Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.53% higher at 16,105.5, signalling that Dalal Street was headed for a positive start on Thursday.

Japanese shares were trading higher, tracking a positive lead from Wall Street after the Federal Reserve minutes hinted at a less hawkish interest rate hike plan than markets particiapants had expected. Japan’s Nikkei 225 rose 0.6% and Topix jumped 0.95%.

Meanwhile, Chinese shares were trading lower after negative remarks on China’s economy by Premier Li Keqiang. Hang Seng fell 0.71% and CSI 300 was down 0.25%.

Indain rupee edged up 5 paise to 77.52 against the US dollar on Wednesday.

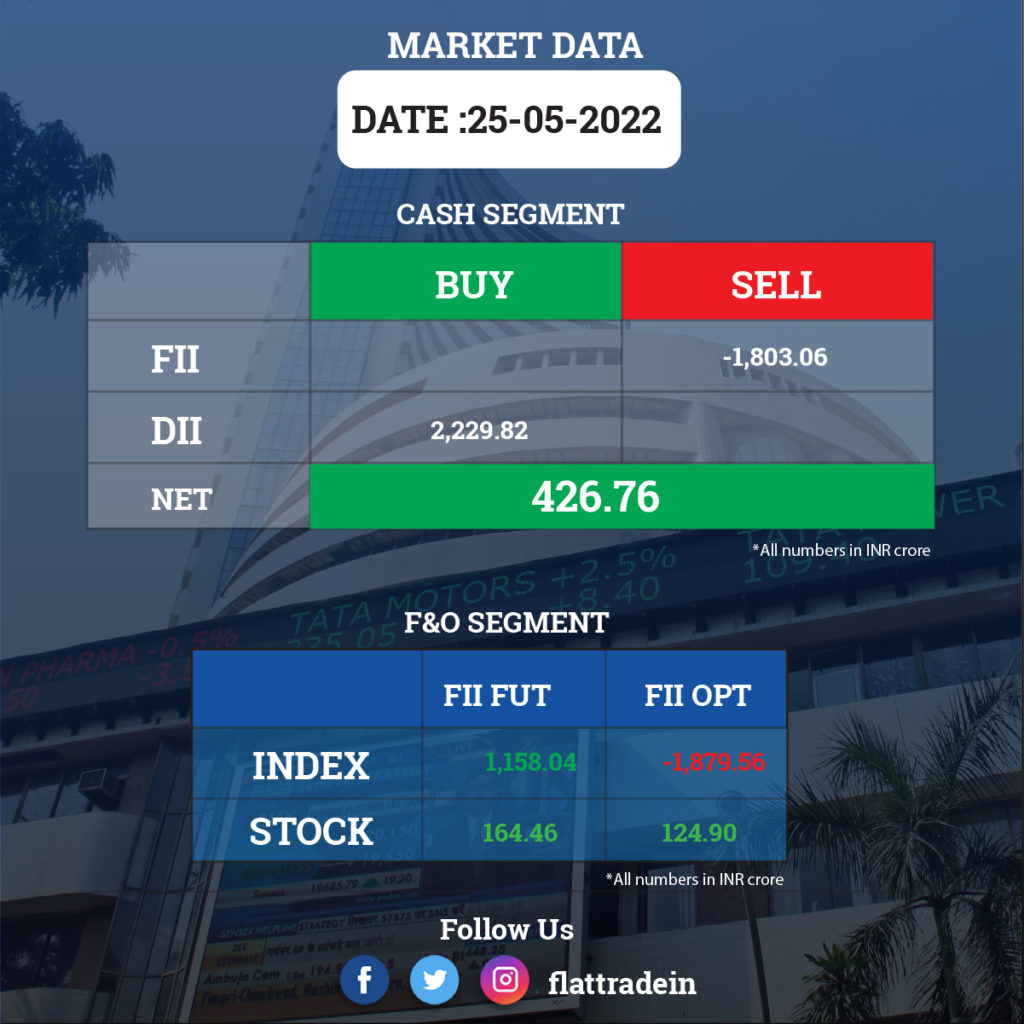

FII/DII Trading Data

Upcoming Results

Hindalco Industries, Motherson Sumi Systems, Muthoot Finance, Zee Entertainment Enterprises, Aarti Surfactants, Oberoi Realty, Aban Offshore, AllCargo Logistics, Ansal API, Astrazeneca Pharma, Berger Paints, Colgate Palmolive India, Cummins India, Good Year India, Gujarat State Fertilizers Corporation, India Glycols, Jet Airways, Kirloskar Industries, Chemcon Speciality Chemicals, NMDC, Page Industries, Prestige Estate Projects, Quess Corp, Shalimar Paints, and Sudarshan Chemicals will release their quarterly results.

Stocks in News Today

InterGlobe Aviation (IndiGo): The company said its losses widened to Rs 1,681.80 crore in the March quarter compared with Rs 1,147.20 crore in the corresponding quarter last year. The rise in losses was due to higher fuel costs. Its total income for the quarter jumped 29% YoY to Rs 8,207.50 crore from Rs 6,361.80 crore in the same quarter last year.

Infosys: The IT major has collaborated with global cybersecurity company Palo Alto Networks to elevate the security maturity of large enterprises with mission-critical digital landscapes and to help prevent the threat of cyberattacks. The companies will enhance these security solutions for their worldwide customers like Mercedes-Benz.

Adani Ports and Special Economic Zone Limited (APSEZ): The company has reported a 21.78% decline in consolidated net profit to Rs 1,033 crore for the fourth quarter ended March 2022. It had clocked a consolidated net profit of Rs 1,321 crore in the corresponding period of the previous fiscal. Consolidated total income of the company increased to Rs 4,417.87 crore for the fourth quarter of FY22 as against Rs 4,072.42 crore in the year-ago period.

