Cello World Limited plans to raise up to Rs 1900 crore capital through an initial public offering. The subscription for the IPO will be open from October 30 to November 1, 2023. The pice band is fixed at Rs 617-648 per share.

The IPO consists of offer for sale of 2.93 crore of shares worth Rs 1900 crore. The face value of each shares is Rs 5 and the lot size is 23 shares per one lot. Employees of the company will get a discount of Rs 61 per share to the final issue price.

Company Summary

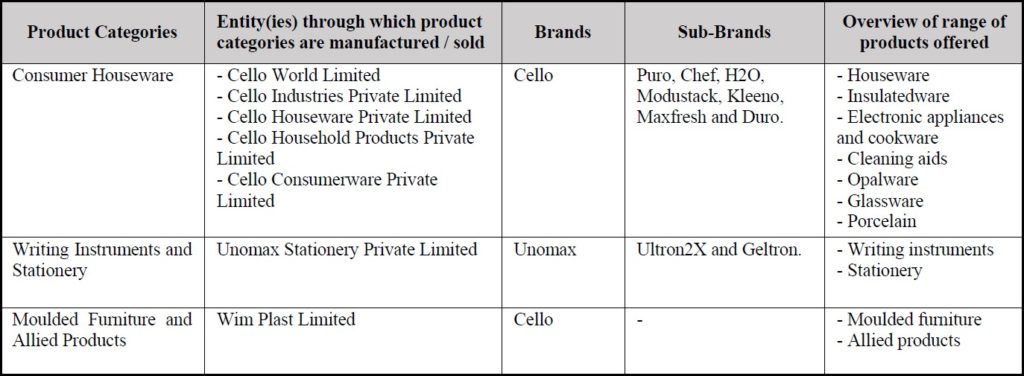

Cello World Limited is a prominent player in the consumerware market in India with presence in the consumer houseware, writing instruments and stationery, and moulded furniture and allied products and consumer glassware categories. The table below shows the brands, sub-brands and range of products offered across the three product categories,

According to its red herring prospectus, the company’s revenue derived from its in-house manufacturing operations aggregated to 78.65%, 82.63%, and 79.37% of its total revenue from operations for the Financial Years 2021, 2022 and 2023, respectively. The remaining products consisting of steel and glassware products are manufactured by third-party contract manufacturer.

As of June 30, 2023, Consumer Houseware category had 717 distributors and approximately 58,716 retailers located across India. Writing Instruments and Stationery category had 29 super-stockist, approximately 1,509 distributors and about 60,826 retailers in India. Moulded Furniture and Allied Products category had 1,067 distributors and about 6,840 retailers in India.

The company owns or leases and operate 13 manufacturing facilities across five locations in India, as of June 30, 2023, and it is currently establishing a glassware manufacturing facility in Rajasthan. The company’s manufacturing capabilities allows it to manufacture a diverse range of products in-house.

Company Strengths

- Well-established brand name and strong market positions.

- Diversified product portfolio across various price points catering to diverse consumer requirements.

- Strong track record of scaling up new businesses and product categories.

- Wide distribution network with a presence across multiple channels.

- Ability to achieve economies of scale leading to operational efficiency and consistent growth in earnings.

- Skilled and experienced management team.

Company Financials

Period Ended | Q1FY24 | FY23 | FY22 | FY21 |

Total Assets (Rs in crore) | 1,686.05 | 1,551.69 | 1,333.66 | 1,146.51 |

Total Revenue (Rs in crore) | 479.88 | 1,813.44 | 1,375.11 | 1,059.58 |

Revenue from Operations (Rs in crore) | 471.77 | 1796.69 | 1359.17 | 1049.45 |

EBITDA (Rs in crore) | 127.3 | 437.27 | 349.5 | 286.87 |

EBITDA Margin | 26.98% | 24.34% | 25.71% | 27.34% |

Profit After Tax (Rs in crore) | 82.82 | 285.05 | 219.52 | 165.54 |

PAT Margin | 17.55% | 15.90% | 16.20% | 15.80% |

Return on Capital Employed | 8.06% | 44.48% | 40.92% | 58.73% |

Debt to equity ratio | 0.30 | 0.62 | 1.70 | 5.11 |

Purpose of the IPO

The purpose of the IPO is to achieve the benefits of listing the equity shares on the stock exchanges and carry out the Offer for Sale of equity shares aggregating up to Rs 1900 crore by the selling shareholders. Further, the company expects the listing will enhance the visibility and brand image of the company. The company will not receive any proceeds from the Offer for Sale.

Company Promoters

Pradeep Ghisulal Rathod, Pankaj Ghisulal Rathod and Gaurav Pradeep Rathod are the promoters of the company.

IPO Details

IPO Subscription Date | October 30 to November 1, 2023 |

Face Value | Rs 5 per share |

Price Band | Rs 617 to Rs 648 per share |

Lot Size | 23 shares |

Total Issue Size | 2,93,20,987 shares aggregating up to Rs 1,900 crore |

Offer for Sale | 2,93,20,987 shares aggregating up to Rs 1,900 crore |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 23 | Rs 14,904 |

Retail (Maximum) | 13 | 299 | Rs 193,752 |

Small HNI (Minimum) | 14 | 322 | Rs 208,656 |

Small HNI (Maximum) | 67 | 1,541 | Rs 998,568 |

Large HNI (Minimum) | 68 | 1,564 | Rs 1,013,472 |

Allotment Details

Event | Date |

Allotment of Shares | November 6, 2023 |

Initiation of Refunds | November 7, 2023 |

Credit of Shares to Demat Account | November 8, 2023 |

Listing Date | November 9, 2023 |

To check allotment, click here