PhysicsWallah IPO is a bookbuilt issue of ₹3,480.00 crore. It combines a fresh issue of 28.44 crore shares aggregating to ₹3100.00 crore and an offer for sale of 3.49 crore shares aggregating to ₹380.00 crore.

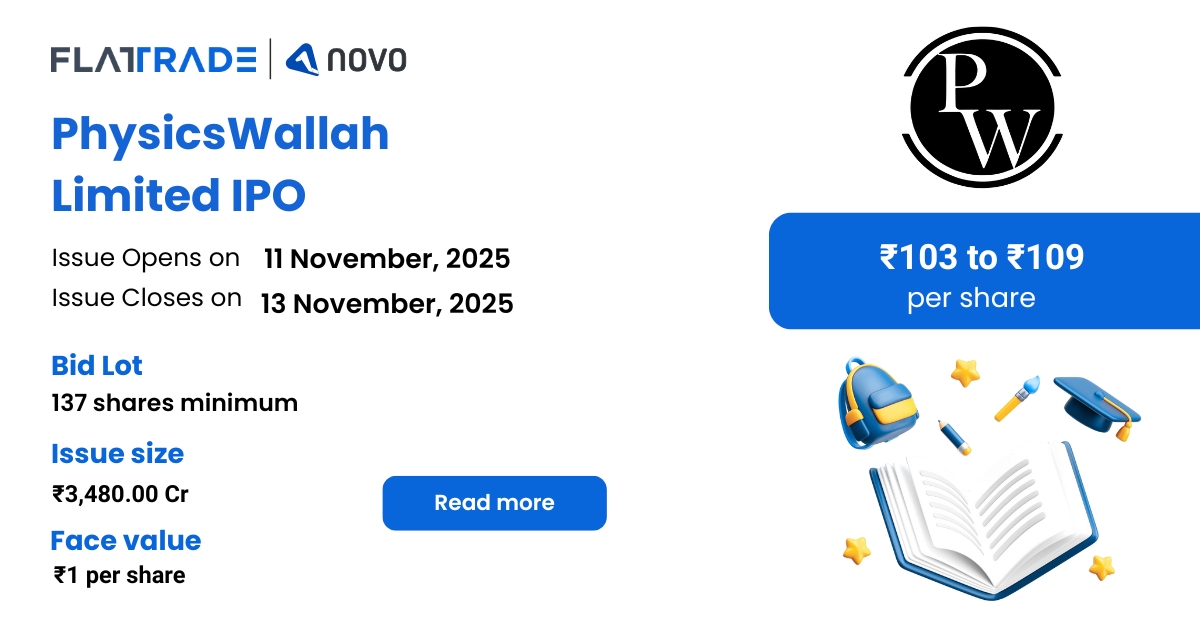

The IPO opens for subscription on November 11, 2025, and closes on November 13, 2025. The allotment is expected to be finalized on Friday, November 14, 2025. The price band for the IPO is set at ₹103 to ₹109 per share, and the minimum lot size for an application is 137 shares.

Company Summary

Physicswallah is an edtech company offering test-preparation courses for various competitive examinations, such as JEE, NEET, and UPSC, as well as upskilling courses in data science and analytics, banking and finance, and software development. It offers online services via social media channels, websites, and apps, and also offers tech-enabled and hybrid centers. It is among the top 5 edtech companies in terms of revenues in India and has 13.7 million subscribers on YouTube as of July 15, 2025.

Key Numbers:

- 13 million Unique Transacting users (Online) and 0.33 million students enrolled for offline centers.

