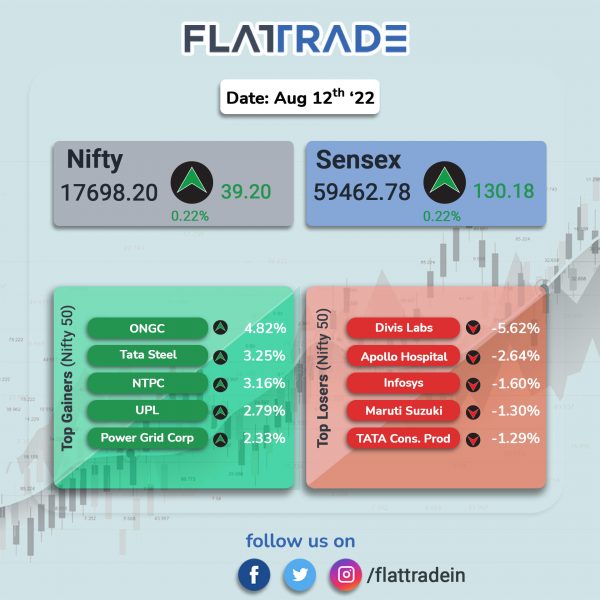

Benchmark indices ended slightly higher in a choppy session ahead of India’s inflation data as losses in IT and Pharma stocks were offset by gains in Oil & Gas, Energy and Metal stocks. The Sensex and the Nifty 50 indices gained 0.22%, each.

The broader market outperformed their larger peers. The S&P BSE MidCap gained 0.15% and S&P BSE SmallCap advanced 0.39%.

Top Nifty sectoral gainers were Ol & Gas [2.25%], Energy [1.88%] and Metal [1.64%]. Top losers were Media [-1.41%], IT [-1.15%] and Pharma [-1.15%]

The Indian rupee fell 2 paise to 79.66 against the US dollar on Friday.

Stock in News Today

Grasim Industries: The company posted 12.7 per cent increase in consolidated net profit at Rs 2,758.75 crore for the quarter ended June 30, 2022. The company had posted a net profit of Rs 2,447.97 crore in the year-ago period. Revenue from operations was up 40.77 per cent at Rs 28,041.54 crore during the quarter under review as against Rs 19,919.40 crore in the year-ago period. Total expenses were at Rs 24,393.95 crore in the reported quarter as against Rs 16,853.28 crore in the year-ago period.

Divis Laboratories: The pharmaceuticals company reported a 26% rise in its consolidated net profit at Rs 702 crore as compared to Rs 557 crore in the same quarter last year. Its revenue from operations rose about 15% to Rs 2,254 crore in Q1FY23 from Rs 1,960.6 crore in Q1FY22. The company’s forex gain in Q1FY23 rose to Rs 56 crore as against the gain of Rs 20 crore in Q1FY22.

Dabur: The company’s chairman, Amit Burman, resigned from his post on August 10. The company said non-executive vice chairman, Mohit Burman, has been appointed as the non-executive chairman of the board of directors of the company, with effect from August 11 for a period of 5 years. Amit will continue to remain the non-executive director of the fast-moving consumer goods (FMCG) company.

Vedanta: The Supreme Court sought a response from the Centre on an appeal of Vedanta against a Delhi High Court verdict related to a production sharing contract (PSC) of Vedanta and the ONGC to produce oil from the Barmer oil field in Rajasthan.

Info Edge: The company posted a standalone net profit of Rs 148 in Q1FY23, up 41% from the same period last year. The company’s standalone revenue was up 54.6% YoY to Rs 507.6 crore in Q1Fy23. The company’s MD and CEO, Hitesh Oberoi, said that its recruitment business continued to grow strongly and showed renewed momentum in the business.

Paytm: The financial services company announced its operating performance update for the month of July 2022. The company’s loan distribution business continued to grow at an annualised run rate of over Rs 25,000 crore in July. Its loan distribution business rose to 2.9 million, witnessing a year-on-year (YoY) growth of 296%. The total merchant GMV processed through Paytm’s platform for July aggregated to approximately Rs 1.06 lakh crore ($13 billion), registering a growth of 82% YoY.

Kolte-Patil Developers: The realty firm has acquired 25 acres of land in Pune to develop a housing project with an estimated sales revenue of Rs 1,400 crore. The company has acquired Pune-based Sampada Realities, which owned this land parcel. Under the deal, Kolte-Patil has acquired a residential development potential of around 2.5 million square feet at Kiwale in Pune. The transaction entails the acquisition of around 85 per cent equity shares in Sampada Realities and the remaining 15 per cent stake is to be acquired in due course.

Fineotex Chemicals: The company reported reported 115 per cent year-on-year (YoY) jump in its consolidated revenue at Rs 135.8 crore in Q1FY23. The company’s consolidated profit after tax rose 110 per cent YoY at Rs 20.3 crore. Ebitda grew 167 per cent YoY at Rs 26.20 crore in Q1FY23.

Greaves Cotton: The engineering company reported a consolidated Profit After Tax (PAT) of Rs 15.94 crore in the April-June quarter of FY23. It had posted a loss of Rs 22.48 crore in the corresponding period of the previous fiscal. Its consolidated net revenue rose more than two-fold to Rs 660.19 crore in the reported quarter from Rs 228.97 crore in Q1FY22.