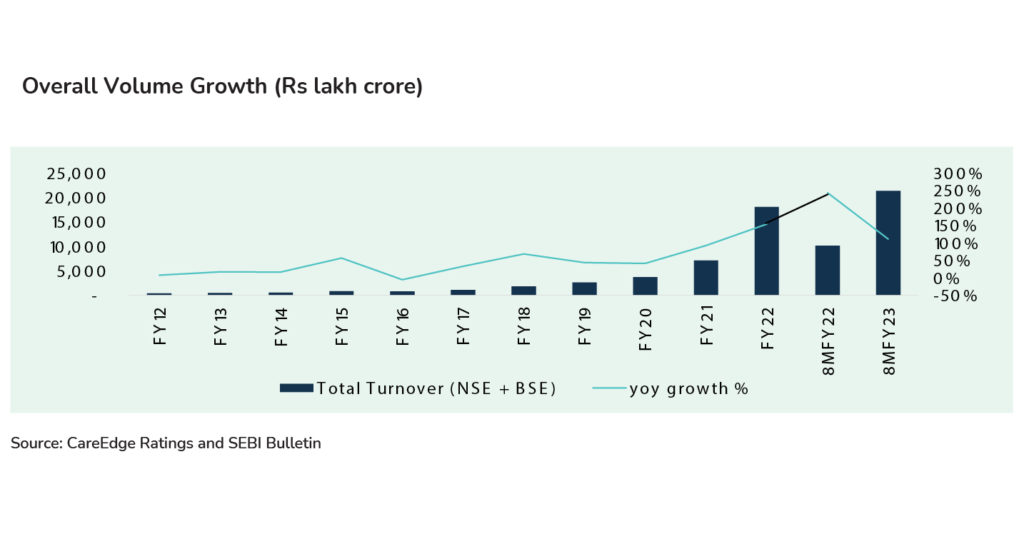

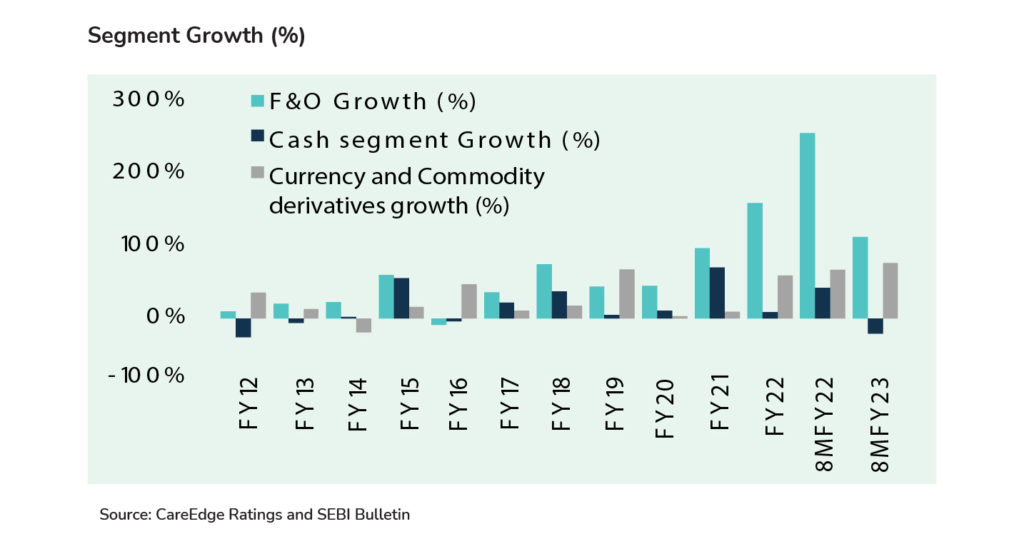

Indian capital market has seen robust growth in terms of volume in the past two years since the pandemic, driven by the Futures & Options (F&O) segment, according CareEdge Ratings. In fiscal 2021, the market volumes grew by 92% YoY, while in 2022 it grew further by 154%. This significant growth was on the back of ample liquidity and increased participation from retail investors. The F&O segment grew by 97% in FY21 and 160% in FY22, while the cash segment rose 70% in FY21 before tapering down to a modest 9% in FY22.

