Market Opening - An Overview

SGX Nifty futures were trading 0.45 percent higher at 17,308, signalling that Dalal Street was headed for a positive start on Friday.

Chinese markets were trading lower as investors’ optimism was dented as Apple flagged supply constraints. Japan’s stock market was closed on account of public holiday. China’s Hang Seng dropped 1.1% and CSI 300 index fell 0.48%.

Indian rupee inched up 5 paise to 76.48 against the US dollar on Thursday.

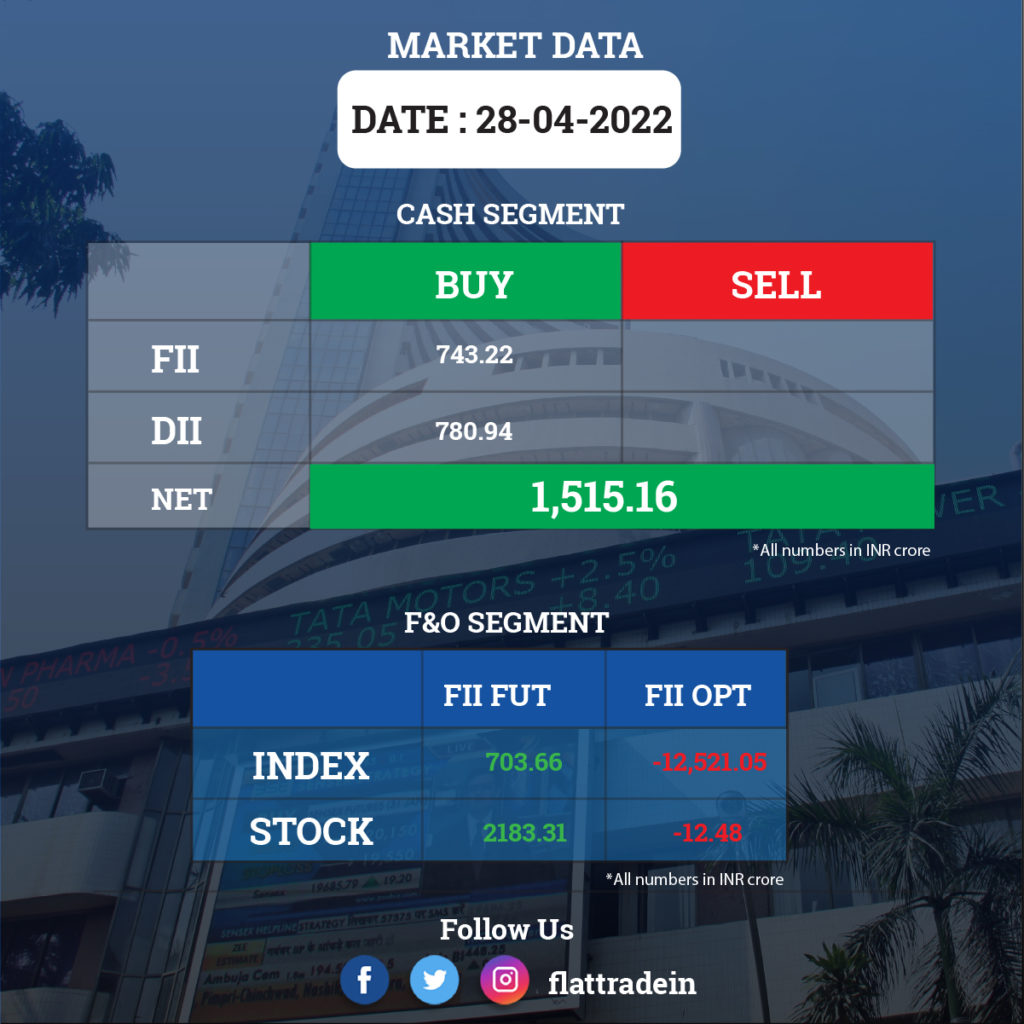

FII/DII Trading Data

Upcoming Results

Maruti Suzuki India, IndusInd Bank, UltraTech Cement, Wipro, SBI Cards and Payment Services, Can Fin Homes, Geojit Financial Services, Gillette India, GNA Axles, Gokaldas Exports, HFCL, Just Dial, L&T Finance Holdings, Lloyds Metals and Energy, RPG Life Sciences, Shriram City Union Finance, Solara Active Pharma Sciences, Sonata Software, Star Health and Allied Insurance Company, Supreme Industries, Tanla Platforms, Tata Chemicals, and Thyrocare Technologies will release their quarterly results today.

Stocks in News Today

Axis Bank: The private sector lender registered a 54 percent year-on-year (YoY) growth in standalone profit at Rs 4,118 crore, largely driven by significant fall in provisions and improved asset quality performance in Q4FY22. Net interest income grew by 16.7 percent YoY to Rs 8,819 crore with credit growth of 15 percent and deposits growth of 19 percent YoY for March 2022 quarter.

