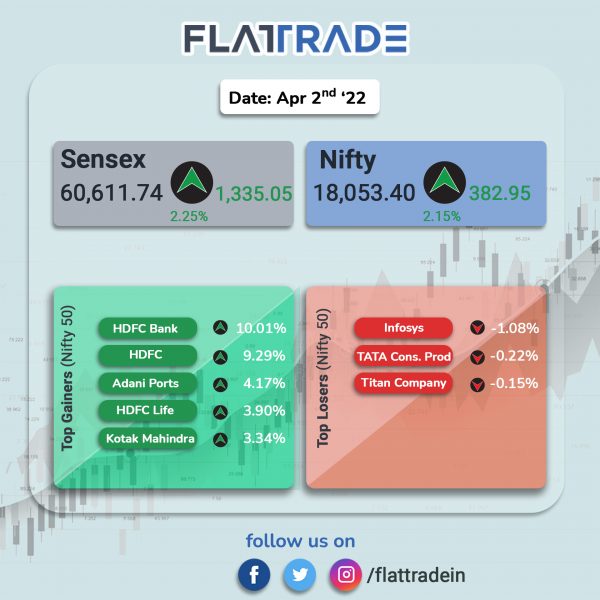

Dalal Street zoomed and breached key psychological levels after the merger announcement of HDFC and HDFC Bank. The Sensex jumped 2.25% and the Nifty surged 2.17%.

The buoyant mood spilled over to other sectors and indices. Broader indices also gained as a few companies reported good numbers with respect to their sales. Nifty Midcap 100 jumped 1.63% and BSE Smallcap rose 1.68%.

Top gainers among Nifty sectoral indices were Financial Services [4.64%], Bank [4%], Private Bank [3.92%], Metal [1.99%] and Pharma [1.54%]. All other sector ended in green.

Indian rupee strengthened by 24 paise to 75.54 against the US dollar on Monday.

S&P Global released the manufacturing Purchasing Managers’ Index data. The factory activity based on manufacturing PMI slipped to 54 in March from 54.9 in February.

Stock in News Today

HDFC Bank and HDFC: India’s largest private sector lender HDFC Bank will merge with housing finance firm HDFC Ltd, the companies said. Shareholders of HDFC Ltd will receive 42 shares of the bank for 25 shares held. Existing shareholders of HDFC Ltd will own 41 per cent of HDFC Bank.

Indian Oil Corporation (IOC) and Larsen & Toubro (L&T): The state-run oil refinery IOC, engineering major L&T and green energy player ReNew Power said that they will form a joint venture (JV) to develop the green hydrogen sector in India. The JV will focus on developing Green Hydrogen projects in a time-bound manner to supply Green Hydrogen at an industrial scale.

Tata Power: The company’s arm Tata Power Renewables has commissioned a 300 MW solar plant in Dholera, Gujarat with the country’s largest single-axis solar tracker system. The project will generate 774 MUs (million units) annually. Along with this, it will reduce approximately 704,340 MT/year (tonnes per annum) of carbon emission.

Kalyan Jewellers: The company plans to raise up to $200 million through its subsidiary, Kalyan Jewellers FZE, to refinance old debt. The subsidiary firm will issue senior US dollar-denominated fixed-rate notes (bonds). Rating agency Standard and Poor’s (S&P) has assigned a preliminary ‘B’ long-term issuer credit rating to Kalyan Jewellers India Ltd (KJIL) and the proposed senior secured notes issued by Kalyan Jewellers FZE.

In a separate news, for FY2022, the company recorded a year-on-year growth of 25% in its revenue on a consolidated basis, with the India business growing over 23% as compared to the year-ago period.

Bajaj Auto: The two-wheeler manufacturer reported a 20% decline in total vehicle sales at 2,97,188 units in March 2022 compared to the year-ago period. The company had sold a total of 3,69,448 vehicles, including commercial vehicles, in March 202. Bajaj Auto registered a growth of 8 per cent in its vehicle sales at 43,08,433 units in FY22, as against 39,72,914 units in the previous financial year.

PB Fintech (Policybazaar): Shares of the company rose over 5% after global brokerage firm Morgan Stanley upgraded the company’s rating to ‘Overweight’ post a sharp correction in the stock. However, it said that “risks to growth and capital costs for insurance companies are rising”.

Indo Count Industries: Shares of the company closed nearly 8% higher after the company completed the acquisition of the home textile business of GHCL. With this buyout, Indo Count has now become the largest global home textile bedding manufacturer.

Mahindra & Mahindra Financial Services: The company disbursed approximately Rs 3,832 crore in March 2022, a rise of 66% YoY growth. The collection efficiency (CE) was at 109% for March 2022, similar as March 2021. The disbursement for FY2022 stood at approximately Rs 27,466 crore, registered a YoY growth of 45%.

PTC India Ltd: Shares of the company rose over 10.3% after the company reported record volume of 87,450 million units of energy during FY2022. PTC continued to develop new products and services, and it was able to achieve 9.25% growth in its trading volume compared to previous years.