POST MARKET

Indian equity indices slipped for a third straight session on Thursday, weighed down by a sell-off in metal stocks and select financials, even as strength in FMCG, IT, and auto stocks helped cushion the fall.

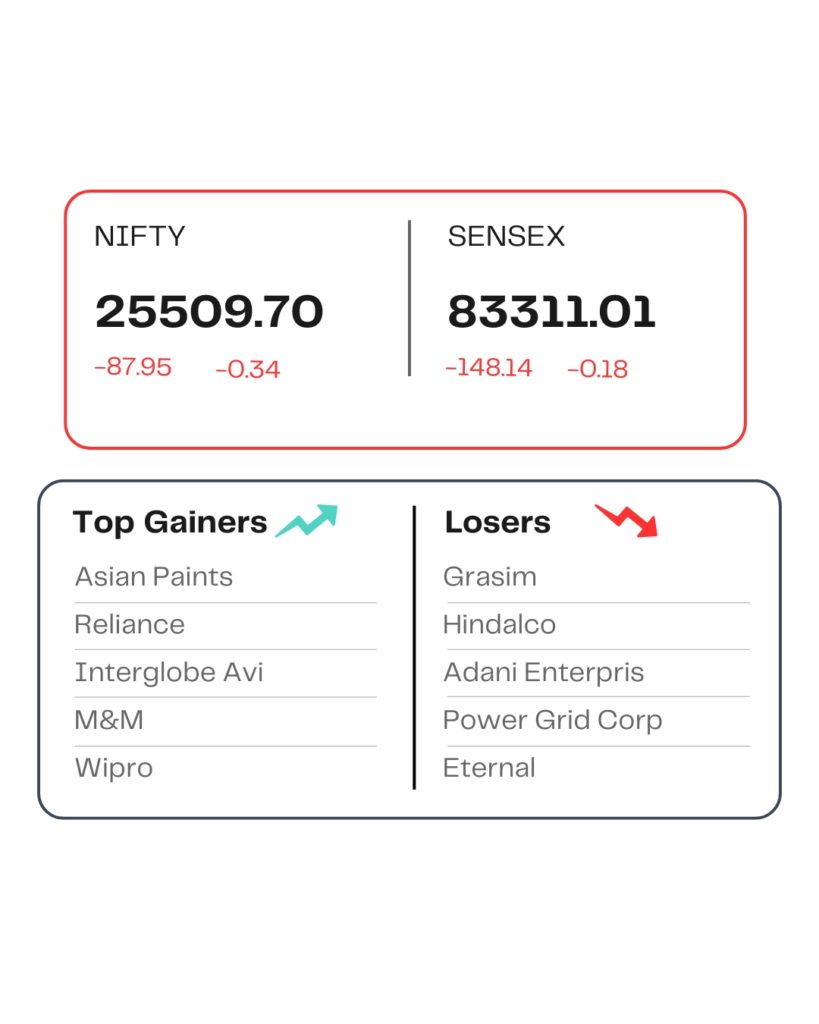

At close, the Sensex was down 148.14 points or 0.18 percent at 83,311.01, and the Nifty was down 87.95 points or 0.34 percent at 25,509.70. About 1174 shares advanced, 2855 shares declined, and 130 shares were unchanged.

On the sectoral front, metal, power, realty, and media are down 1.5-2.5%. However, FMCG, auto, and IT ended with marginal gains.

Asian Paints, Interglobe Aviation, M&M, Reliance Industries, and UltraTech Cement were among the major gainers on the Nifty, while losers were Hindalco, Grasim Industries, Adani Enterprises, Power Grid Corp, and Eternal.

Among the broader market indices, the BSE Midcap index fell 1.2%, and the smallcap index shed 1.5%.

STOCKS TODAY

Delhivery

The shares of Delhivery plunged more than 8.5 percent to hit the lower circuit. This comes after the company posted a net loss of Rs 50.4 crore for the second quarter of the financial year 2026, as against a net profit of Rs 10.2 crore reported in the corresponding quarter of the previous financial year.

Hindalco Industries

The shares of Hindalco Industries sharply dropped 5.17 percent after the firm’s subsidiary Novelis released its results for the second quarter of the ongoing financial year 2026. The share price of the company ended at Rs 786.55 per share.

Blue Star

The shares of Blue Star dropped more than 6.5 percent after the company said that it continued to see demand slowdown in the air conditioner segment as prolonged rains and lower temperatures impacted secondary sales and delayed channel offtake.

Ola Electric

Shares of Ola Electric went down almost 5 percent to reach their two-month low after the electric two-wheeler maker cut its FY26 revenue forecast. Ola reaffirmed its fiscal year 2026 auto gross margin target of 40%, but lowered the revenue forecast to Rs 3,000 crore-Rs 3,200 crore from Rs 4,200 crore-Rs 4,700 crore projected last quarter.

Zydus Lifesciences

Zydus Lifesciences’ share price is down 3.60 percent following the United States Food and Drug Administration’s (USFDAs) inspection at the group’s manufacturing plant located SEZ–II, Ahmedabad, between August 11-14, 2025.

Source – Money Control