Indian equity indices closed lower at the end of a volatile week on negative global cues, higher-than-expected US retail inflation leading to fears of aggressive rate hike by the US central bank, FII outflow and ongoing Russia-Ukraine crisis.

The crisis led to higher oil prices, which also weighed on Indian markets and other global markets. Brent Crude prices crossed $95 per barrel on Friday.

For the week, the Sensex closed 0.84% lower to 58,152.92 and the Nifty fell 0.81% to 17374.75.

Broader markets also closed lower tracking benchmark indices for the week. Nifty Midcap 100 fell 2.3% and BSE Smallcap plunged 3.4%.

FIIs continued their selling spree. In the cash segment, FIIs were net sellers and sold for Rs 5641.8 crore during the week. DIIs were net buyers and they bought for Rs 3562.2 crore in the week. In FY22, FIIs have sold for Rs 1,95,608.9 crore and DIIs have bought for 1,46,464.6 crore.

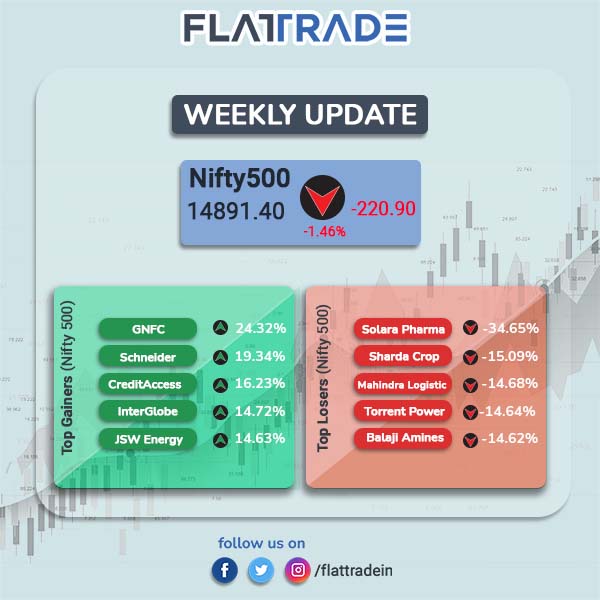

Nifty 500 closed 1.29% lower at 14,891.30. Among Nifty 500 stocks, top losers were Solara Active Pharma Sciences [-34.7%] Sharda Cropchem [-15.1%], Mahindra Logistics [-14.7%], Torrent Power [-14.6%] and Balaji Amines [-14.6%]. Top gainers Gujarat Narmada Valley Fertilizers [24.3%], Schneider Elecrtric Infrastructure [19.3%], CreditAccess Grameen [16.2%], InterGlobe Aviation [14.7%] and JSW Energy [14.6%].

Company News

Hero MotoCorp: The two-wheeler manufacturer reported a 36.7 per cent decline in standalone net profit at Rs 686 crore in Q3FY22 due to lower sales and higher commodity prices. The company registered a net profit of Rs 1084.47 crore in the year-ago period. Revenues from operations stood at Rs 7,883.27 crore in the reported quarter, down by 19% compared to Rs 9,775.77 crore in the year-ago period.

Bharti Airtel: The telecom company’s net profit dipped 2.8 per cent YoY to Rs 830 crore in Q3FY22 compared with a net profit of Rs 854 crore. The company’s revenue for the quarter grew 12.6 per cent to Rs 29,867 crore on a yearly basis. The average revenue per user rose 6.5 per cent QoQ and 11.6 per cent YoY to Rs 163 due to an increase in mobile tariffs in November. Meanwhile, Airtel’s board gave an enabling approval for raising up to Rs 7,500 crore through debt instruments.

Adani Wilmar: The company’s shares debuted and opened on a weaker note. However, shares of the company skyrocketed during the week and broke into Rs 50,000-crore market cap club. The stock opened lower at Rs 227 on the NSE against the issue price of Rs 230. The company shares rose 67.84% to close at Rs 381 apiece. It hit a high of Rs 419.90 apiece during the week.

Tata Power: The company posted a 74 per cent rise in its consolidated net profit to Rs 552 crore for the Oct-Dec quarter on the back of higher revenues. Consolidated PAT (profit after tax) was up by 74 per cent YoY year at Rs 552 crore as against Rs 318 crore in Q3FY21. Consolidated revenue also rose by 42 per cent to Rs 11,015 crore in Q3FY22, from Rs 7,756 crore in Q3FY21.

Power Grid Corporation of India Ltd: The state-run company’s consolidated net profit declined by 2.2 per cent to Rs 3,292.97 crore in the October-December quarter compared to Rs 3,367.71 crore in the year-ago period. Total income of the company rose to Rs 10,723.61 crore in the quarter from Rs 10,359.48 crore in the same period a year ago.

Steel Authority of India Ltd (SAIL): The company reported a 4.1 per cent rise in consolidated net profit at Rs 1,528.54 crore for the October-December period of FY22, as against a consolidated net profit of Rs 1,468.20 crore in the year-ago period. Its consolidated income during the quarter increased to Rs 25,398.37 crore in Q3FY22, from Rs 19,997.31 crore in the same quarter a year ago.