Bharat Petroleum Corporation Ltd (BPCL): The company reported a 82% decline in net profit in the quarter ended March 2022 as the firm held fuel prices despite rise in cost. It posted a net profit of Rs 2,131 crore in Q4FY22 as compared with Rs 11,940.13 crore in the year-ago period. Revenue from operations rose 25% YoY to Rs 1.23 trillion on higher oil prices but losses on petrol, diesel and domestic LPG sales dented the financials.

Coal India Ltd (CIL): The company posted a 45.9% rise in its consolidated net profit at Rs 6,692.94 crore for the quarter ended March 2022 compared with a consolidated net profit of Rs 4,586.78 crore in the year-ago period. The consolidated revenue from operations increased to Rs 32,706.77 crore in Q4FY22 from Rs 26,700.14 crore in the year-ago period.

National Aluminium Company Ltd (NALCO): The company reported a 9.5% rise in consolidated profit at Rs 1,025.46 crore for the quarter ended March 2022, as against a consolidated profit of Rs 935.74 crore in the year-ago period. The company’s consolidated income during the reported period increased to Rs 4,492.10 crore from Rs 2,874.47 crore in the year-ago period.

Apollo Hospitals Enterprises: The hospital chain said its consolidated profit after tax declined by 46% to Rs 90 crore for the fourth quarter of FY22 as against a PAT of Rs 168 crore in the year-ago period. Revenue from operations rose to Rs 3,546 crore in the reported quarter as compared with Rs 2,868 crore in the year-ago period. The company’s board recommended a dividend of Rs 11.75 per share of face value of Rs 5 each for the financial year ended March 2022. It also approved the re-appointment of Prathap C Reddy as a whole time director designated as an Executive Chairman for a period of two years with effect from June 25, 2022, subject to the approval of shareholders.

Sundaram Finance: The Non-banking finance company reported a 43 per cent jump in its net profit for the quarter ending March 31, 2022 at Rs 299 crore. The Chennai based company registered a net profit at Rs 209 crore during the corresponding quarter previous year.

