Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.17% lower at 17,480, indicating that Dalal Street was headed for a negative start on Thursday.

Asian stocks fell on Thursday on concern over economic growth and hawkish stance from central banks, pushing up the US dollar. Japan’s Nikkei 225 index fell 1.51% and Topix was down 1.26%. china’s Hang Seng dropped 0.88% and CSI 300 index slipped 0.09%.

The Indian rupee strengthened by 51 paise to 79.45 against the US dollar on Tuesday.

India’s gross domestic product (GDP) rose 13.5% year-on-year in the April-June period. However, it was lower than the predictions made by the Reserve Bank of India (RBI 16.2%) and other analysts.

India’s eight core sectors grew 4.5% in July, slowing from an upwardly revised 13.2% in June, the commerce ministry said on August 31.

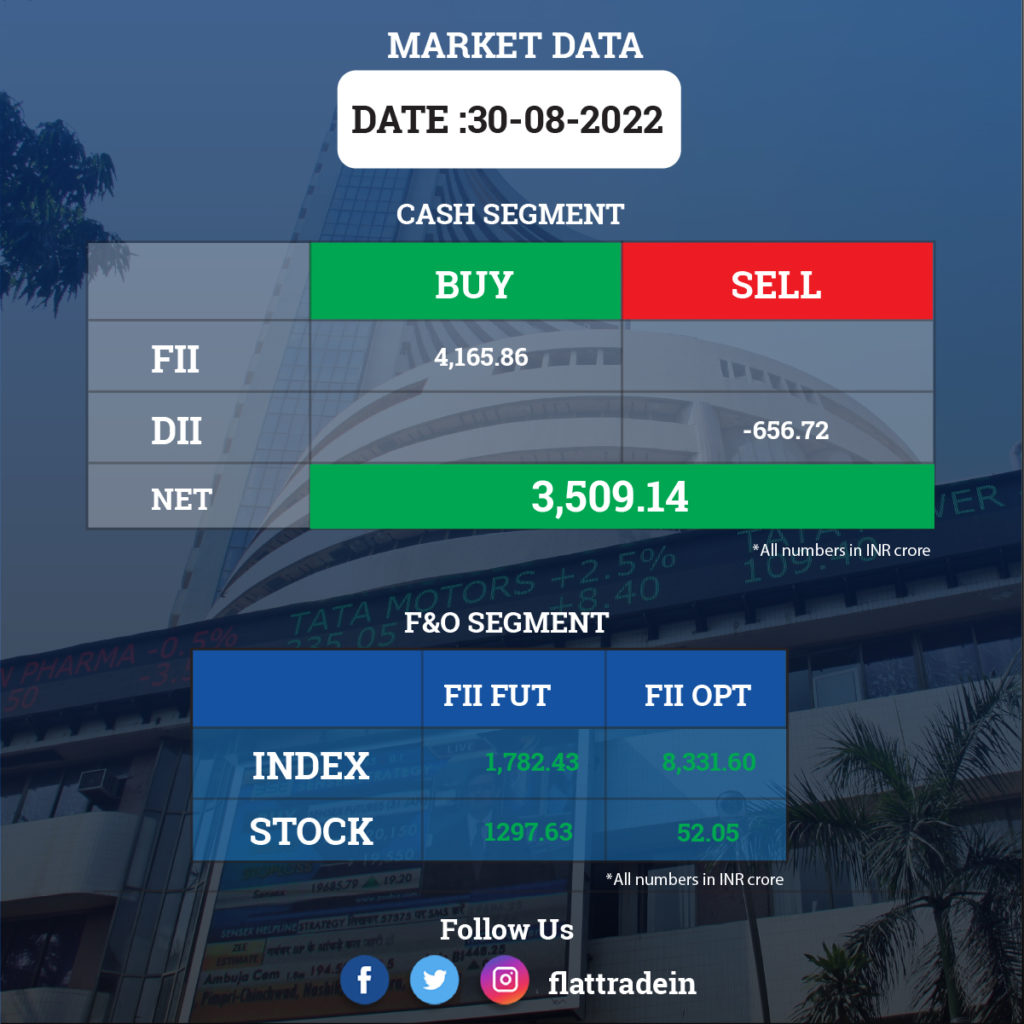

FII/DII Trading Data

Stocks in News Today

Tata Steel: The company said that it will invest more than 65 million euros for hydrogen-based steel manufacturing in the Netherlands. Hydrogen has the potential to decarbonise steel manufacturing. Tata Steel has inked pacts with three firms — McDermott, Danieli and Hatch — for the further technical preparations for hydrogen-based steel manufacturing in the Dutch city of Ijmuiden.

