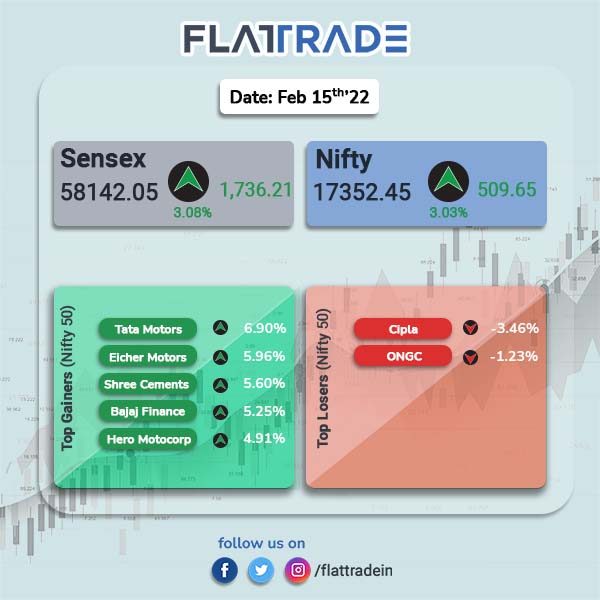

Benchmark equity indices rebounded as Russia-Ukraine geopolitical tensions eased and crude oil prices fell. The rally was aided by gains in auto, banking and technology stocks. The Sensex jumped 3.08% and Nifty surged 3.03%. Brent crude fell 2.76% and US crude was down 3.12%

Broader markets also rose tracking benchmark indices. Nifty Midcap 100 advanced 2.86% and BSE Smallcap gained 1.97%. Top gainers among Nifty sectoral indices were Auto [4.01%], PSU Bank [3.99%], Media [3.77%], Bank [3.42%] and IT [3.05%].

Indian rupee rose 28 paise to 75.33 against the US dollar.

Stock in News Today

Axis Bank and Zee Learn Ltd: Zee Learn received a communication from Axis Bank, for invocation of corporate guarantee of Rs 91.62 crore granted in favour of Digital Ventures Pvt on Sept. 25, 2014. Zee Learn has been asked to pay the said amount within seven days from the receipt of the letter. Learn is evaluating necessary steps for further action.

SpiceJet: The airline posted a consolidated net profit of Rs 42.45 crore in Q3FY22 compared with a net loss of Rs 66.77 crore in the year-ago period. Total revenue from operations stood at Rs 2,262.65 crore as against Rs 1,691.64 crore in the corresponding period last fiscal.

Cipla Ltd: Shares of the company fell after more than 2 per cent of the total equity of the pharmaceutical company changed hands through block deal. According to NSE exchange filing made by the company, Y K Hamied, Chairman, and MK Hamied, Vice Chairman, who are also promoters, sold 2,01,69,756 shares, representing 2.5 per cent of the total issued and paid-up share capital of the company.

ACC Ltd: The cement producer has successfully commissioned 1.6 MTPA Grinding Unit (GU) at Tikara in Uttar Pradesh. With this, the total capacity of Tikaria GU will be 3.91 MTPA. ACC aims to manufacture environment friendly cement products with low carbon emission in the new facility.

Balkrishna Industries: The company reported a 2% YoY rise in net profit to Rs 329 crore in Q3FY22. It total income rose 39% YoY to Rs 2,079 crore in Q3FY22. Raw Material costs zoomed 58% to Rs 1,015 crore in Q3FY22 from Rs 642 crore in Q3FY21. EBITDA in the reported quarter was Rs 507 crore, up 6% YoY and EBITDA margin stood at 24.4% in Q3FY22, as against 31.9% in Q3FY21.

Spandana Sphoorty Financial Ltd: The company has posted a consolidated net profit of Rs 45.1 crore in Q3FY22 as against a loss of Rs 29.7 crore in the year-ago period. The income from operations in the reported quarter, rose marginally to Rs 346.1 crore from Rs 337.9 crore in Q3FY21.

FSN E-Commerce Ventures (Nykaa): The company’s institutional investors have rejected proposed changes to the company’s Articles of Association (AoA) that sought to give special rights to promoters to nominate one-third of the directors and the chairperson of the board irrespective of their shareholding. The institutional investors include mutual funds, insurance companies and foreign portfolio investors.

Info Edge: The company has acquired a 25% stake for Rs 11.25 crore in Juno Learning, an online school that teaches sales techniques to entry-level professionals and students. The Company has agreed to acquire 4,331 compulsorily convertible preference shares having a face value of Rs 10 each.

Zomato: Shares of the company recovered after hitting the lowest point in intraday trading amid continued selling in loss-making internet companies even as the wider market recovered from frantic selling a day prior. The stock hit a new low of Rs 75.75 and slipped below the IPO issue price of Rs 76. However, it closed at Rs 82.70 per equity share.