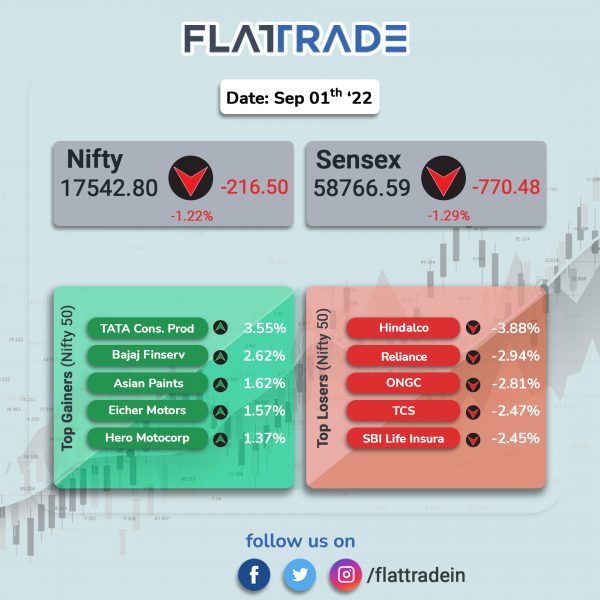

Benchmark equity indices fell due to global growth concerns and weaker-than-expected domestic GDP weighed on investors’ sentiments. The Sensex tanked 1.29% and the Nifty 50 index fell 1.22%.

Broader markets outperformed headline indices. The Nifty Midcap 100 index edged up 0.11% and the BSE SmallCap rose 0.48%.

Top Nifty sectoral losers were IT [-1.98%], Energy [-1.92%], Oil & Gas [-1.82%], Pharma [-1.14%] and Metal [-0.94%]. Top gainers were Realty [1.08%], PSU Bank [0.715] ans Auto [0.37%]

The Indian rupee fell 11 paise to 79.56 against the US dollar on Thursday.

The S&P Global India Manufacturing Purchasing Managers’ Index (PMI) dipped to 56.2 in August from a reading of 56.4 in July. A reading above 50 indicates expansion and a reading below 50 denotes contraction. India’s manufacturing activity continued to expand for the 14th straight month with production and new orders strongest since November 2021. .

India’s gross GST collections stood at Rs 1.43 lakh crore in August 2022. The government said that the Gross GST revenue came in at Rs 1,43,612 crore, 28% higher than the year-ago period.

Stock in News Today

Airtel: The telcom company announced several new cloud offerings under Edge Cloud Portfolio ahead of the 5G service launch. The new cloud offerings will include Edge content delivery network (CDN). Airtel Cloud’s Edge CDN will accelerates web and video content delivery, the company said in a statement.

Biocon: Shares of the company closed 2.7% lower after US health regulator issued Form 483 to the company with 11 observations each for its two sites in Bengaluru and six for a plant in Malaysia. The USFDA conducted three on-site inspections at Biocon Biologics’, Biocon’s subsidiary, seven manufacturing facilities spanning two sites in Bengaluru, India and one at Johor, Malaysia.

Maruti Suzuki India (MSI): The automaker posted a 26.37% increase in total sales at 1,65,173 units in August 2022. The company had sold a total of 1,30,699 units in the same month last year. Total domestic passenger vehicle sales were at 1,34,166 units, a growth of 30% YoY, it added.

Bajaj Auto: The company said that the total vehicle sales grew 8% on an annual basis to 4,01,595 units in August. The automaker had sold a total of 3,73,270 vehicles in August 2021. Total domestic sales rose 49% to 2,56,755 units in the month under review, from 1,72,595 units in August 2021. The two-wheeler exports volume fell 28% to 1,44,840 units in August this year, from 2,00,675 units in the year-ago period.

ICICI Bank: The private sector lender hiked its MCLR by 10 bps across tenors, effective September 1. Its overnight to one-year MCLR now ranges between 7.75% and 8%, according to the bank’s website.

Bandhan Bank: The lender has increased its MCLR by 41-65 bps across various periods, resulting in its overnight to three-year MCLR ranging from 9.14% to 10.47%.

Alembic Pharma: The drugmaker said that the USFDA issued a Form 483 with two observations after conducting inspection at the company’s injectable facility at Karkhadi. The company received Form 483 with 2 observations from the US drug regulator. None of the observations are related to data integrity and are addressable, the company said in an exchange filing.

MM Forgings: The company agreed to make strategic investment in Abhinava Rizel by subscribing shares equivalent to 88% of share capital. The company entered into share subscription and shareholders’ agreement with Abhinava Rizel. MM Forgings did not not disclose the cash paid for the deal and the transaction is expected to be completed by September 30.

Zydus Lifesciences: The pharma has received final approval from the USFDA to market Venlafaxine extended-release tablets and Pregabalin extended-release tablets. Venlafaxine is used to treat depression, anxiety, panic attacks and social anxiety disorder. The drug had annual sales of $46 million in the US.

Dish TV: Shares of the company surged 20% after the d2h satellite service provider said Chairman Jawahar Lal Goel would not seek a reappointment, indicating a win for Yes Bank, Dish TV’s top shareholder.

VST Tillers Tractors: The company’s total sales rose 7.97% to 3,602 units in August 2022 from 3,336 units sold in August 2021. The company’s power tillers sales grew 15.37% YoY to 3,002 units in August 2022 from 2,602 units in August 2021. Meanwhile, total tractor sales dropped 18.26% YoY to 600 units in August 2022.

MOIL: The company has cut the prices of ferro grades of manganese ore with manganese content of minimum 44%, by 15% with effect from September 1. The prices of all other ores with manganese content below 44% have been decreased by 10%.

Equitas Small Finance Bank: The company has revised its interest rates for fixed deposits of domestic and NRE/ NRO clients. The special interest rate offer is for limited period starting from September 1 to September 7, on entering its 7th year of successful banking. Customers can avail interest rates up to 7.32% interest per annum on 888 days fixed deposit. For senior citizens, interest rates have been increased to 7.82% and 7.47% for NRE Customers. The interest payout options under this special offer are monthly and quarterly.

Deepak Fertilisers: Shares of the company fell 5% after the company approved allotment of 56,44,877 shares of face value of Rs 10 each to International Finance Corporation, following the conversion of foreign currency bonds. IFC agreed to convert bonds worth $15 million at Rs 195 apiece.