Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.68% lower at 16,939, signalling that Dalal Street was headed for a negative start on Wednesday.

Asian share markets fell as investors were worried that higher interest rates would push global economy into recession. Japan’s Nikkei 225 index tanked 2.33% and Topix dropped 1.85%. China’s CSI 300 index fell 0.79% and HAng Seng slumped 2.31%.

Indian rupee rose 4 paise to 81.58 against the US dollar on Tuesday.

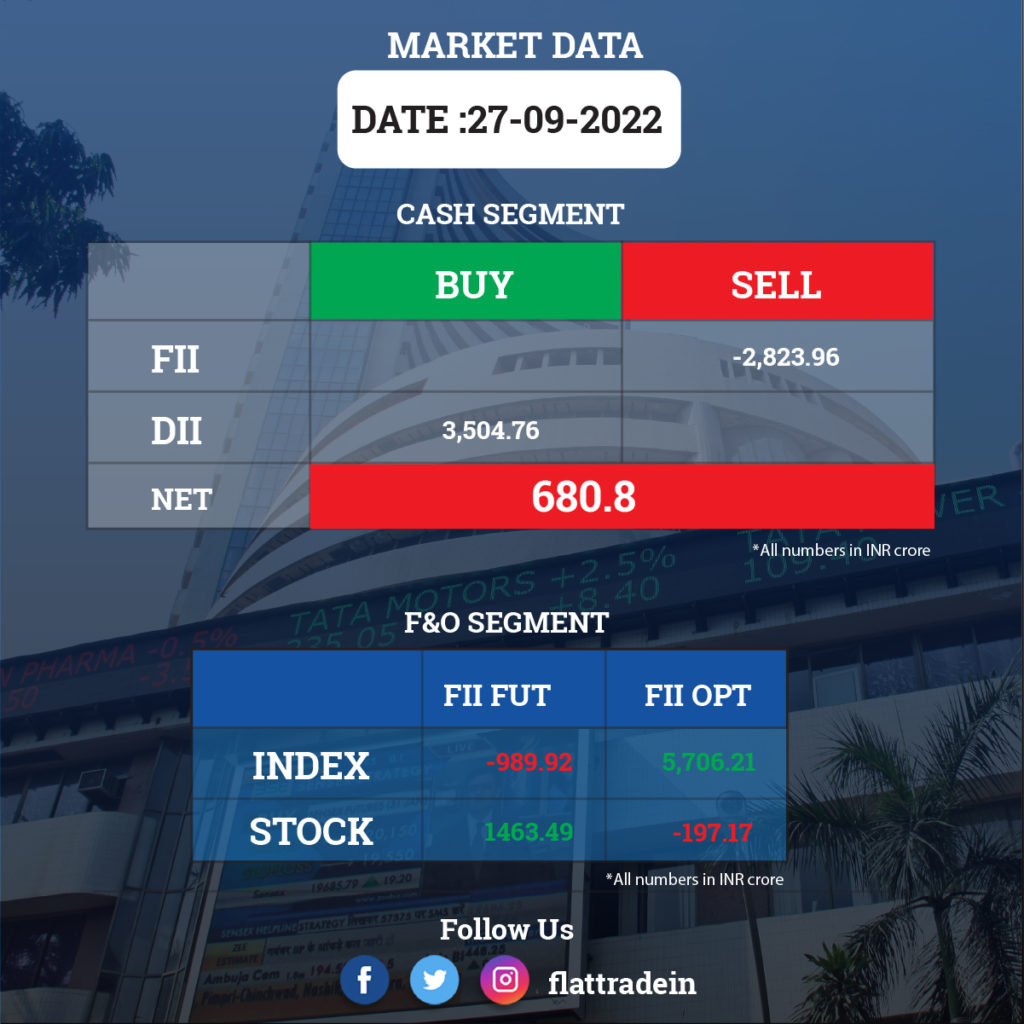

FII/DII Trading Data

Stocks in News Today

Reliance Retail: The retail arm of Reliance Industries has announced the launch of Reliance Centro, a fashion and lifestyle departmental store. The first Reliance Centro store was launched in Vasant Kunj, Delhi. “Reliance Centro is aimed at democratising fashion in India, by strengthening its reach & connect with consumers in India,” the company said.