In other news, Tata Steel on Tuesday said it has invested around Rs 54 crore in its wholly-owned arm TSML through acquisition of additional shares on preferential basis. The funds will be used by TSML to meet capital expenditure requirements, a regulatory filing said.

Adani Transmission: The company’s arm, Adani Electricity Mumbai (AEML), said that it is investing Rs 500 crore to install smart meters for seven lakh consumers in the financial capital by the end of 2023. It said that the 7 lakh smart meters is the first phase target and the remaining 20 lakh consumers will get smart meters by the end of FY25.

InterGlobe Aviation (IndiGo): IndiGo and British carrier Virgin Atlantic have announced a codeshare agreement. The agreement will allow Virgin Atlantic to sell seats to passengers connecting onto IndiGo flights. The initial codeshare destinations in India include Chennai, Bengaluru, Hyderabad, Kolkata, Ahmedabad, Amritsar, Goa, Delhi and Mumbai.

The company’s CEO Ronojoy Dutta, who will be stepping down next month ahead of his tenure, has agreed to an enhanced two-year non-compete period. Dutta is to step down as the Whole Time Director and CEO of InterGlobe Aviation, the parent IndiGo, on September 30 whereas his current tenure is till January 23, 2024.

Vodafone Idea: Shareholders of the telecom company have approved elevation of company’s chief financial officer Akshaya Moondra as new chief executive officer, according to voting result of the annual general meeting. The company held its 27th AGM (annual general meeting) on Monday in which 99.75 per cent shareholders voted in favour of the special resolution to appoint “Akshaya Moondra as chief executive officer of the company”.

Ashok Leyland: The company said that it has bagged orders from major fleets for 1,400 school buses in the UAE, the company’s largest ever supply of school buses in this country. The total fleet deal for the GCC-made buses has been bagged by Ashok Leyland’s UAE distribution partners, Swaidan Trading – Al Naboodah Group.

Infosys: The Indian IT company has divested its entire holding in the US-based Trifacta for $12 million. The transaction was completed on August 29. Infosys had made a minority investment of $10 million during 2016-2019 in Trifacta, a data engineering software company headquartered in San Francisco.

Zee Entertainment (ZEEL): A merger between the Indian unit of Japan’s Sony and Zee Entertainment to create a $10 billion TV enterprise will potentially hurt competition by having “unparalleled bargaining power”, the country’s antitrust watchdog found in an initial review, according to an official notice seen by Reuters. The CCI’s findings will delay regulatory approval of the deal and could force the companies to propose changes to its structure, three Indian lawyers familiar with the process said, according to Reuters report.

NHPC and PTC India: The state-run hydro power giant NHPC has inked a pact with PTC India to supply electricity to be generated from upcoming West Seti & Seti River-6 projects in Nepal. As per the MoU, PTC shall purchase the Contracted Capacity from NHPC from date of commercial operation of the projects for onward sale to the state utilities/discoms/bulk consumers on long term basis in India and neighbouring countries.

Tata Motors: The automaker has acquired the entire shareholding of Marcopolo SA in the joint venture entity Tata Marcopolo Motors. With this, Tata Marcopolo Motors has become a wholly owned subsidiary of Tata Motors.

Shriram Transport Finance Company: The NBFC plans to raise an additional 50 billion rupees ($627.20 million) in the second half of the financial year to fund growth opportunities. It has already raised 50 billion rupees in the first half of this year and the additional funds raised would be separate from its existing refinancing plans amounting to 500 billion rupees, Umesh Revankar, managing director of STFC, told Reuters.

