India’s economy grew at 20.1% in the Apr-Jun quarter of FY22, compared with year ago period on constant price basis. Constant price represent the real GDP which is adjusted for inflation. The economy contracted in the same period of last year by 24.4%.

The spike in GDP in terms of percentage points was due to low base effect. Though it has recovered significantly in Q1, it is yet to touch the levels of Q1 in FY20. GDP is calculated as the sum of the gross value added (GVA) at basic prices, plus all taxes on products, less all subsidies on products.

GVA is defined as the production and service output value in rupee terms minus the value of intermediate consumption and is a measure of the contribution to growth made by an individual producer, industry or sector. GVA gives the value of goods and services produced in the country after subtracting the cost of inputs and raw materials that have gone into the production of those goods and services.

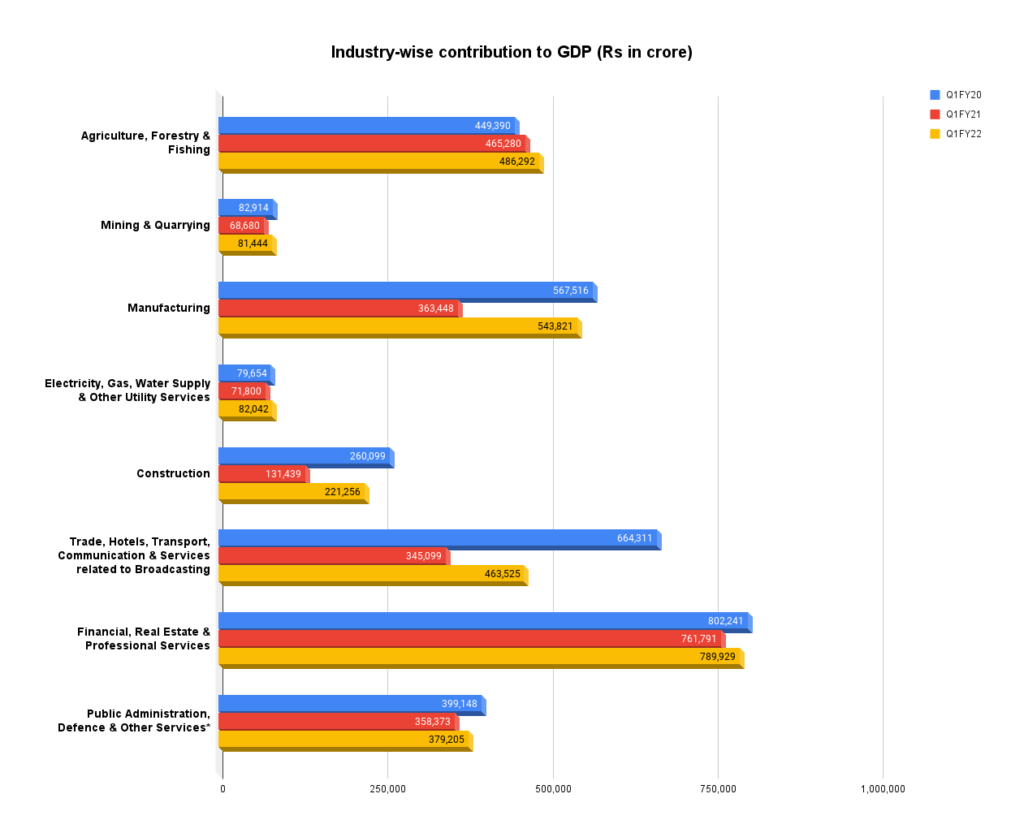

The below image shows various industries’ contribution to the Indian economy. Manufacturing and Construction saw the strongest rebound during the quarter compared to the same period in the last fiscal year. The Public Administration, Defence & Other Services category include the Other Services sector i.e. Education, Health, Recreation, and other personal services.

Private Final Consumption Expenditure (PFCE) at 55.1% is the major contributor to the Indian economy. Any fluctuation in this item which is a measure for private consumption will adversely affect the the GDP growth. Gross Fixed Capital Formation was healthy in Q1 of FY22 and it was close to Q1 numbers in FY20.

Exports and imports in Q1FY22 were higher than the levels in Q1FY20 levels. Exports stood at Rs 7.68 trillion in Q1FY22, higher than Rs 5.52 trillion in Q1FY21 and Rs 7.06 trillion in Q1FY20. Imports rose to Rs 8.30 trillion in Q1FY22 from Rs 5.18 trillion in the same period FY21. But it was lower than Q1FY20 at Rs 8.77 trillion.

Fiscal Deficit

India’s fiscal deficit in April-July narrowed to Rs 3.21 lakh crore from Rs 8.21 lakh crore year-on-year, government data showed. The fiscal deficit or the gap between expenditure and revenue for 2020-21 was 9.3 percent of the Gross Domestic Product (GDP), better than 9.5 percent projected in the revised estimates in the Budget in February.

According to the government data, the central government’s total receipts stood at Rs 6.83 lakh crore or 34.6 percent of corresponding BE 2021-22 up to July 2021. Out of the total receipts till July 2021, Rs 5,29,189 crore was tax revenue (net to centre), Rs 1,39,960 crore non-tax revenue and Rs 14,148 crore non-debt capital receipts. Non-debt capital receipts consist of recovery of loans worth Rs 5,777 crore and disinvestment proceeds of Rs 8,371 crore. The government’s total expenditure was Rs 10.04 lakh crore.

To read more stories on Indian economy, click here