Paras Defense and Space Technologies Ltd is set to go public through an initial public offering and the company has fixed its price band of Rs 165-175 a share. The IPO subscription will open on September 21, 2021 and end on September 23, 2021.

The issue size of the IPO is Rs 170.78 crore based on the upper band of Rs 175 apiece and the face value of each equity share is Rs 10. There will be a fresh issue of Rs 140.60 crore and an offer for sale of 17,24,490 equity shares aggregating to Rs 30.18 crore. The listing date or the stock market debut is expected to be on October 1, 2021.

Company Summary

Paras Defence is a Mumbai-headquartered company engaged in designing, developing, manufacturing and testing of a range of defence and space engineering products and provide related solutions. They cater to four major segments of Indian defence sector: defence and space optics, defence electronics, electro-magnetic pulse protection solution and heavy engineering. They are also the sole Indian supplier of critical imaging components such as large size optics and diffractive gratings for space applications in India.

The company’s clientele are Bharat Electronics Limited (BEL), Hindustan Aeronautics Limited (HAL), Bharat Dynamics Limited (BDL), Hindustan Shipyard Limited (HSL), Electronic Corporation of India Limited (ECIL), Tata Consultancy Services Limited (TCS), Solar Industries India Limited, Alpha Design Technologies Private Limited and Astra-Rafael Comsys Private Limited. Foreign clients include Advanced Mechanical and Optical Systems in Belgium and Tae Young Optics Company Limited and Green Optics in South Korea. The company has a current order book of Rs 3,04.992 crore as of June 30, 2021.

They have two manufacturing facilities located at Ambernath in Thane, Maharashtra and Nerul in Navi Mumbai, Maharashtra. Paras’ R&D activities are mainly undertaken at their centres at Nerul in Navi Mumbai, Maharashtra and Bengaluru, Karnataka. Their Ambernath facility produces heavy engineering products, while Nerul facility is into manufacturing of optics, production of integration of electronics and EMP protection products and solutions.

Company Strengths

- Extensive range of products and solutions for both defence and space applications

- Manufacturing expertise in high precision optics for the space and defence industry

- Strong R&D capabilities with a focus on innovation

- Well positioned to benefit from the Government’s push to make India a manufacturing hub

- Strong relationships with a diverse customer base in India and international markets

Company Promoters

Sharad Virji Shah and Munjal Sharad Shah are the promoters of the company.

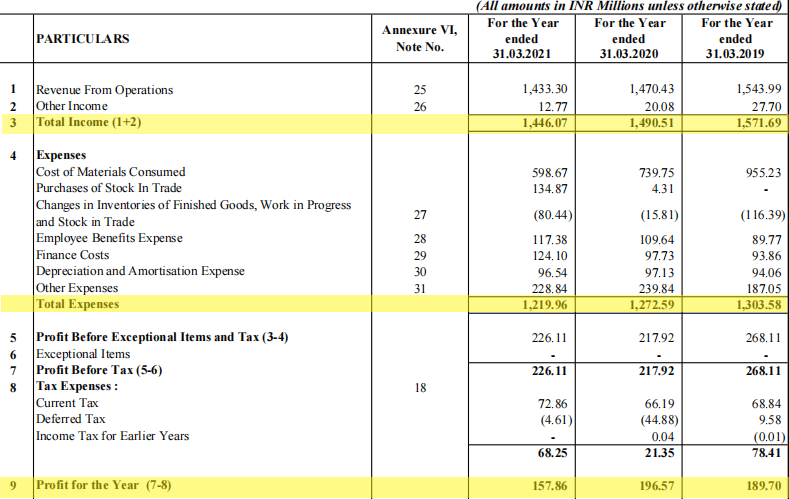

Financial Summary

Purpose of the IPO

The proceeds from the IPO will be used for the following purposes.

- Procurement of machinery and equipment. The board of directors have proposed an amount of Rs 34. 657 crore to be funded for capital expenditure from the net proceeds.

- To meet the working capital requirements of Rs 60 crore for smooth functioning of the company

- Repayment or prepayment of all or a portion of certain borrowings/outstanding loan facilities amounting to Rs 12 crore

- General corporate purposes

IPO Details

| IPO Opening Date | 21-09-21 |

| IPO Closing Date | 23-09-21 |

| Issue Type | Book Built Issue IPO |

| Face Value | Rs 10 per equity share |

| IPO Price | Rs 165 to Rs 175 per equity share |

| Market Lot | 85 Shares |

| Min Order Quantity | 85 Shares |

| Listing At | BSE, NSE |

IPO Lot Size

| Application | Lots | Shares | Amount (Cut-off) |

| Minimum | 1 | 85 | Rs 14,875 |

| Maximum | 13 | 1105 | Rs 1,93,375 |

To read more about earlier IPOs in 2021, click here