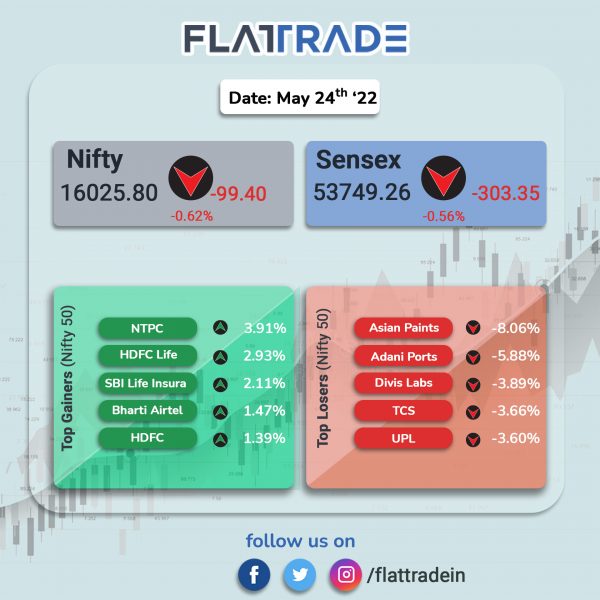

Benchmarks equity indices declined for the third straight day, dragged by losses in information technology, realty, PSU banks and metal stocks. The Sensex fell 0.56% and the Nifty 50 dropped 0.62%.

The broader indices underperformed headline indices. The Nifty Midcap 100 slumped 2.45% and BSE Smallcap tanked 2.94%

Top losers among Nifty sector indices were IT [-3.38%], Realty [-2.88%], Media [-2.86%], PSU Bank [-2.03%] amd Metal [-1.95%]. Top gainers were Financial Services [0.68%] and Private Bank [0.27%].

Rupee edged up 5 paise to 77.52 against the US dollar on Wednesday.

Stock in News Today

IT companies: Shares of Indian IT services companies fell after brokerge firm Nomura downgraded five of seven stocks in its coverage. Nomura expects tech spending to decline due to dynamic changes in macro-economic conditions and a hawkish Federal Reserve. The brokerage firm also estimates growth rates to decelerate due to revenue and earnings volatility.

Hindustan Zinc: Shares of the company rose on Wednesday after media reports said that the Cabinet has approved 29.5% stake sale in the company. As of March 31, Vedanta held 64.92% stake in the company, while LIC owned 2.6%.

NMDC: Shares of the company fell 4.23% after the the company announced reduction in price of iron ore by 14.5%. Lump ore is fixed at Rs 5,500 per tonne, while iron ore fines is priced at Rs 4,410 per tonne.

Max Healthcare: The company’s consolidated revenue rose 17% to Rs 939 crore in Q4FY22 as against Rs 802 crore in the year-ago period. Its net profit soared 78% to Rs 124 crore in ther reported quarter compared with Rs 70 crore in the same period last year. EBITDA was up 25% YoY to Rs 210 crore in the quarter under review.

SpiceJet: The budget carrier said that it has signed and concluded the settlement and consent terms with Switzerland-based investment bank Credit Suisse in a pending dispute with the latter. The settlement involves payment of a certain amount upfront and the balance amount over a mutually agreed timeline.

Cipla: The pharma company has been rated ‘STRONG’ in Sustainability Yearbook 2022 released by rating agency CRISIL. Cipla is amongst the top 5 companies in the manufacturing sector and has the highest ESG score amongst peers in the pharmaceutical sector. CRISIL analysed 586 companies across 53 sectors for over 350+ parameters on Environment, Social and Governance (ESG) components for evaluation.

Natco Pharma: Johnson & Johnson and Momenta Pharmaceuticals have filed a lawsuit against Natco and its marketing partner Mylan in the Pennsylvania Federal Court alleging infringement of two old patents. Natco said this is a meritless suit for a product that has been in the market for more than 5 years and it will strongly “defend against” this suit.

Ducon Infratechnologies: The company will provide its proprietary coal clean technology, fuel gas desulphurisation for Suratgarh Supercritical Thermal Power Station in Rajasthan. The anticipated value of the order is in range of Rs 150 crore-Rs 200 crore.

Aster DM Healthcare: Shares of the company rose more than 13% in intraday trading after it reported robust fourth-quarter results. Its consolidated net profit surged 114.7% to Rs 226.27 crore in the reported quarter from Rs 105.39 crore in the year-ago period. It revenue was up 14% to Rs 2,727.79 crore, as agaisnt Rs 2,390.88 crore in the same period a year ago.