Campus Activewear Limited is a athlesiure footwear brand which plans to raise ₹1400.14 crore through Initial Public Offering. The subscription for the IPO opens on April 26, 2022 and ends on April 28, 2022.

The price band is fixed at ₹278-292 per equity share. The issue comprises of only Offer For Sale of 47,950,000 equity shares of face value of ₹5 apiece.

The employee reservation portion of the Offer will be up to 200,000 equity shares and the employee discount is Rs 27 per equity share to the final issue price.

Company Summary

Campus Activewear Limited is the largest sports and athleisure footwear brand in India in terms of value and volume in Fiscal 2021. The company’s brand ‘CAMPUS’ was introduced in 2005 and it is a lifestyle-oriented sports and athleisure footwear company. It has a diverse product portfolio for the entire family, offering multiple choices across styles, color palettes, price points and an attractive product value proposition.

Campus has approximately 15% market share in the branded sports and athleisure footwear industry in India by value for Fiscal 2020, which increased to approximately 17% in Fiscal 2021, according to its red herring prospectus. It is one of the very few established Indian brands in a segment which is primarily dominated by international brands.

Campus has 425 distributors directly servicing and fulfilling orders of over 19,200 geographically mapped retailers at a pan-India level.

The company operates their exclusive brand outlets (EBOs) under two models: through company opened company operated stores (“COCOs”) and franchisees. It has have 57 COCOs and 28 franchisees as on December 31, 2021.

The company owns and operates five manufacturing facilities across India with an installed annual capacity for assembly of 28.80 million pairs as of December 31, 2021.

During Apr-Dec of FY22, 38.05% of the total sales came from products priced less than ₹1049, 21.36 % from products priced ₹1050-1499 and 40.59% from products priced at and above ₹1500. The last category (₹1500) contributed only 25.13% in fiscal 2020.

According to its red herring prospectus, during Apr-Dec of FY22, 82.99% of revenue from operations was contributed by men’s category and 7.75% was contributed by women’s category and 8.93% by kids and children’s category.

Company Strengths

- India’s largest sports and athleisure footwear brand and fastest growing scaled sports and athleisure footwear brand.

- Strong product portfolio across the demand spectrum.

- Sustained focus on design and product innovation according to latest global trends and styles through its fashion forward approach.

- Integrated manufacturing capabilities supported by robust supply chain.

- Strong brand recognition, innovative branding and marketing approach.

- The company’s experienced management team.

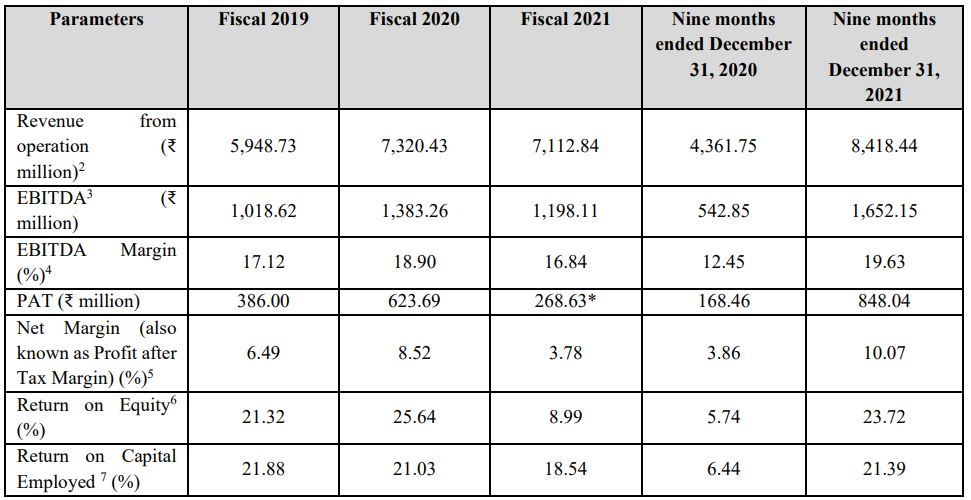

Company Financials

Purpose of the IPO

- The objects of the Offer are to achieve the benefits of listing the equity shares and offer for sale of up to 47,950,000 equity shares by the selling shareholders.

- The IPO is expected to enhance the company’s brand name and provide liquidity to its the existing shareholders.

Company Promoters

Hari Krishan Agarwal and Nikhil Aggarwal are the promoters of our company.

IPO Details

IPO Opening Date | 26-Apr-22 |

IPO Closing Date | 28-Apr-22 |

Issue Type | Book Built Issue IPO |

Face Value | ₹5 per equity share |

IPO Price | ₹278 to ₹292 per equity share |

Market Lot | 51 Shares |

Minimum Order Quantity | 51 Shares |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount (Cut-off) |

Minimum | 1 | 51 | ₹14,892 |

Maximum | 13 | 663 | ₹193,596 |

IPO Allotment Details

Campus Activewear Limited IPO allotment date is on May 4, 2022 and expected initiation of refund is on May 5, 2022. The shares are likely to be listed on the bourses on May 9, 2022

You can check your allotment of Campus Activewear Limited IPO in BSE or Link Intime