Tata Chemicals: The company reported a 69.39 per cent growth in consolidated profit after tax (PAT) to Rs 340 crore for the quarter ended December 2021, as against a PAT of Rs 200.72 crore during the corresponding quarter last year. Its revenue from operations during October-December 2021 jumped 20.54 per cent to Rs 3,141.58 crore, compared with Rs 2,606.08 crore in the year-ago period.

TVS Motor Company: The two-wheeler maker registered a near 9 per cent YoY rise in net profit at Rs 288.8 crore for the quarter ended December 2021. The revenue rose 5.8 percent year-on-year to Rs 5,706.4 crore. The company sold 8.35 lakh units in the reported quarter as against 9.52 lakh crore in the year-ago quarter.

Zomato: Food delivery company said its net loss narrowed by 81 per cent year-on-year (YoY) to Rs 66 crore in the December quarter (Q3). Meanwhile, its revenue rose 86 per cent YoY to Rs 1,112 crore in Q3FY22. Zomato said it will continue to invest both in its core food business and in quick commerce, and increased the potential investments in this category up to $400 million cash over the next two years.

ACC Ltd: The cement maker on Wednesday reported a 40.55 per cent decline in its consolidated net profit to Rs 280.85 crore for the fourth quarter ended on December 2021. The company had posted a profit of Rs 472.44 crore in the October-December quarter a year ago. Its total revenue from operations during the quarter under review was at Rs 4,225.76 crore, up 1.95 per cent compared to Rs 4,144.72 crore in the corresponding period of the last year.

Jindal Steel & Power Ltd (JSPL): The company reported a 27.2 per cent drop in consolidated profit at Rs 1,866.08 for the quarter ended December 2021 due to higher expenses compared with a consolidated profit of Rs 2,566.68 crore in the corresponding period of the previous fiscal. The consolidated income of the company during the October-December 2021 period increased to Rs 12,535.35 crore, over Rs 9,643.88 crore in the year-ago period.

Godrej Consumer Products Ltd (GCPL): The FMCG company reported a 4.93 per cent increase in consolidated net profit at Rs 527.60 crore in Q3FY22 compared with a net profit of Rs 502.80 crore in the year-ago period. Its total revenue from operations was up 8.08 per cent at Rs 3,302.58 crore during the quarter under review, as against Rs 3,055.42 crore in the corresponding period last fiscal.

Jindal Stainless Ltd (JSL): The company said its Q3FY22 consolidated profit rose nearly three times to Rs 441.78 crore from a profit of Rs 170.20 crore in the year-ago period. Income during the third quarter increased to Rs 5,682.37 crore, from Rs 3,592.04 crore in the year-ago period. The profit was attributed to strong exports and good product mix.

Indian Bank: The lender reported a 34 per cent jump in standalone profit after tax (PAT) at Rs 690 crore for December quarter 2021 compared with a PAT of Rs 514 crore in the year-ago period. Net interest income marginally grew by 2 per cent to Rs 4,395 crore from Rs 4,314 crore in the year-ago period. Gross NPA increased to 9.13 per cent as against 9.04 per cent.

National Aluminium Company Ltd (Nalco): The company said its December quarter consolidated profit surged over three times to Rs 830.67 crore compared with a profit of Rs 239.71 crore for the year-ago period. Income during the quarter increased to Rs 3,845.25 crore over Rs 2,414.95 crore in the year-ago period.

Economy News

The RBI in its three-day policy decision meeting during the week said that it would keep repo rate unchanged at 4%. Reverse repo rate stands at 3.35%.

The Marginal Standing Facility (MSF) rate is at 4.25%. The MPC said the policy stance will remain “accommodative” as long as needed. The real GDP growth was projected at 7.8% for FY23, while inflation target was reduced to 4.5% for FY23.

To read more on MPC meeting and how the markets reacted, click here

India’s factory output growth based on Index Of Industrial Production (IIP) index decelerated to its lowest in 10 months to 0.4 per cent in December as Omicron-led restrictions weighed on production, indicating that India’s economic recovery remained fragile.

The IIP had registered a growth of 1.3 per cent in November 2021 and 2.2 per cent in December 2020.

The data released by the statistics department on Friday showed that manufacturing activity contracted by 0.1 per cent during the month, while mining and electricity output grew at 2.6 per cent and 2.8 per cent, respectively.

Global Markets

In the US markets, the technology-heavy Nasdaq Composite performed poorly and ended the week down about 15% from its recent peak and remained in correction territory. Investors weighed earnings reports against concerns over interest rate hike. For the week, the S&P 500 dropped 1.82%, the Dow fell 1.0%, and the Nasdaq plunged 2.18%.

The Labor Department reported that the inflation based on consumer price index (CPI) advanced 7.5% in January on a yearly-basis. Core inflation, excluding food and energy purchases, rose 6.0% in January. This led to investors expecting the interest rate to be increased faster and aggressively in the coming months, sending the benchmark 10-year U.S. Treasury note yield above 2%.

Japan’s stock markets registered gains, with the Nikkei 225 index increasing 0.93% and the broader Topix index advanced 1.66%, helped by strong corporate earnings.

Chinese markets closed higher after positive comments from Chinese officials and expectations of further easing of the government’s regulatory clampdown. For the week, Shanghai Composite index gained 3.3% and the CSI 300 index added 0.8%.

The private Caixin/Markit services purchasing managers’ index (PMI) fell to 51.4 in January from December’s 53.1 reading.