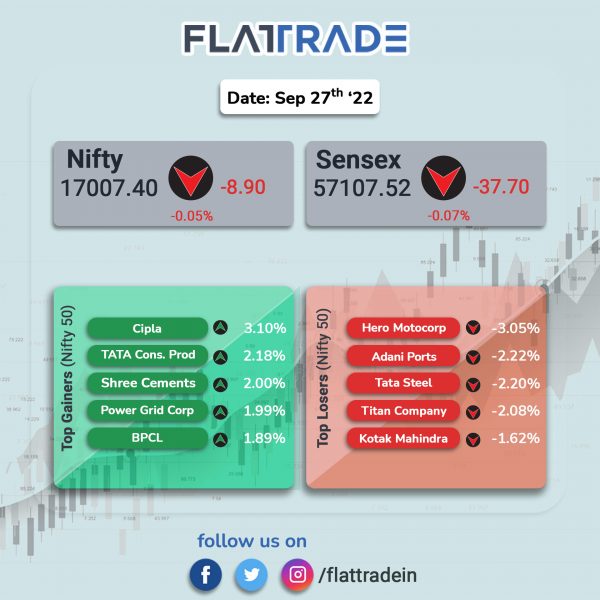

Benchmark stock indices closed nearly flat as gains in Oil & Gas, pharma, IT and FMCG stocks were offset by losses in metal, financial services and auto stocks. The Sensex slipped 0.07% and the Nifty inched down 0.05%.

The Nifty Midcap 100 index rose 0.16% and the BSE Smallcap advanced 0.49%.

Top gainers among Nifty sectoral indices were Oil & Gas [1.13%], Pharma [0.98%], IT [0.97%] and FMCG [0.64%]. Top losers were Metal [-0.86%], Financial Services [-0.8%], Bank [-0.67%], Auto [0.51%] and Private Bank [-0.4%].

Indian rupee rose 4 paise to 81.58 against the US dollar on Tuesday.

Stock in News Today

Adani Group: The group will invest more than $100 billion in the next decade, Chairman Gautam Adani told a Forbes Global CEO Conference in Singapore. “We have earmarked 70% of this investment for the energy transition space and we intend to do far more,” Adani said. Adani group aims to raise renewable portfolio by another 45 GW of hybrid renewable power generation.

Reliance Jio: The telecom arm of Reliance Industries plans to launch affordable 5G phones priced between Rs 8,000-12,000 once the coverage has reached a good threshold to attract the mass-market 4G smartphone users to its 5G network, according to a report by Counterpoint. The report also said that at some point in 2024, Jio will also launch an affordable 5G mmWave + Sub-6 GHz smartphone as the cost deltas between the two would have narrowed.

Nazara Technologies: Shares of the company fell 3.89% in Tuesday’s intraday trade after the Tamil Nadu Cabinet approved an ordinance to ban online gaming in the state. The company is a diversified gaming and sports media platform that offers interactive learning, subscriptions and sports simulation games.

Power Grid: Shares of the company rose 3.51% in intraday trading after The Economic Times reported that government rejected a proposal for Power Grid to buy a controlling stake in power financier REC, citing Power Minister RK Singh. Shares of the company closed 2% higher at Rs 204.85 per equity share.

HFCL: The company’s material subsidiary, HTL, has established a state-of-the-art polymer compounding facility as backward integration at its Hosur plant in Tamil Nadu for manufacturing of Polyolefin based compounds of various grades and colours which are required as raw material for manufacturing of optical fibre cables. With an installed capacity of 24,000 MT per annum, the company aims to improve profitability.

In a separate exchange filing, the company said it has bagged purchase orders aggregating to Rs 202.6 crore. The company received orders worth Rs 167.60 crore from Reliance Retail, Reliance Projects & Property Management Services for supply of optical fibre cables and another order worth Rs 35 crore from an overseas customer for supply of various types of optical fiber cables and related accessories. The orders are expected to be executed by March 2023.

Optiemus Infracom: The company’s subsidiary, Optiemus Electronics, has partnered with smart devices maker Realme DIZO for locally manufacturing smartwatches and audio wearables for Indian consumers. The brand has already started manufacturing some of its products, including DIZO Watch D, here in India and will eventually move to production of the other DIZO products – existing and upcoming ones in phases.

Tata Steel: Shares of of the company fell 2.2% on Tuesday and has fallen 7% in the past two trading days erasing all gains that were made after the board of directors of Tata group had approved amalgamation of all metal companies into Tata Steel last week.

EKI Energy Services: The company announced that its subsidiary, GHG Reduction Technologies, has completed the capacity expansion at its manufacturing plant in Nashik, Maharashtra. The company said that the plant has a capacity to manufacture 5 million improved cookstoves per year.

CMS Info Systems: Shares of the company rose after the credit rating agency ICRA revised its outlook on the ratings of the company to ‘positive’ from ‘stable’. Simultaneously, the agency has reaffirmed the company’s short-term rating at “ICRA A1+” and the long-term rating at “ICRA AA”. The rating agency said that the revision in outlook reflects ICRA’s expectation that the company is likely to register a healthy revenue growth and higher accruals generation over the near to medium term.