POST-MARKET REPORT

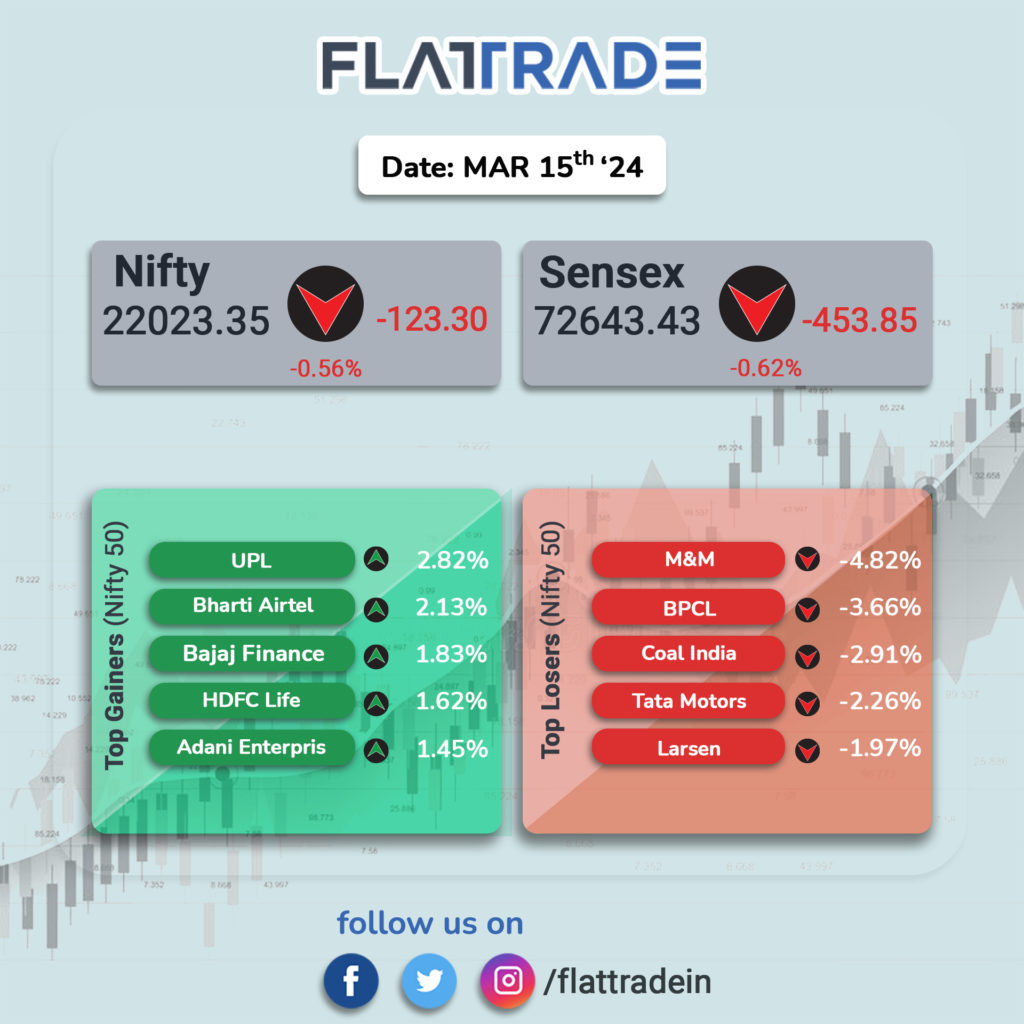

India’s benchmark Sensex and Nifty faced their first weekly decline after four weeks of gains and posted around two percent loss during the week. At close, the Sensex is down 0.63 percent at 72,643.43 and the Nifty 0.56 percent lower at 22,023.35.

The top losers of today are Mahindra and Mahindra (down 4.99 percent), BPCL (down 4.15 percent), and Coal India (down 2.85 percent) while UPL (up 3.18 percent), Bharti Airtel (up 1.62 percent) and HDFC Life Insurance Company (up 1.53 percent) closed as the top gainers.

Among the sectors except for Nifty Metal and FMCG indices that ended flat, all other sectoral indices ended on a negative note with Nifty Oil & Gas (down 1.98 percent) and Auto (down 1.57 percent) ending as the top losers among the sectoral indices.

Considering Broader markets, BSE MidCap and SmallCap lost around 4 percent and 6 percent while Nifty Midcap 100 index was 0.5 percent lower and the Nifty Smallcap 100 index gained 0.2 percent.

STOCKS TODAY

RailTel: The share surged by up to 7 percent following the announcement of a Rs 113.46 crore work order from Odisha Computer Application Centre (OCAC). The order involves setting up IP-MPLS network connectivity in Odisha under OdishaNet Phase 1.0. Over the past year, RailTel has risen over 227 percent against Nifty’s 30 percent.

Shakti Pumps (India): The share hit a 5 percent upper circuit after securing a Rs 93 crore order. The company received a Letter of Award from the Maharashtra Energy Department Agency (MEDA) for 3,500 solar photovoltaic water pumping systems (SPWPS) across the state.

KPI Green Energy: The stock surged 3 percent after securing a wind-solar power project from Gujarat Urja Vikas Nigam Limited (GUVNL). The company stated in an exchange filing that it emerged as the successful winner of GUVNL’s tender for developing a 500 MW hybrid renewable power project, with a greenshoe option for an additional 500 MW.

Biocon: Biocon’s shares dropped more than 4 percent following the acquisition of subsidiary Biocon Biologics’ India-branded formulation business by Eris Lifesciences for Rs 1,242 crore. The transaction, valued 3.4 times revenue and 18 times EBITDA, involves over 430 employees moving to Eris. The acquired business includes portfolios in insulin, oncology, and critical care.

Ashok Leyland: Ashok Leyland Limited’s shares fell 2 percent as investors sought to secure profits following a 3 percent rally the previous day. The company disclosed that its subsidiary, Hinduja Tech, signed a definitive agreement with Creador, which will acquire a 19.6 percent stake in the company for $50 million. This investment values Hinduja Tech at a post-money equity of $255 million.

Tata Investment Corp Ltd: The share plummeted 5 percent to hit the lower circuit after 35 crore shares changed hands in a block deal, CNBC reported. The details of the buyers and sellers were not known. This marks the fifth consecutive trading session where the stock hit the lower circuit, declining about 22.6 percent during the period.

L&T Technology Services: The stock surged over 2 percent following an Rs 800-crore order win. The company will deliver advanced cybersecurity solutions to enhance public safety in Maharashtra. Teaming up with KPMG Assurance and Consulting Services LLP as a forensics partner, they will create an advanced cybersecurity system and establish a cybercrime prevention center, utilizing artificial intelligence and digital forensic tools to combat cyber threats.