Torrent Pharmaceuticals: The company has entered into definitive agreements to acquire 100% of Curatio Healthcare for Rs 2,000 crore to strengthen its presence in the dermatology segment, it said in a regulatory filing. Sequoia-backed Curatio has a portfolio of over 50 brands that are marketed in India.

Axis Bank: The lender will invest between Rs 49.9 crore and Rs 69.9 crore to acquire 9.94% stake in Fairfax-backed Go Digit Life Insurance. Axis Bank has entered into an indicative and non-binding term sheet with Go Digit Life Insurance for the proposed investment by picking up equity in the insurer in two tranches, subject to regulatory approval.

LIC: The company has acquired over a 2% stake in state-owned refiner Bharat Petroleum Corporation Ltd (BPCL) for nearly Rs 1,598 crore since December 2021. LIC said its shareholding has increased to 9.04% from 7.03% of the paid-up capital of the company.

Indraprastha Gas: The company said it had provided a record 3.75 lakh new connections for piped cooking gas to households during FY22. The company said it had set up 99 new CNG stations during April 2019 and March 2020, taking the total number of CNG stations to 711. The company achieved gross turnover of ₹8443 crore and PAT was Rs.1315 crore in FY2021-22.

Mothersons Sumi Wiring India (MSWIL): The company is considering the issuance of bonus shares to its existing shareholders and its board of directors will meet on September 30 to consider the bonus issue proposal.

Bank of India: The bank has invested in the capacity of promoter shareholder of ONDC, an amount of Rs 10 crore in ONDC, under the private placement route, the lender said in a regulatory filing. With this, the bank’s shareholding in the company will be 5.56% of the total shareholding in ONDC.

Oil and Natural Gas Corp (ONGC): The PSU has for the first time sold oil through a three-month local tender, commanding $5-$8 per barrel more than existing rates under new rules that allow producers marketing freedom, Reuters reported citing industry sources. ONGC hopes to get better participation in subsequent tenders, according to the report.

63 moons technologies: The company said it will provide next-generation technology solutions to Italy-based Spuma SRL as it targets pan-European markets. Spuma SRL will leverage 63moons’ expertise on real-time mission critical solutions, using the latest technology suite. 63 moons will be offering SaaS model with earnings by way of share in revenue by transaction charges and services earned by the digital ecosystem which is the model of 63moons for high-growth IP monetization.

Jet Airways: The airline is in advanced stage of talks with aircraft makers and lessors to lease planes and expects to restart operations in the coming weeks, according to executives at the airline. The executives said the operations of Jet Airways will commence before the end of this year and the initial fleet plan is close to being finalised.

Fortis Healthcare: IHH Healthcare is in discussions with relevant authorities in India to determine the next step for its stalled open offer for an additional 26.1 per cent stake in Fortis. IHH said that the Supreme Court has given a direction to the High Court to inter alia consider issuing appropriate process and appointing forensic auditor(s) to analyse the transactions entered between Fortis and RHT and other related transactions.

Birla Corporation: The company will be investing about $1 billion over the next eight years to ramp up cement production capacity to 30 million tonnes (mt). Currently, the company’s consolidated capacity stands at nearly 20 mt and the next leg of growth from 20 mt to 30 mt will be a mix of greenfield, brownfield projects and de-bottlenecking of existing operations.

Mahindra CIE Automotive: Mahindra & Mahindra has sold 82,42,444 shares or 2.173% shareholding in associate company Mahindra CIE Automotive. The sale has been executed through the bulk deal window at a gross price of Rs 285 per share. After the sale, the shareholding of the company in Mahindra CIE has come down from 11.427% to 9.254%.

Bharat Heavy Electrical: The company has received an order for setting up the 2×660 MW Talcher thermal power project Stage-III on EPC (engineering, procurement & construction) basis from NTPC.

Supriya Lifescience: The board has appointed Rajeev Kumar Jain as Chief Executive Officer and Key Managerial Personnel of the company. Rajeev will be joining as CEO on October 3, 2022, to take the company on the next phase of its growth journey. Shireesh Ambhaikar has resigned as Chief Executive Officer of the company citing personal reasons.