F&O segment volumes have always been significantly higher than cash segment volumes, as investors can take large positions through higher leverage and less upfront cash requirement compared to the cash segment, the rating agency stated. However, despite the sharp increase in F&O volumes, its contribution to the overall broking income remains relatively low and the cash segment remains the cash cow for the broking industry.

Discount Brokers vs Traditional Brokers vs Bank-based Brokers

The total income of brokers – discount, traditional, and bank-based brokers – comprises mainly of broking income and other income, which includes fees income and interest income, according to CareEdge Ratings. Large traditional brokers and bank-based brokers have relatively better diversification in their total income profile with broking income contributing about two-thirds of the total income, CareEdge noted. These brokers have diversified their income channels through income from margin trading funding and providing wealth services such as insurance and mutual funds distributions.

Meanwhile, the number of active clients grew and discount brokers have managed to corner a market share of about 70% of total active clients at end of fiscal 2022. However, this has not commensurately translated in the share of broking income or profitability at an aggregate level.

Discount brokers constitute about 40% of the total industry’s broking income and around 30% of net profits. On the other hand, bank-based brokers contribute about one-third of broking income and close to 50% of net profits with an active client share of just over 20%. This is because clients of discount brokerage firms are majorly focused on trading in the F&O segment, while clients of bank-based brokers have higher share in cash segment.

Nonetheless, traditional brokers have been investing in technology in the past last few years and expanding their network to acquire new clients. Consequently, their cost-to-income ratio have increased. CareEdge believes that once the cost-to-income ratio of traditional brokers normalises, their profit margins will improve from current levels. Like bank-based brokers, the traditional ones are also expected to benefit from their diversified income sources and relatively higher share of cash segment trading.

Stringent Regulatory Compliance

In the recent past, the market regulator Sebi has come out with stringent rules to improve the functioning of capital markets and their intermediaries, and protect investor capital from being misused. These include peak margin that was introduced in September 2021 to set strict rules on leverage. Then the “Demat Debit Pledge Instructions” (DDPI) was implemented in July 2022 and it replaced the Power of Attorney provided by clients to brokers. Further, the Quarterly fund settlement introduced in October 2022 where funds in the trading account must be transferred back to the client’s bank account once in a quarter by the brokers will also help in mitigating the risk for investor capital.

Moreover, SEBI is contemplating to designate some of the country’s top brokers as qualified stock brokers (QSBs) which will increase the compliance requirements for those QSBs. Additonally, it plans to introduce ASBA concept in the secondary market similar to one for the IPO market. Accordingly, the client’s funds will be directly transferred to the clearing house, and brokers would only execute trades for their clients to avoid potential misuse of clients’ funds by the brokers.

All these possible regulatory changes are good for capital markets and investors, but increases the compliance and operational cost for broking companies. As a result, CareEdge believes that bank-based brokers are adequately prepared to handle these additional compliance requirements since they are already subject to additional monitoring from the RBI. Also, some of the large traditional brokers have sufficient capacity to adapt swiftly to the changing regulatory requirements. However, the rating agency expects that a few small brokers may find the regulatory compliance to weigh on their sustenance, and may lead to consolidation in the industry.

Industry Outlook

CareEdge expects the exponential growth in volume and active clients reported in the past two fiscal years is unsustainable over long term. Accordingly, CareEdge estimates moderation in the active clients’ growth in the near term. Nevertheless, retail participation is still low in Indian capital markets and it is likely to augur well for the long-term sustained growth of clients for the overall broking industry.

CareEdge expects the total income growth for the broking industry will moderate to about 10% in FY23, from about 47% in FY22. The total income for FY23 is expected to be about Rs 28,000 – Rs 30,000 crore with discount brokers continuing to contribute about 40% of the industry’s total income. Further, traditional and bank-based brokers are expected to have a relatively flattish growth with total income more or less equal to the levels of FY22.

CareEdge expects the broking industry performance in FY24 to be largely in line with the trends seen in FY23 with a potential for inorganic growth for some traditional brokers benefiting from consolidation in the industry.