Vedanta: The mining company’s consolidated net profit for the March quarter (Q4) dropped 10 per cent year-on-year (YoY) to Rs 5,799 crore. However, its revenue from operations (net sales) jumped 41 per cent YoY to Rs 39,342 crore for the same period, helped by higher sales volumes and improved commodity prices. Its copper division witnessed a loss of Rs 330 crore in Q4FY22 that weighed on its overall profitability. The company announced first interim dividend of Rs 31.5 per share for the financial year 2022-23.

Ambuja Cements: The company a 30.26 per cent decline in its consolidated net profit to Rs 856.46 crore for the first quarter ended March 2022 on account of rising fuel prices. The company, which follows the January-December financial year, had clocked a net profit of Rs 1,228.24 crore in the year-ago period. Its revenue from operations rose by 2.4 per cent to Rs 7,900.04 crore during the quarter under review compared to Rs 7,714.81 crore in the year-ago period.

Biocon Ltd: The biotechnology company posted reported a 4 per cent decline in consolidated net profit to Rs 283.9 crore in Q4FY22, compared with a consolidated net profit of Rs 296.4 crore in the same quarter previous fiscal. Consolidated revenue from operations in the fourth quarter stood at Rs 2,408.8 crore as against Rs 1,842.1 crore in the year-ago period, it added. The company has appointed former HSBC India Chairperson Naina Lal Kidwai as an independent director.

Tata Motors: The automaker expects to aggressively increase annual production of electric vehicles (EVs) to more than 80,000 units this financial year, Reuters reported citing sources with knowledge of the matter. That compares with the 19,000 EVs it built and sold in the last financial year.

Bank of Maharashtra: The public-sector bank reported an over two-fold increase in its consolidated net profit at Rs 355 crore in the quarter ended March, helped by a fall in the bad loan proportions and less provisioning. The lender had posted a net profit of Rs 165.23 crore in the year-ago period. Total income of the bank, however, was down at Rs 3,948.48 crore in the January-March quarter of FY22, as against Rs 4,334.98 crore in the same quarter of FY21.

Tata Power Company: The company has collaborated with National Real Estate Development Council (NAREDCO) to install 5,000 electric vehicle charging points across Maharashtra. Tata Power will provide a comprehensive EV charging solutions across properties of member developers of NAREDCO.

IIFL Finance: The company clocked nearly 30 percent year-on-year growth in consolidated profit at Rs 321 crore on strong sales and operating profit. Revenue from operations during the quarter grew by 16 percent to Rs 1,856.2 crore compared to the year-ago period.

Fineotex Chemical: Profit after tax of the group has increased by 42 percent year-on-year to Rs 17 crore on strong topline and operating income. Revenue rose by 62 percent YoY to Rs 121.4 crore in the quarter ended March 2022, and operating EBITDA surged 67 percent to Rs 21.52 crore in the same period.

PNB Housing Finance Ltd: The company’s net profit rose by 33 per cent to Rs 170 crore for the fourth quarter ended March 2022 (Q4FY22) from Rs 127 crore in Q4FY21. Its net interest income fell by 37 per cent in the reported quarter to Rs 377 crore from Rs 593 crore in Q4FY21.

Piramal Enterprises Ltd: The company plans to raise up to Rs 700 crore through issue of Non-Convertible Debentures (NCDs) on a private placement basis, according to its regulatory filing. The company’s board will meet on May 4 to consider and approve the issuance of NCDs for up to Rs 50 crore. There will also be an option to retain oversubscription for up to Rs 650 crore with the total size aggregating up to Rs 700 crore.

Colgate-Palmolive (India) Ltd: The company said its board has approved the appointment of Prabha Narasimhan, a former senior HUL executive, as the Managing Director and Chief Executive Officer of the company for five years. Narasimhan’s appointment will be effective from September 1, 2022.

Embassy Office Parks REIT: The company said its net profit rise jumped five increased fivefold to Rs 280 crore in the quarter ended March 2022, compared to the year-ago period. Consolidated revenue from operations increased 2 per cent YoY to Rs 783 crore in the said period.

Sterlite Technologies: The company in a BSE filing said the board has approved raising of funds up to Rs 1,000 crore.

Shriram Transport Finance (STFC): The company has posted a 44 per cent increase in net profit in the fourth quarter of FY22 to Rs. 1,086.13 crore, compared to Rs. 754.93 crore in the same period the previous year. The company’s Net Interest Income increased by 22.16 per cent to Rs. 2,627.82 crore in the reported quarter as against Rs. 2,151.12 crore in the year-ago period.