NHPC: The state-owned hydro power player posted an almost seven per cent rise in its consolidated net profit to Rs 515.90 crore in the March 2022 quarter. The company had reported a consolidated net profit of Rs 482.35 crore in the quarter ended March 2021.

Torrent Pharma: The drug maker said its consolidated loss stood at Rs 118 crore for the fourth quarter ended March 2022 on account of impairment provision of Rs 425 crore related to discontinuation of liquids business in the US. The company had reported a net profit of Rs 324 crore in the January-March period of 2020-21 fiscal.

Max Healthcare Institute: The company said its profit after tax increased by 58% to Rs 172 crore for the fourth quarter ended March 2022. It had reported a net profit of Rs 109 crore in the year-ago period. Gross revenue rose to Rs 1,298 crore for the period under review as compared with Rs 1,161 crore in the year-ago period.

Whirlpool of India Ltd: The consumer durables manufacturer reported a 35.04% decline in consolidated net profit to Rs 84.48 crore for the fourth quarter ended in March 2022 due to soft industry demand and rising commodity costs. It had posted a net profit of Rs 130.06 crore during the same period last fiscal. Its revenue from operations was down by 4.07% at Rs 1,706.91 crore during the quarter under review as against Rs 1,779.39 crore in the corresponding period of the previous fiscal.

Bata India: The shoemaker reported over two-fold increase in its consolidated net profit at Rs 62.96 crore for the fourth quarter ended March 2022. IT had posted a net profit of Rs 29.47 crore in the year-ago period. Its revenue from operations increased 12.77% to Rs 665.24 crore during the quarter under review, as against Rs 589.90 crore in the corresponding quarter of FY21. The board of the company recommended a dividend of Rs 54.5 per equity share for a face value of Rs 5 each.

Deepak Fertilisers: The company reported a 144.30% jump in consolidated profit after tax (PAT) at Rs 282.91 crore for the quarter ended March 2022, compared with a PAT of Rs 115.80 crore during the corresponding quarter of FY21. Revenue from operations during the quarter rose 27.77% to Rs 2,012.48 crore as compared to Rs 1,575.08 crore in the same period of the previous fiscal.

Fortis Healthcare Ltd: The company reported a 40% jump in consolidated net profit at Rs 87.03 crore in the fourth quarter of fY22 compared with a consolidated net profit of Rs 62.36 crore in the same quarter of the previous fiscal. Consolidated revenue from operations during the quarter under review stood at Rs 1,378.1 crore as against Rs 1,252,44 crore in the year-ago period.

Power Finance Corporation (PFC): The state-owned company registered a consolidated net profit of Rs 4,295.90 crore in the March quarter, as against a consolidated net profit of Rs 3,906.05 crore in the year-ago period. Total income in the reported quarter rose to Rs 18,873.55 crore from Rs 18,155.14 crore in the same period a year ago. The company’s board has recommended a dividend of Rs 1.25 per equity share with face value of Rs 10 each for FY22.

Bank of India: The lender’s net profit rose 142.3% to Rs 606 crore in Q4FY22, on improvement in net interest margins. It had posted a net profit of Rs 250 crore in Q4FY21. In the reporting quarter, its net interest income rose 36% YoY to Rs 3,986 crore as against Rs 2,936 crore in the year-ago quarter.The board recommended a dividend of Rs 2 per equity share (of face value of Rs 10) for 2021-22 subject to shareholders’ nod.

Suzlon Energy: The company reported a consolidated net loss of Rs 205.52 crore in the Q4FY22. The consolidated net loss of the company stood at Rs 54.25 crore in the year-ago quarter. Total income in the quarter under review rose to Rs 2,478.73 crore from Rs 1,141.15 crore in the same period a year ago.

The company said it has successfully concluded refinancing of its debt of the State Bank of India-led existing consortium of 16 lenders with REC Limited-led consortium of two lenders.