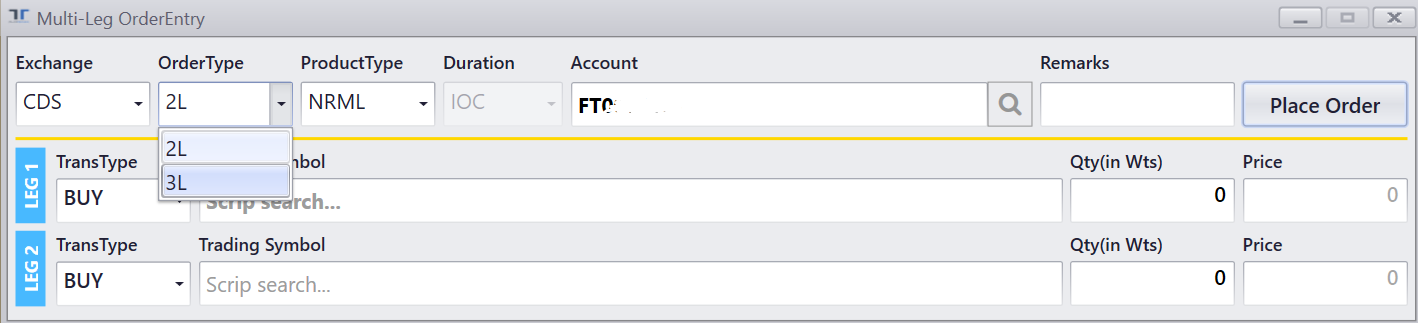

Multi leg order is an order type introduced in FLATTRADE trading software, where the client can place 2L/3 L orders by hedging the positions either in options or in futures. This is a derivative product and can hedge the positions across the derivative products.

In Options, you can hedge the pricing speculation through the Multi leg order strategy. The Multi leg order allows the investor to buy and sell options contract simultaneously with the different or same strike price. These are advanced trading strategies. When the fluctuation in the price is clear, however, the direction is unclear; you can use the multi leg order strategy. There are different multi legged strategies such as straddle, strangle, ratio spread, and butterfly.

The Multi leg orders incur lesser cost compared to call-put or bid-ask orders. Let us assume you are buying an option contract of a stock at a strike price of Rs.1000 and simultaneously selling an option contract of the same stock at the same strike price of Rs.1000. On the date of expiry of contracts, the trading cost here for the multi leg order lesser compared to the bid-ask trade cost.

Understanding Multi leg order strategies:

Straddle: Straddle strategy involves buying a call and put options simultaneously at the same strike price with the same expiry date and underlying asset.

Strangle: Strangle strategy involves buying a call and put options at different strike prices with the same expiry date and underlying assets.

Ratio Spread: Here, the investor holds an unequal number of long and short options simultaneously.

Butterfly spread: It combines the bull and bear spreads with a fixed risk and capped profit. It usually involves four options contracts with three different strike prices, but the same expiration.

FLATTRADE is introducing Multi leg order strategy in our trading system. You can place these orders on both Desktop version app and Mobile apps.

Why worry on margins /leverages when you can trade on Multi leg order with less margins !

Benefits of FLATTRADE Multi leg order:

- You can avail 2 legs or 3 leg order.

- It can be used to hedge the positions.

- It is an IOC (immediate or Cancel) product.

- Only market orders are allowed.

- It can hedge options to options and hedge stock futures and stock options.

- Easy to place Multi leg orders through Mobile and Desktop apps.

Strategies can be created based on the below derivative groups, where Multi leg orders can be placed in these 6 different groups of stocks/ index:

- Group1: Nifty Options

- Group2: Index Futures

- Group3: Stock F&O symbol starting A – G

- Group4: Stock F&O symbol starting H – M

- Group5: Bank Nifty Options

- Group6: Stock F&O symbol starting N – Z