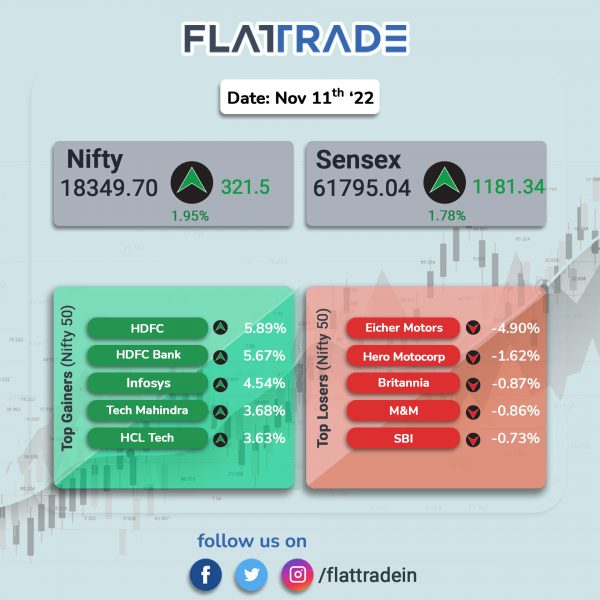

Indian markets ended in the green after investors’ sentiments were boosted by lower-than-expected US inflation rate, strengthening rupee and higher FII inflows. The Sensex index rose 1.95% and the Nifty 50 index jumped 1.78%.

Broader markets underperformed headline indices. Nifty Midcap 100 index edged up 0.07% and the BSE Smallcap index was up 0.33%.

Top gainers among Nifty sectoral indices were IT [3.81%], Financial Services [2.17%], Metal [2.03%], Realty [1.67%] and Oil & Gas [1.43%]. Top losers were PSU BAnk [-0.67%], Auto [-0.30%] and FMCG [-0.15%].

Indian rupee appreciated by Rs 1.01 to 80.79 against the US dollar on Friday.

Stock in News Today

Mahindra & Mahindra (M&M): The automaker reported a 46% YoY jump in its standalone profit after tax (PAT) at Rs 2,090 crore in the September quarter of the current fiscal. The company’s quarterly revenue rose 57% YoY to Rs 20,839 crore. EBITDA recorded an increase of 50% YoY to Rs 2,496 crore in Q2FY23. The total number of vehicles sold during the quarter shot up by 75% on a YoY basis to 1,74,098. M&M’s operating margin declined from 12.47% in the year-ago period to 11.98% in Q2. The company said it recorded the highest-ever quarterly revenue in auto and farm segments.

Hindalco Industries: The company reported a 35.5% YoY fall in consolidated net profit for the September quarter to Rs 2,205 crore. Sequentially, the consolidated net profit declined 46% from Rs 4,119 crore. Consolidated revenue from operations rose nearly 18% YoY to Rs 56,176 crore. The higher revenue was on the back of higher volumes and better realisations. Sequentially, the revenue was marginally down 3 percent from Rs 58,018 crore. Novelis, the company’s subsidiary, delivered robust results driven by a recovery in automotive and aerospace segments and better pricing. The company had a consolidated debt of 42,063 crore in the reported quarter, down 14 percent from the debt it had of Rs 48,011 crore at the end of the September 2021 quarter.

Ashok Leyland: The company has reported a profit after tax of Rs 199 crore for the second quarter ended September 30, helped by strong sales. It had posted a net loss of Rs 83 crore in the September 2021 quarter. Revenues during the period under review stood at Rs 8,266 crore compared to Rs 4,458 crore a year ago. The company’s domestic MHCV (medium and heavy commercial vehicles) volume rose to 25,475 units in the second quarter against 11,988 units in the year-ago period, it said. Its light commercial vehicle (LCV) sales volume increased by 28% to 17,040 units against 13,328 units in the same period last fiscal. Export volumes of MHCV and LCV for the reported quarter surged 25% to 2,780 units as against 2,227 units a year earlier.

Emami: The FMCG company said that its consolidated revenue was up 3.4% at Rs 813.75 crore in Q2FY23 from Rs 787.12 crore in Q2FY22. Its consolidated net profit fell 1% to Rs 184.18 crore in Q2FY23 as agaisnt Rs 185.27 crore in Q2FY22. EBIDA fell 32% YoY to Rs 245.07 crore in the quarter under review. EBITDA margin stood at 30.1% in Q2FY23 compared with 46% in Q2FY22.

Rail Vikas Nigam: Shares of rose over 6% in intraday trade after company won a project in Maldives. The estimated cost of the project is Rs 1544.6 crore. The project is named Development of UTF (Uthuru Thila Falhu- Island) Harbour, according to its stock exchange filing.

Alembic Pharma: The company’s consolidated revenue was up 14% at Rs 1,475 crore in Q2FY23 as against Rs 1,292 crore in th eyear-ago period. Net profit fell 19% to Rs 133 crore in the quarter under review from Rs 164 crore in the year-ago period. EBITDA slipped 2% YoY to Rs 233 crore in th eyear-ago period. EBITDA margin stood at 15.8% in Q2FY23 compared with 18.5% in the year-ago period.

Matrimony.com: The matchmaking service provider has reported a consolidated net profit for the July-September quarter at 11.70 crore. It had registered a consolidated net profit of Rs 16.57 crore during corresponding quarter of previous financial year. The consolidated total income went up to Rs 119.07 crore during the quarter under review from Rs 113.90 crore registered in the same period of last financial year.

Pricol: The company posted a consolidated net profit at Rs 47.52 crore for the July-September 2022 quarter. It had registered a consolidated profit at Rs 14.66 crore during corresponding quarter a year ago. The consolidated total income during the quarter under review was up at Rs 516.46 crore from Rs 409.49 crore in same period a year ago.

Capacit’e Infraprojects: The company has reported a 15% increase in its consolidated net profit at Rs 22 crore during the quarter ended September 2022 on higher revenues. It had registered Rs 19 crore net profit in the year-ago period. The company’s revenue from operations rose 25% to Rs 431 crore in the reported quarter from Rs 345 crore in the year-ago quarter. Its EBIDTA grew by 26% to Rs 84 crore in Q2FY23 compared to Rs 67 crore in the Q2FY22. The company’s order book on a standalone basis stood at Rs 9,026 crore at the end of September 2022 quarter.

GVK Power and Infrastructure Limited (GPIL): The company posted a multi-fold fall in its consolidated net profit at Rs 153.87 crore during the September 2022 quarter due to higher expenses. Its had posted a profit of Rs 2,395.01 crore in the year-ago period. The company’s total income increased to Rs 1,012.05 crore in Q2FY23 from Rs 93.71 crore in the year-ago period. Expenses soared to Rs 840.10 crore in the reported quarter as against Rs 182.24 crore in the same period last fiscal.