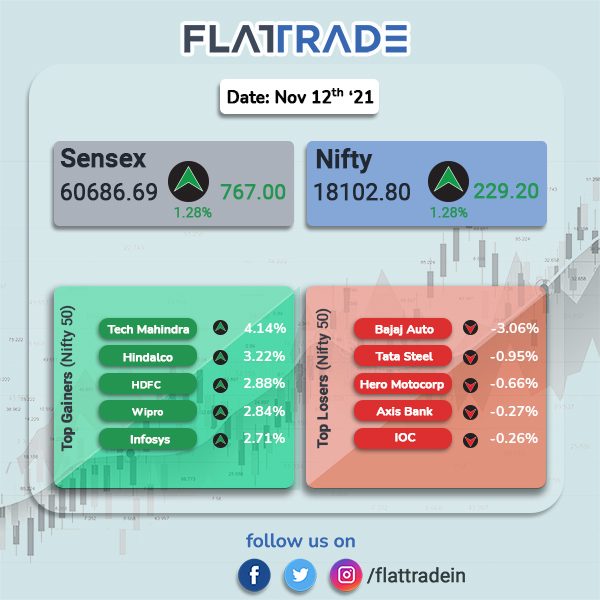

Benchmark Indian indices rose more than 1% as inflationary worries waned and investors focused on economic recovery and quarterly earnings. The Sensex closed 1.28% higher at 60686.69 and Nifty rose 1.28% to 18102.75.

Top gainers among Nifty sectoral indices were IT (2.10%), Realty (1.65%), Energy (1.32%), Financial Services (1.08%) and FMCG (0.96%). The laggards were Nifty Media (-0.13%) and PSU Bank (-0.08%).

Indian rupee rose 7 paise to 74.44 against the US dollar on Friday.

Stock in News Today

Vodafone Idea: The telecom operator reported a consolidated net loss of Rs 7132.3 crore in Q2FY22, compared with a net loss of Rs 7218.5 crore in the same period of last year. Revenue from operations fell to Rs 9406.4 crore in Q2FY22 from Rs 10791.2 crore in the year-ago period. Mobile average revenue per user stood at Rs 109, a rise of 4.8% quarter-on-quarter.

Hindalco Industries: The company’s consolidated net profit in Q2FY22 soared 783% to Rs 3417 crore from Rs 387 crore in the year-ago period. Its consolidated revenue in the reported quarter rose 53% to Rs 47,665 crore from Rs 31,237 crore in Q2FY21. Hindalco reported standout performances across all business segments.

Tata Consumer Products: The company has signed a deal agreement to acquire 100% equity shares of Tata SmartFoodz Limited (TSFL) from Tata Industries Limited, for a cash consideration of Rs 395 crore. “The acquisition will give us access to a unique technology and the product portfolio synergises well with our existing distribution infrastructure both in India and internationally,” said Sunil D’Souza, MD and CEO, Tata Consumer Products.

Motherson Sumi: The company’s net profit fell to Rs 93.04 crore in Q2FY22 from Rs 387.93 crore in the year-ago period. Revenue from operations fell Rs 14,076.39 crore in Q2FY22 from Rs 14,957.21 crore in Q2FY21. Its EPS fell to 26 paise during the quarter from 80 paise in the year-ago period.

Vodafone Idea and SBI: the company is in talks with the public-sector lender for fresh loans, according to people familiar with the matter, Bloomberg reported. State Bank of India has asked Vodafone Idea to first outline a turnaround strategy, the people said.

Fino Payments Bank: The company had a tepid stock market debut as it opened at Rs 544.35, down 6% from its issue price of Rs 577 per equity share. Shared of the company closed at Rs 543.90.