- Average collection per user: 3,930.55 as of June 30, 2025

- Multiple courses across 13 education categories

- 303 total offline centers as of June 30, 2025

- 6,267 Faculty members as of June 30, 2025

- 18,028 employees as of June 30, 2025

- 4382 books published

Company Strengths

- 46 million Total Number of Paid Users in Fiscal 2025, grew at a CAGR of 59.19% from fiscal 2023 to 2025

- Presence across a large number of education categories in India, with courses offered through multiple channels

- Proprietary technology stack enhances students’ learning experience

- Specialized faculty members across categories, quality content, and a well-planned curriculum

- Experienced management team led by our visionary founders

Company Financials

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 5,075.67 | 4,156.38 | 2,480.74 | 2,082.18 |

| Total Income | 905.41 | 3,039.09 | 2,015.35 | 772.54 |

| Profit After Tax | -127.01 | -243.26 | -1,131.13 | -84.08 |

| EBITDA | -21.22 | 193.2 | -829.35 | 13.86 |

| Net Worth | 1,867.92 | 1,945.37 | -861.79 | 62.29 |

| Reserves and Surplus | 787.92 | 467.06 | -1254.74 | -187.65 |

| Total Borrowing | 1.55 | 0.33 | 1,687.4 | 956.15 |

| Amount in ₹ Crore | ||||

Objectives of IPO

- Capital expenditure for fit-outs of new offline and hybrid centers of our Company

- Expenditure towards lease payments of existing identified offline and hybrid centers operated by our Company

- Capital expenditure for fit-outs of new offline centers of Xylem

- Lease payments for Xylem’s existing identified offline centers and hostels

- Investment in our Subsidiary, Utkarsh Classes & Edutech Private Limited for expenditure towards lease payments for Utkarsh Classes’ existing identified offline centers

- Expenditure towards server and cloud-related infrastructure costs

- Expenditure towards marketing initiatives

- Acquisition of additional shareholding in our Subsidiary, Utkarsh Classes & Edutech Private Limited

- Funding inorganic growth through unidentified acquisitions and general corporate purposes

Promoters of the company

Alakh Pandey and Prateek Boob are the company promoters.

IPO Details

| IPO Date | November 11, 2025 to November 13, 2025 |

| Listing Date | November 18, 2025 |

| Face Value | ₹1 per share |

| Price Band | ₹10 to ₹109 per share |

| Lot size | 137 shares |

| Total Issue size | 31,92,66,054 shares (aggregating upto ₹3840.00 Cr ) |

| Fresh Issue | 28,44,03,669 shares (aggregating upto ₹3100.00 Cr ) |

| Offer for Sale | 3,48,62,385 shares of ₹1 (aggregating upto ₹380.00 Cr ) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 2,60,79,56,938 shares |

| Share Holding Post Issue | 2,89,23,60,607 shares |

Category Reservation Table

| Application Category | Maximum Bidding Limits | Bidding at Cut-off Price Allowed |

| Only RII | Upto Rs 2 Lakhs | Yes |

| Only sNII | Rs 2 Lakhs to Rs 10 Lakhs | No |

| Only bNII | Rs 10 Lakhs to NII Reservation Portion | No |

| Only employee | Upto Rs 5 Lakhs | Yes |

| Employee + RII/NII | 1. Employee limit: Upto Rs 5 Lakhs (In certain cases, employees are given a discount if the bidding amount is upto Rs 2 Lakhs) 2. If applying as RII: Upto Rs 2 Lakhs 3. If applying as NII: sNII > Rs 2 Lakhs and upto Rs 10 Lakhs, and bNII > Rs 10 lakhs | Yes for Employee and RII/NII |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 137 | ₹14,933.00 |

| Retail (Max) | 13 | 1,781 | ₹1,94,129.00 |

| S-HNI (Min) | 14 | 1,918 | ₹2,09,062.00 |

| S-HNI (Max) | 66 | 9,042 | ₹9,85,578.00 |

| B-HNI (Min) | 67 | 9,179 | ₹10,00,511.00 |

Allotment Schedule

| Basis of Allotment | Fri, 14 Nov, 2025 |

| Initiation of Refunds | Mon, 17 Nov, 2025 |

| Credit of Shares to Demat | Mon, 17 Nov, 2025 |

| Tentative Listing Date | Tue, 18 Nov, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on November 13, 2025 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Net Offer |

| Retail Shares Offered | Not more than 10% of the Net Offer |

| NII Shares Offered | Not more than 15% of the Net Offer |

Source – SEBI, Chittorgarh

To check allotment, click here