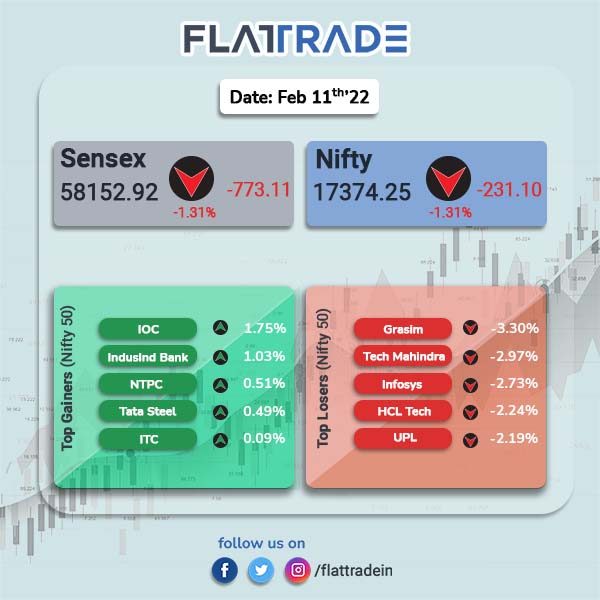

Dalal Street closed lower, mirroring global peers as high inflation in the US and a potential steep rate hike by the world’s biggest economy spooked investors. Benchmark indices Sensex and Nifty closed 1.31% lower each.

Broader markets also witnessed heavy sell-off by investors and traders. Nifty Midcap 100 tanked 2.02% and BSE Smallcap plunged 1.90%.

Top losers were Nifty IT [-2.72%], PSU Bank [-2.01%], Realty [-1.98%], Financial Services [-1.47%], Media [-1.36%]. All sectoral indices closed in the red.

Indian rupee plunged 44 paise to 75.38 against the US dollar.

Stock in News Today

Divi’s Laboratories: The company’s net profit rose 91.71% to Rs 902.24 crore in the quarter ended December 2021 as against Rs 470.62 crore during the corresponding quarter last fiscal. Sales rose 46.54% to Rs 2,493.24 crore in the quarter ended December 2021 as against Rs 1,701.44 crore in the year-ago period.

PB Fintech (Policybazaar): Shares of the company tanked 10.28% to Rs 778.90 apiece following a reported block deal, in which its founder has trimmed stake. PB Fintech said in a regulatory filing that its co-founders Yashish Dahiya and Alok Bansal will be selling shares worth 2.4 per cent of their stake in a block deal worth $130-140 million.

Motherson Sumi Systems: The company reported a 69% fall in consolidated net profit to Rs 245.08 crore in Q3 FY22 from Rs 798.38 crore in Q3 FY21. Total revenue from operations declined 6% YoY to Rs 16,117.51 crore during the reported quarter. EBITDA in Q3 FY22 was Rs 1,383 crore, up by 14% from Rs 1,208 crore in Q2 FY22.

Schneider Electric Infrastructure: The company’s net profit rose 57.11% to Rs 52.38 crore on 27.13% rise in net sales to Rs 600.46 crore in Q3FY21 over the year-ago period. Total expenses rose 24.78% year-on-year to Rs 550.05 crore in Q3FY22. Shares of the company closed 19.73% higher.

Sun TV Network: The media company’s standalone net profit rose 3.52% to Rs 457.39 crore on 6.25% rise in net sales to Rs 1,033.10 crore in Q3 December 2021 over Q3 December 2020. Its EBITDA grew by 20.18% at Rs 721.87 crore for the current quarter as against Rs 600.68 crore during the same quarter a year ago.

Apollo Hospitals: The company reported a 81.2% rise in net profit at Rs 243.2 crore in Q3FY22 from Rs 134.2 crore in the year-ago period. Its revenue rose 31.8% to Rs 3,639 crore as against Rs 2,760 crore in the same period last fiscal. The company’s EBITDA jumped 50.4% to Rs 587 crore in the reported quarter from Rs 390.3 crore in the year-ago period.

Max Healthcare Institute Ltd: The healthcare providers has inked a deal to acquire Eqova Healthcare for Rs 47.18 crore. Eqova has long term exclusive rights to aid development and provide medical services to a 400-bed hospital to be built on 2.1 acres of land parcel in Patparganj, Delhi.

Linde India: The company has signed a 15-year long-term agreement structured on Lease and O&M basis with ESL Steel (ESL), a Vedanta Group Company for supply of 800 tonnes per day of Oxygen and 900 tonnes per day of Nitrogen to them at their steelworks at Bokaro. The company will set up an onsite Air Separation Unit (ASU) at ESL’s Bokaro steelworks, which will serve ESL’s demand for gases for its brownfield expansion and will also cater to Linde India’s requirement of gases for merchant markets.

Alkem Laboratories: The company has signed a license agreement with Harvard University’s Office of Technology Development (OTD). Under the agreement, Alkem will develop and commercialize a novel technology that will treat diabetic neuropathy, foot ulcers, peripheral arterial disease (PAD), and other injuries caused by vascular disease. The license grants Alkem commercialization rights in the United States and India.

The India Cements Ltd: The company has reported a standalone profit in Q3FY22 at Rs 3.30 crore, as against a standalone profits at Rs 62.02 crore during the corresponding quarter in the previous year. Total income on a standalone basis stood at Rs 1,114.22 crore as against Rs 1,162.91 crore registered in the year-ago period. The company’s performance was severely affected by the record monsoon in the southern states which stalled construction activities.

JSW Steel: The company reported a 15 per cent rise in crude steel production at 16.46 lakh tonne for the month of January 2022. The company’s crude steel production was at 14.32 lakh tonne (LT) in the year-ago period. The production of its flat-rolled products increased by 23 per cent to 12.47 LT over 10.14 LT in January 2021.