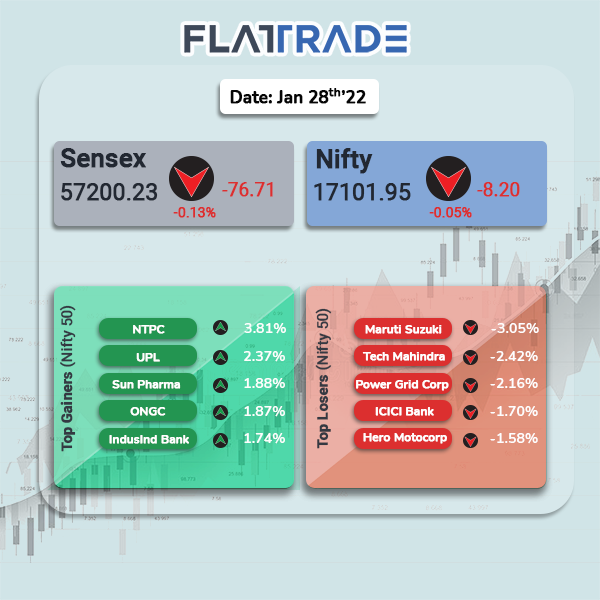

The key benchmark indices erased entire day’s gains and slipped into red ahead of the upcoming Union Budget next week. Banking and auto stocks weighed on the markets. The Sensex closed 0.13% lower to 57200.23 and Nifty fell 0.05% to 17101.95.

Meanwhile, broader markets were upbeat and closed in the positive territory. For the day, Nifty Midcap 100 jumped 1.5% and BSE Smallcap rose 1.07%.

Top gainers among Nifty sectoral indices were Nifty IT [1.13%], Pharma [1.05%], and Commodities [1.04%]. Top losers were Nifty Bank [-0.77%], Auto [-0.59%] and Private Bank [-0.59%].

Indian rupee rose 3 paise to 75.04 against the US dollar.

Stock in News Today

Bharti Airtel: Google will invest up to $1 billion in Bharti Airtel through a mix of equity investment and commercial partnership in affordable devices, the companies announced. The shares would be issued on a preferential basis at a price of Rs 734 per share and Google will get a 1.28 per cent stake in the company.

State Bank of India (SBI): The lender’s Chairman Dinesh Kumar Khara said that all the requisite approvals for setting up of National Bad Assets Company have been received. As many as 15 accounts will be transferred to NARCL in this financial year, he added while addressing a virtual press conference.

Meanwhile, the lender listed its maiden issue of $300-million Formosa bonds on India INX GIFT IFSC. This is the first such issuance by any Indian Bank in Formosa Bond market. Formosa bond is a bond issued in Taiwan.

Kotak Mahindra Bank: The private-sector lender’s net profit stood at Rs 2,131 crore in Q3FY22 as against Rs 1,854 crore in the year-ago period. Net Interest Income stood at Rs 4,334 crore in the reported quarter compared with Rs 3,876 crore in the corresponding quarter last fiscal. The net NPA stood at 0.79% in the Q3FY22 as against 1.06% in Q2FY22.

Larsen & Toubro (L&T): The company said that its wholly-owned arm, L&T Hydrocarbon Engineering, has bagged a large offshore contract from ONGC for the seventh development phase of their pipeline replacement projects. The contract involves engineering, procurement, construction, installation and commissioning of 350 km subsea pipelines and related offshore works spread out across country’s west coast offshore fields of ONGC.

Zomato Ltd: The company has decided to foray into the financial services business and has decided to create a non-banking finance company (NBFC) as a wholly-owned subsidiary for the purpose. The proposed paid-up capital of NBFC will be Rs 3 crore, while the authorised capital is pegged at Rs 10 crore.

SpiceJet Ltd: The Supreme Court granted three weeks’ time to to resolve its financial dispute with Swiss firm Credit Suisse AG, and stayed the operation of the Madras High Court verdict permitting winding-up petition and directing the official liquidator to take over the assets of the low-cost airline.

Vedanta Ltd: The company’s net income stood at Rs 4,164 crore in Q3FY22 compared with a net profit of Rs 4,616 crore in Q2FY22. Revenue rose to Rs 33,697 crore in the reported quarter from Rs 30,048 crore in the previous quarter.

Dr Reddy’s Laboratories: The drugmaker reported a multi-fold jump in consolidated net profit at Rs 706.5 crore in Q3FY22 compared with a net profit of Rs 27.9 crore in the same period of FY21. Revenues stood at Rs 5,319.7 crore during the third quarter as compared with Rs 4,929.6 crore in the same period of FY21.

Glenmark Pharmaceuticals: The drug manufacturer said its US-based unit has received approval from the US health regulator to market Metronidazole Vaginal gel, in the US market. The drug firm has received final approval by the US Food & Drug Administration (USFDA) for its product which is a generic version of Bausch Health US LLC’s MetroGel-Vaginal.

HCL Technologies: The IT firm said it has opened an Innovation Centre focused on Engineering and R&D services in Edmonton, Alberta. The Centre will serve as a hub for HCL Engineering teams to co-innovate with customers and solve complex business problems for clients globally.

Dixon Technologies: The electronics contract manufacturer said its net income was down 26% at Rs 46.38 crore in Q3FY22 as against Rs 62.64 crore in Q2FY22. Revenue was up 10% at Rs 3,073.25 crore in the reported quarter compared with Rs 2,803.78 crore

Chambal Fertilisers: The company’s net income fell 14% QoQ to Rs 435.17 crore. Revenue was up 6% QoQ at Rs 4,743.33 crore. The company’s board approved an interim dividend of Rs 4.50 per share.