You Might Also Enjoy

a

Speciality chemicals manufacturer Chemplast Sanmar Limited is set to open for IPO subsription on August 10 and close August 12. The company plans to raise Rs 3850 crore through fresh issue or equity shares worth Rs 1300 crore and offer for sale of equity share totalling Rs 2550 crore by its current shareholders and promoters.

The offer for sale has Sanmar Holdings selling equity shares worth Rs ₹2,463.44 crore and Sanmar Engineering Services Ltd selling Rs 86.56 crore.

Chemplast Sanmar is one of the leading specialty chemicals manufacturer in India focusing on specialty paste PVC resin and manufacturing of starting materials and intermediates for pharmaceutical, agro-chemical and fine chemicals sectors.

The company is the largest manufacturer of specialty paste PVC resin in India, in terms of installed production capacity as of end of December 2020. It is also the third largest manufacturer of caustic soda and the largest manufacturer of hydrogen peroxide, each in Tamil Nadu, Karnataka, Telangana, Andhra Pradesh, Kerala and Puducherry in terms of installed production capacity as of December-end 2020.

Chemplast is part of SHL Chemicals Group, which is a constituent of the Sanmar Group. Canadian investor Prem Watsa led Fairfax India Holdings Corporation has invested in the SHL Chemicals Group since 2016.

The Promoter of the company is Sanmar Holdings Limited (SHL) and SHL holds 13,24,80,000 equity shares, according to its Red Herring Prospectus.

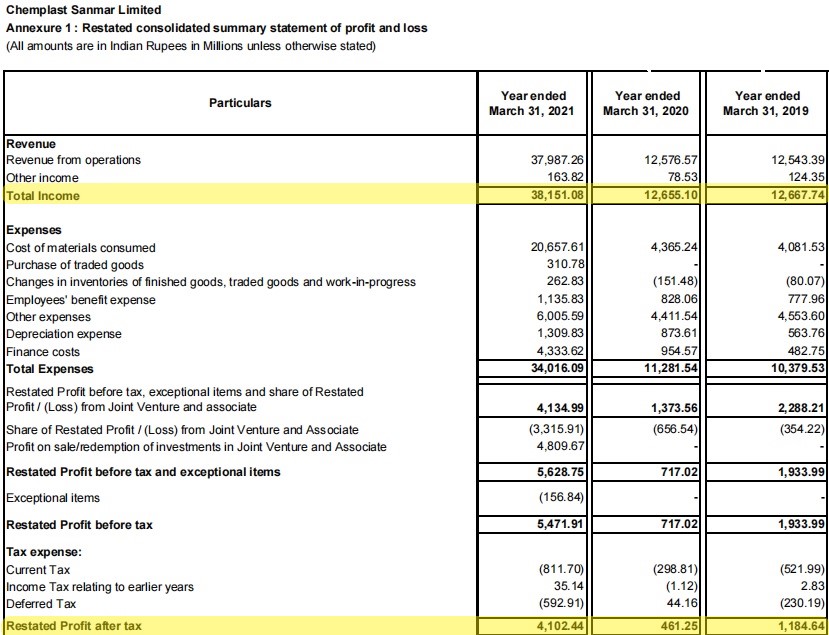

Below is the company’s profit and loss account statement for the past three years. The company has reported profit during all the three years.

The company plans to use the net Proceeds for the following purposes

IPO Opening Date | August 10, 2021 |

IPO Closing Date | August 12, 2021 |

Issue Type | Book Built Issue IPO |

Face Value | ₹5 per equity share |

IPO Price | ₹530 to ₹541 per equity share |

Market Lot | 27 Shares |

Min Order Quantity | 27 Shares |

Listing At | BSE, NSE |

Issue Size | Rs 3850 crore |

IPO Listing Date | August 24, 2021 |

Application | Lots | Shares | Amount (Cut-off) |

Minimum | 1 | 27 | Rs 14,607 |

Maximum | 13 | 351 | Rs 1,89,891 |

To read more about another IPO on August 10 by Aptus Value Housing Finance, click here

a