Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.88% higher at 18,434, signalling that Dalal Street was headed for a positive start on Friday.

Asian shares were trading higher as investors were buoyed by hopes of a slower Fed rate hikes due to the slowing pace of the US inflation. The benchmark Nikkei 225 index surged 2.70% and the Topix index rose 1.84%. The Hang Seng index soared 4.98% and the CSI 300 index was 1.96% higher.

Indian rupee fell 31 paise to close at 81.81 against the US dollar on Thursday.

The CPI-based inflation in the US eased to 7.7% in October, according to the latest report by the US Labour Department.

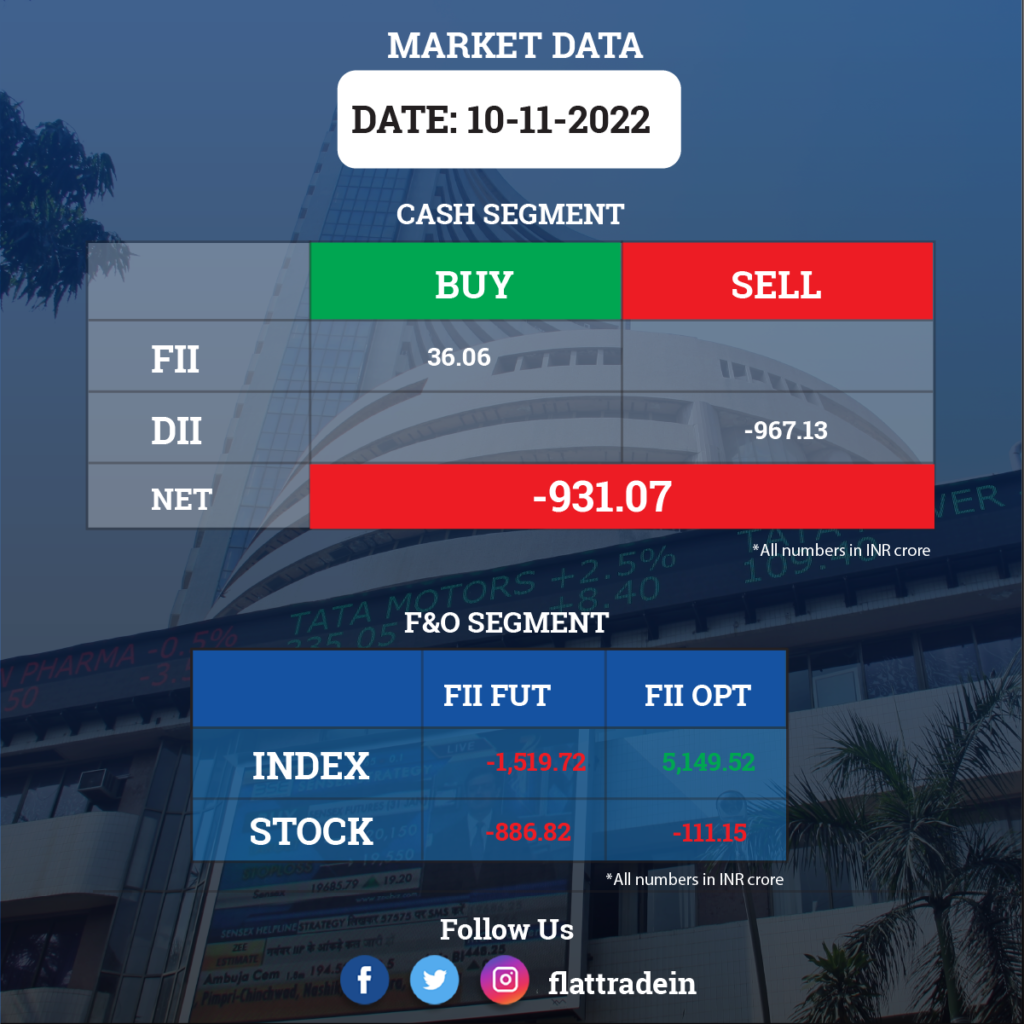

FII/DII Trading Data

Upcoming Results

Life Insurance Corp of India, Hindalco Industries, Mahindra & Mahindra, ABB India, Adani Power, Alkem Laboratories, Alembic Pharmaceuticals, Ashoka Buildcon, Astral, Astrazeneca Pharma India, Bharat Dynamics, BHEL, Delhivery, Dhani Services, Easy Trip Planners, Emami, Exide Industries, Fortis Healthcare, GSK Pharma, Glenmark Pharma, Hindustan Aeronautics, Ipca Laboratories, Lemon Tree Hotels, Pfizer, Sun TV Network, Thermax, Ujjivan Financial Services, Zee Entertainment Enterprises, and Zydus Lifesciences will report their quarterly earnings on November 11.

Stocks in News Today

Eicher Motors: The makers of Royal Enfield registered a 76% year-on-year growth in profit at Rs 657 crore for the quarter ended September FY23 backed by strong operating as well as top line performance. Revenue from operations at Rs 3,519 crore for the quarter grew by 56.4% and EBITDA increased by 75% to Rs 821.4 crore compared to year-ago period. Margin expanded to 23.3% from 20.9% in the same period. Royal Enfield sold 2.03 lakh motorcycles in September FY23 quarter, an increase of 64.7% YoY.

Apollo Hospitals Enterprises: The healthcare services provider reported a 20% year-on-year decline in profit at Rs 212.8 crore for the quarter ended September FY23 impacted by weak operating performance, and higher purchases of stock-in-trade. Revenue from operations grew by 14.4% to Rs 4,251 crore compared to year-ago period. EBITDA for the quarter at Rs 565.4 crore declined by 8% and margin fell by 330 bps YoY to 13.3% for the September FY23 quarter.

