India’s central bank concluded its three-day monetary policy meeting on Feb 10. The Monetary Policy Committee (MPC) kept key interest rates unchanged and maintained an accommodative policy stance.

The Reserve Bank of India (RBI) Governor Shaktikanta Das said that the MPC voted unanimously to keep the repo rate at four percent and maintained status quo for other important policy rates too as the committee felt the Indian economy needed continued support despite rise in inflation. Das also reiterated that the central bank would stay the course and take necessary and calibrated policy actions to push growth.

After the announcement, interest rate sensitive stocks like financial services stocks, housing finance companies, realty, auto sector reacted positively. Even, broader market reacted favourable to the policy decision.

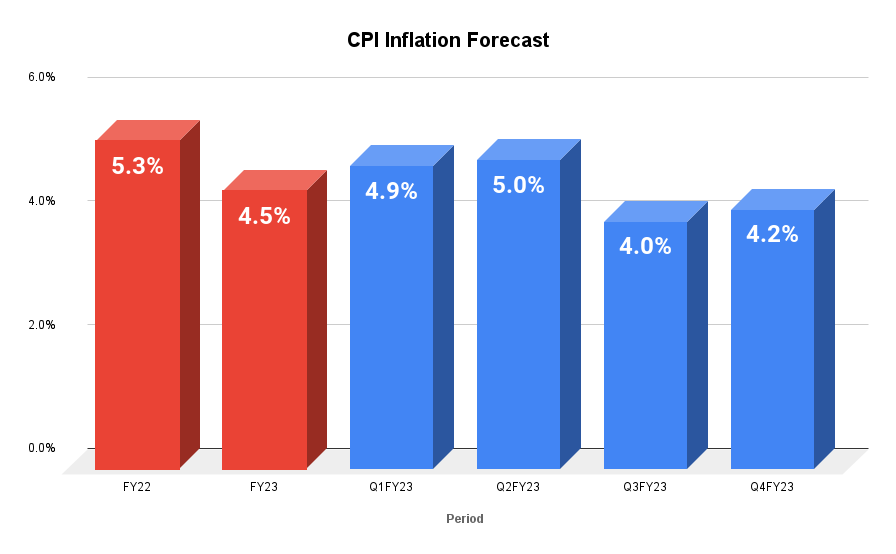

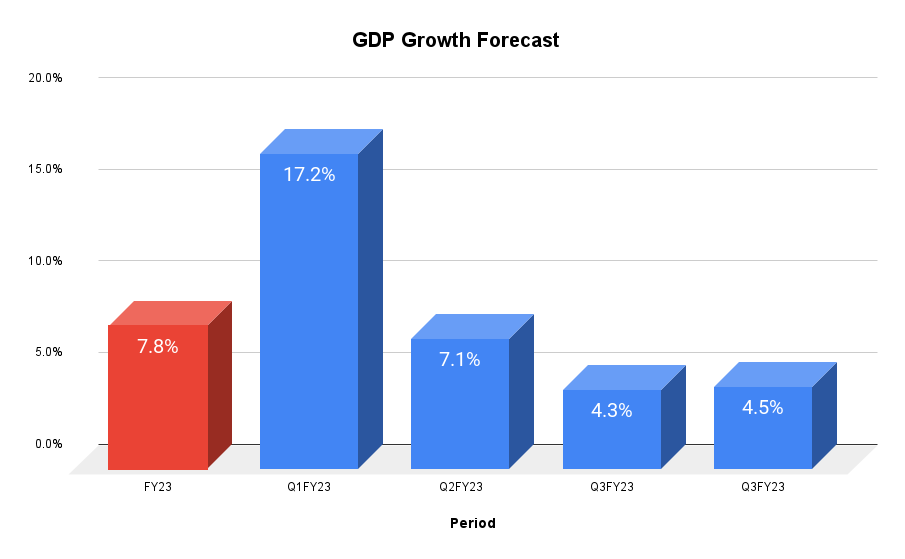

The RBI also gave its inflation and GDP forecast for the next financial year. The RBI Governor said that the inflation projections are benchmarked to international crude oil prices and it is based on projections of where oil price will be, considering both upside and downside projections.

The chart below shows RBI estimates of CPI inflation and GDP for the next fiscal year.

*Click on the chart for an enlarged image

Top Gainers

The stocks related to various sectors that are closely linked to key interest rates and those stocks which rallied after the monetary policy decision are mentioned below,

Banks: Kotak Mahindra Bank [1.75%], HDFC Bank [1.84%], AU Small Finance Bank [0.81%], IndusInd Bank [0.54%] and Axis Bank [0.74%].

Realty: Brigade Enterprises [2.5%], Godrej Properties [1.91%], DLF [1.24%] and IBull Real Estate [0.64%].

Housing Finance Companies: Repco Home Finance [5%], Aavas Financiers [3.5%], LIC Housing Finance [2.9%], Can Fin Homes [1.9%] and HDFC [1.7%].

Metal: Jindal Steel & Power [5.86%], Ratnamani Metals [2.56%], NMDC [2.31%], Tata Steel [2.13%] and Hindustan Copper [2.08%].

Auto: Mahindra & Mahindra [1.5%], TVS Motor Company [1.3%] and Tata Motors [1.2%]