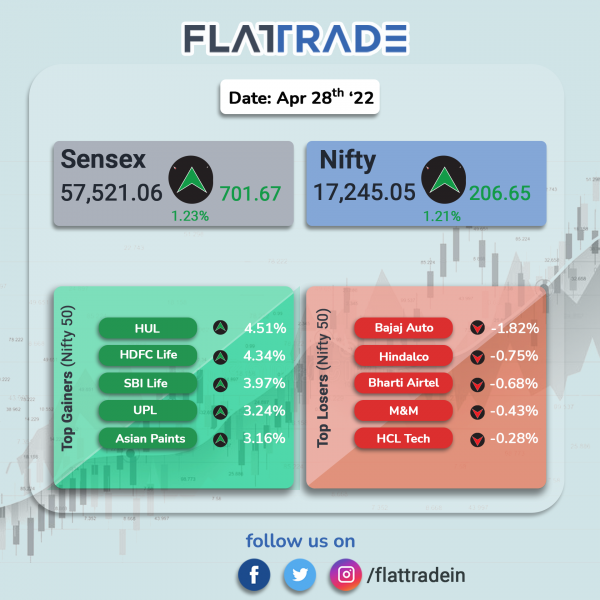

Equity indices closed higher mirroring global markets and broad-based buying by investors. The Sensex rose 1.23% and the Nifty jumped 1.21% to close above 17,200-mark. The Nifty Midcap 100 rose 0.6% and BSE SmallCap edged up 0.12%.

Top gainers among Nifty sector indices were FMCG [2.19%], Energy [1.82%], Bank [1.09%], IT [1.01%] and Private Bank [0.97%]. Nifty Media was the sole sector index that fell 3.15% as Network 18 shares tanked 19.66% and TV18 Broadcast tanked 17.76%

Indian rupee inched up 5 paise to 76.48 against the US dollar on Thursday.

Stock in News Today

Bajaj Finserv: The company’s consolidated net profit rose 37.5% YoY at Rs 1,346.08 crore from Rs 979.06 crore in the same period last fiscal. Revenue rose 22.6% to Rs 18,861.87 crore in Q4FY22, from Rs 15,386.88 crore in corresponding quarter last fiscal. The company’s board has recommended a dividend of Rs 4 per share.

Cyient: The IT company said it will acquire Singapore-based Grit Consulting for USD 37 million (about Rs 284 crore) in an all-cash deal. The company will pay 50 per cent of the consideration and remaining 50 per cent as an earnout over the next two years, subject to business performance, according to the filing. The deal is expected to close by May 5, 2022.

SBI Life Insurance Co Ltd: The company reported a 26 percent rise in net profit at Rs 672.15 crore for the fourth quarter ended March 2022. Its profit stood at Rs 532.38 crore in the same quarter of the previous fiscal. Net premium income rose 12 percent year on year to Rs 17,433.77 crore compared with Rs 15,555.74 crore in the same quarter last year. Total income rose marginally by 2.5 percent to Rs 21,427.88 crore in the quarter under review from Rs 20,896.70 crore in the same last fiscal.

Varun Beverages: Shares of the company rose more than 6% in intraday trading after it posted robust results. Its consolidated net income rose 97% at Rs 254.21 crore in Q4FY22 from Rs 129.26 crore in the year-ago period. Revenue rose 26.33% to Rs 2,867.48 crore in the said quarter from Rs 2,269.88 crore in the corresponding period last year. Ebitda was up 39.14% to Rs 531 crore in the reported quarter from Rs 381.62 crore in the year-ago period. The company also approved one bonus share for two equity shares held.

Chennai Petroleum Corp: Shares of the company soared 10% after reporting strong growth in net profit, revenue and Ebitda for the quarter-ended March 2022. Its consolidated net profit surged 314% to Rs 1,001.92 crore in Q4FY22 from Rs 241.98 crore in the year-ago period. Revenue was up 42.7% to Rs 20,997.13 crore in the reported quarter from Rs 14,705.48 crore in the corresponding quarter last year. EBITDA climber 203% to Rs 1,581.06 crore in Q4FY22 as against Rs 521.98 crore in the same period last fiscal.

Godrej Properties Ltd: The realty firm said it has acquired a 58-acre land parcel in Nagpur to develop a residential project as part of its strategy to expand business. The project will offer an estimated saleable area of 1.5 million square feet.

Mahindra Lifespace Developers: Shares of the company jumped nearly 8 per cent in morning trade on Thursday, after the company reported a consolidated net profit of Rs 154.5 crore for the last fiscal, as against a net loss of Rs 71.7 crore in FY21. Its consolidated total income stood at Rs 408.2 crore in the last fiscal, against Rs 187.8 crore FY21, according to a regulatory filing.

IndiGo: The carrier became the first airline in the country to land aircraft using the indigenous navigation system GAGAN, according to a statement issued on Thursday. The flight was conducted using an ATR-72 aircraft and landed at the Kishangarh airport in Rajasthan on Wednesday morning, using GPS-aided geo-augmented navigation (GAGAN). GAGAN has been jointly developed by the Centre-run Airports Authority of India (AAI) and the Indian Space Research Organisation (ISRO).

Coromandel International: Shares of the company rose after it posted better-than-expected results. Its consolidated net profit rose to Rs 289.79 crore in Q4FY22 from Rs 155.85 crore in Q4FY21. Its revenue jumped 49.6% to Rs 4,226.81 crore in hte reported quarter from Rs 2,824.69 crore in the year-ago period. Ebitda stood at Rs 378.97 crore compared with Rs 229.44 crore.

Procter & Gamble Hygiene: Shares of the company rose nearly 1% in intraday trading after it posted its fourth quarter results. Its consolidated net profit rose to Q4FY22 to Rs 102.85 crore from 98.33 crore in the year-ago period. Its revenue rose to Rs 973.26 crore in the reported quarter compared with Rs 759.65 crore in the same period year ago. Ebitda stood at Rs 165.01 crore in Q4FY22 as against Rs 128.69 crore in the year-ago period.

Capacit’e Infraprojects: The company bagged orders worth Rs 826.49 crore from public and private sector clients. Capacite received order worth Rs 599.04 crore for proposed turnkey development of Multi speciality hospital in Bhandup, Mumbai from Municipal Corporation of Greater Mumbai. It also won order worth Rs 227.26 crore for construction of residential project including civil, RCC structure at Seawoods in Navi Mumbai.

Pidilite Industries: The adhesives and sealants manufacturer has partnered with GCP Applied Technologies to offer high-performance waterproofing solutions for sites with high temperature variation and water table, under its brand Dr. Fixit. Pidilite aims to strengthen its product portfolio by offering specialised waterproofing solutions by GCP, with this association.

Cartrade Tech: Shares of the company rose more than 8% in intraday trading after brokerage firm Nomura initiated coverage With ‘Buy’ rating. Nomura has given a target price of Rs 770, an upside of 21%. The brokerage firm said that it expects rising digital spends as a growth trigger for Cartrade.