Adani Green Energy: The company recorded a 49% year-on-year increase in consolidated profit at Rs 149 crore for Q2FY23 led by lower cost of materials sold and finance cost. Revenue from operations increased by 19.5% to Rs 1,686 crore and EBITDA grew by 9% to Rs 966 crore compared to same period last year, but the EBITDA margin fell 550 bps YoY to 57.3% in Q2.

Zomato: The food delivery company posted net loss at Rs 251 crore for the quarter ended September FY23, compared to a loss of Rs 430 crore in same period last year due to higher revenue and improved operating performance. Revenue from operations for the quarter at Rs 1,661 crore increased by 62% over a year-ago period, and EBITDA loss narrowed to Rs 311 crore from loss of Rs 536 crore in the same period last fiscal.

Adani Power: The company has entered into a Memorandum of Understanding to sell its 100% equity stake in subsidiary, Support Properties (SPPL) to AdaniConnex. The transaction value is Rs 1,556.5 crore. ACX is a 50:50 joint venture between promoter group company Adani Enterprises, and EdgeConneX.

Jindal Steel & Power: The company has posted a 92.3% year-on-year decline in consolidated profit at Rs 200 crore for the quarter ended September FY23, impacted by weak operating performance and a decline in top line. Revenue from operations fell 0.7% YoY to Rs 13,521.4 crore in Q2FY23. EBITDA tanked 58% to Rs 1,931.4 crore and margin contracted by 1,950 bps to 14.3% compared to year-ago period. JSPL has prepaid its entire overseas long term debt.

Tata Consultancy Services (TCS): The IT service company announced plans to expand its footprint in Illinois by creating 1,200 new jobs by the end of 2024. With this development, the company plans to accelerate its STEM outreach efforts in local schools to cover 25% more students and teachers. More than 3,000 locals from Illinois currently work for TCS – including 1,100 who were hired within the last five years.

