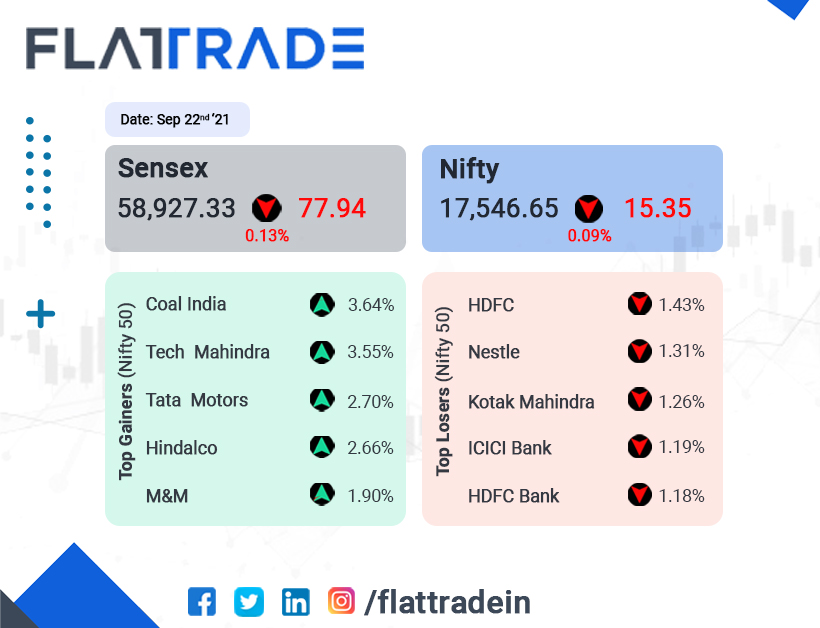

Benchmark Indian indices closed slightly lower in a volatile session, weighed by losses in banking and FMCG stocks. The Sensex fell 0.13% to 58,927.33 and Nifty slipped 0.09% to 175,46.65.

Nifty Bank fell 0.78% and FMCG dropped 0.27%. Among the gainers, Nifty Auto (1.27%), IT (0.93%) and Metal (1.47%) indices witnessed some good inflows.

Indian rupee fell 26 paise to 73.87 against the US dollar on Wednesday.

Investors are also focusing on the U.S. Federal Reserve monetary policy meeting outcome due later today, as they look for a potential timeline for tapering stimulus.

Stock in News Today

Adani Group: The group has issued a statement on the “malicious” social media campaign against the group on the seizure of illegal drugs at Mundra Port. “We thank and congratulate the DRI & Customs teams for seizing the illegal drugs and apprehending the accused,” Adani Group said. “We have no policing authority over the containers or the millions of tonnes of cargo that pass through the terminals in Mundra or any of our ports,” it added.

Axis Bank: The private sector lender said it plans to lend Rs 30,000 crore till FY26 under its sustainable financing framework, a senior official said. “The bank has set a target of incremental lending of Rs 30,000 crore over the next 5 years, under wholesale banking towards sectors included in its Sustainable Financing Framework,” Rajesh Dahiya, Executive Director (Corporate Centre) of Axis Bank said.

ITC Ltd: The company’s share prices continued its upward trajectory to hit 21-month high and it market cap crossed Rs 3 trillion. Foreign brokerage houses expect the company’s cigarettes business will fully recover with the aggressive vaccination drive and decline in coronavirus cases.

Godrej Properties: The real estate developer sold Rs 575 crore-worth homes in a single day at the launch of the second phase of its project Godrej Woods in Noida The company got an overwhelming response from customers to its unique forest-themed phase named Evergreen, taking its total sales in the project to approximately Rs 1,140 crore in the past 6 months. Shares of the company jumped 13.20% to close at Rs 1951.10.

Mphasis: The company will acquire Blink UX, a user experience research, strategy, and design firm for $94 million (over Rs 680 crore) in an all cash deal. Blink is headquartered in Seattle, with over 130 employees. The buyout deal will boost Mphasis’ experience competencies with end-to-end capabilities in UX experience.

Nucleus Software: The company’s shares jumped as much as 16% in intraday trading on the back of a buyback proposal. The board of directors will meet on September 24, 2021, to consider the buyback proposal of fully paid-up equity shares of the company, it said in an exchange filing on Tuesday after market hours.