent equity stake in the company via open market transactions. With this, LIC’s shareholding in the company reduced to 6.7 percent, down from 8.72 percent earlier.