Bata India: The footwear retailer reported a 47.44% rise in consolidated net profit at Rs 54.82 crore in the second quarter ended September 2022, helped by increased footfalls at stores. The company had posted a net profit of Rs 37.18 crore in the July-September quarter a year ago. Its revenue from operations during the quarter under review was at Rs 829.75 crore, up over 35.11% from Rs 614.12 crore of the corresponding quarter of FY22. India’s total expenses in the September quarter were at Rs 769.56 crore, up 33.73%. In the September quarter, Bata’s distribution channel continued to scale up to over 1,100 towns. Its digital business also achieved its “highest revenue” of Rs 95 crore during the quarter contributing 11% of total sales.

Alkem Laboratories: The pharma company has received Form 483 with 3 observations from US FDA for its manufacturing unit in St. Louis, USA. There is no data integrity observation. The US FDA had conducted a pre-approval inspection at the company’s manufacturing facility during October 31 to November 9.

Indian Hotels: The company recorded consolidated profit at Rs 121.6 crore for quarter ended September FY23, against loss of Rs 120.6 crore in same period last year on better top line and operating performance. The low base in year-ago period also supported earnings. Revenue jumped 69.2% to Rs 1,232.6 crore compared to year-ago period. EBITDA at Rs 294 crore for the quarter increased by 304% and margin expanded by 1,390 bps to 23.9% compared to same period last year.

Suzlon Energy: The company posted a consolidated net profit of Rs 56.47 crore in the September quarter, on the back of higher revenues. In the year-ago period, the company had posted a net loss of Rs 12.40 crore. During the quarter, total income rose to Rs 1,442.58 crore, up from Rs 1,361.62 crore in the same period a year ago. Himanshu Mody, Chief Financial Officer of Suzlon Group, said the company has reduced debt by Rs 583.50 crore through the rights issue proceeds. At the end of September 2022, the company’s net debt was Rs 2,722 crore.

Trent: The retail arm of Tata Group reported an on-year 41% jump in standalone net income at Rs 193 crore in the September quarter, driven by robust revenue. Revenue, including GST, rose 78% to Rs 1,929 crore, which is the highest ever for a quarter.

NHPC: The state-run hydro power giant said its board has approved a proposal to merge the company’s arm Jalpower Corporation Ltd with itself. NHPC had acquired Jalpower Corporation and its 120 MW Rangit Stage-IV hydro power project in March 2021 through insolvency proceedings.

Steel Authority of India Ltd (SAIL): The state-owned metal player slipped into red posting a consolidated loss of Rs 329 crore during the quarter ended on September 30, 2022. It had clocked Rs 4,338.75 crore net profit during the July-September period of the preceding fiscal.

Muthoot Finance: The country’s largest gold financier reported a decline of 10% in its consolidated net profit at Rs 901.6 crore in the July-September quarter of FY23 as income fell. It had posted a net profit of Rs 1,002.90 crore in the same period of the previous fiscal year.

Trent: The Tata Group retail arm reported an on-year 41% jump in standalone net income at Rs 193 crore in the September quarter, driven by robust revenue. Revenue, including GST, rose 78% to Rs 1,929 crore, which is the highest ever for a quarter.

Reliance Power: The company reported widening of its consolidated net loss to Rs 340.26 crore in the September quarter, mainly due to higher expenses. The consolidated net loss of the company stood at Rs 133.10 crore in the quarter ended September 30.

Transformers & Rectifiers (India): The power, distribution, and specialty transformer manufacturing company said its consolidated net profit more than doubled to Rs 12.20 crore in the September quarter, mainly due to higher revenues. The consolidated net profit of the company stood at Rs 5.49 crore in the quarter ended September 30.

SJVN: The state-run utility player said it has bagged a contract to build, own and operate a 83 MW floating solar project worth Rs 585 crore in Madhya Pradesh.

Dredging Corporation of India: The state run company reported a standalone profit of Rs 28.61 crore for the quarter ended September 30, 2022. The company had posted a standalone loss of Rs 3.98 crore in the corresponding quarter of the previous fiscal.

India Grid Trust: The power transmission firm said its consolidated net profit almost doubled to Rs 125.79 crore in the September quarter, aided by higher revenues. The consolidated net profit of the company stood at Rs 68.17 crore in the quarter ended September 30, 2021.