Dish TV: The direct-to-home operator said that its Chairman Jawahar Lal Goel will vacate his position at the company’s upcoming AGM on September 26, 2022. Goel, whose proposal for reappointment as Managing Director was rejected by the shareholders in an extraordinary meeting (EGM) held in June this year and has not reapplied for continuation as Chairman.

Zomato: The company has launched its new intercity service that allows customer to order popular authentic dishes from across the country and have them delivered to their doorstep the following day. The restaurant aggregator will pilot the initiative in Gurugram and South Delhi. The online food delivery firm has also decided to narrow its focus on three key areas of food ordering and delivery; supplies to restaurants through ‘Hyperpure’ and quick commerce, Kaushik Dutta, chairman of the company’s board of directors.

Glenmark Pharmaceuticals: The company’s US arm has launched the only-approved fixed-dose combination therapy for seasonal allergic rhinitis in the US market. This Ryaltris nasal spray will be distributed by British drug major Hikma Pharmaceuticals.

Havells: Electrical goods and appliance maker said that it is planning to expand washing machine production capacity at its Rajasthan’s Ghiloth plant, where it will invest Rs 130 crore. This expansion would be financed through internal accruals, said Havells in a regulatory filing.

Inox Leisure: The multiplex operator is confident of pursuing an expansion strategy and has a pipeline of 834 additional screens after FY23, according to the latest annual report of the company. The company, which was operating 692 screens in 73 cities across India as on June 30, 2022, estimates the total screen count to go up to 752 by the end of ongoing fiscal year.

Coffee Day Enterprises: the company said that the debt level has been reduced “significantly” to Rs 1,810 crore as on March 31, according to its latest annual report. However, there have been certain defaults in repayments of principal and interest of the loans and certain lenders have exercised their rights including recalling the loans, Coffee Day Enterprises Ltd (CDEL) said.

NTPC: The PSU has got shareholders’ approval to raise up to Rs 12,000 crore through issuance of non-convertible debentures on private placement basis. The resolution was passed with requisite majority in the annual general meeting held on Tuesday.

SpiceJet: The company announced that it incurred a loss of Rs 458 crore in the January-March quarter (Q4) of FY22 and Rs 789 crore in the April-June quarter (Q1) of FY23 due to high fuel prices, a depreciating rupee, and the third wave of Covid-19. The overall loss incurred by SpiceJet in FY22 was Rs 1,725 crore, 73 per cent more than the previous year. Meanwhile, the carrier said its chief financial officer (CFO), Sanjeev Taneja, has resigned with immediate effect.

Patanjali Foods: The company has laid the foundation stone for an oil palm mill at Industrial Growth Centre, Niglok in East Siang, Arunachal Pradesh, the company said in a release. The food major announced plans to undertake oil palm plantations on 38,000 hectares of land across nine districts in the state.

Cipla: The company and Kemwell India have entered into an “amendment cum assignment agreement”. As per the agreement, the joint venture entity will now be incorporated in the US and there is no other material change in the agreement. The company’s subsidiary Cipla (EU) has agreed to acquire an additional 13.1% stake in Cipla (Jiangsu) Pharmaceutical, a subsidiary of Cipla EU in China.

Sunteck Realty: The company’s subsidiary Clarissa Facility Management has acquired a 10% stake in Rusel Multiventures. With this acquisition, the company plans to leverage facility management expertise to create additional streams of revenue, cost-effectiveness and continous supply of facilities, which will improve its overall effectiveness and productivity.

CreditAccess Grameen: The company through external commercial borrowings with a door-to-door tenure of four years, has entered an arrangement to avail $90 million through a loan syndication arrangement led by HSBC Bank, which acted as lead arranger and book runner. The other lenders in the syndication arrangement include Bank of India, Union Bank of India and UCO Bank.

Inox Wind: The company has received the board approval to raise up to Rs 800 crore through the issuance of non-convertible preference shares to promoters on a private placement basis. The funds raised through the issuance of NCPRPS will be used for repayment of the debt.

Nuvoco Vistas Corporation: The company has announced redemption of NCDs worth Rs 350 crore. The company has made timely payment of redemption amount (principal) and interest for the redeemable, listed, secured and rated non-convertible debentures of Rs 350 crore.