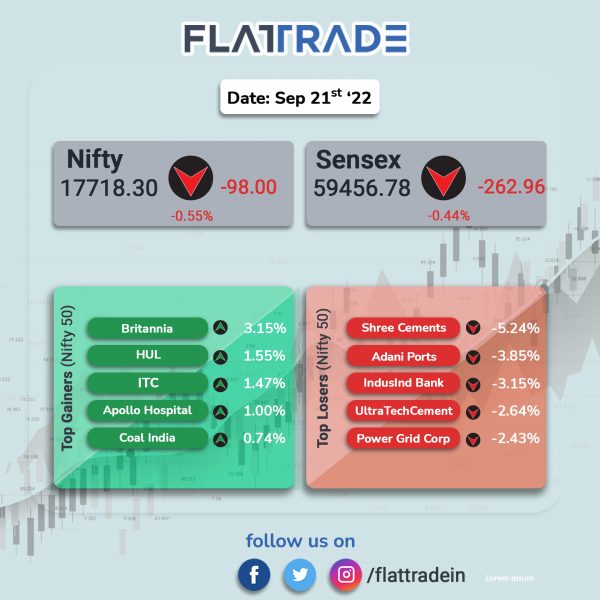

Benchmarks equity indices fell as investors awaited the widely expected interest rate hike by the Federal Reserve. The Sensex fell 0.44% and the Nifty 50 index dropped 0.55%.

In broader markets, the Nifty Midcap 100 index was down 0.74% and the BSE Smallcap lost 0.69%.

Top losers among Nifty sectoral indices were Metal [-2.09%], Energy [-1.49%], Pharma [-1.39%], Realty [-1.29%] and Oil & Gas [-1.17%]. FMCG was the only index that ended in the green with 1.18% gains.

The Indian rupee weakened by 22 paise to 79.97 against the US dollar on Wednesday.

Gold and oil prices soared after Russian President Vladimir Putin announced a partial mobilization and said that the decision has been taken to protect Russia, its people, its sovereignty and territorial integrity. Meanwhile, Russian Defence Minister said that 300,000 reserves will be called up for partial mobilization in Russia.

Brent Crude jumped 2.34% to $92.74 per barrel and WTI Crude soared 2.43% to $ 85.98 per barrel. Spot gold stood at $1675.53 per ounce.

Stock in News Today

Adani Group: The group is planning to foray into steel sector by bidding for the state-owned Rashtriya Ispat Nigam slated for disinvestment in January, according to a report by businessline. Adani Group is expected to be more aggressive than the legacy players such as JSW Steel, Tata Steel and ArcelorMittal Nippon Steel, the report said citing sources.

Tata Consultancy Services (TCS): The IT major has expanded its partnership with Zurich Insurance Germany. TCS will help the insurer modernize, transform and manage the entire application estate supporting its life insurance business; improve, and standardize IT and business processes; accelerate cloud and digital adoption; and drive technical and domain innovation at scale.

KPIT Technologies: The company has approved the acquisition of Technica Germany, Technica Electronics Barcelona, Technica Engineering Spain and Technica Engineering Inc. The cost of acquisition is 80 million euro and the deal is expected to be closed by the end of October 2022. Technica is present in automotive industry and specialises in production-ready system prototyping, automotive ethernet products and tools for validation. Shares of the company rose 4.96% in an otherwise weak market.

C.E. Info Systems (MapmyIndia): The company said that it has acquired 26.37% stake in Kogo Tech Labs, a cutting-edge startup aiming to build the world’s largest travel & hyper local discovery, recommendations, commerce, social and gamified platform, for $1.25 million (~Rs 10 crore), with option to raise its stake to 50% in two years.

K E C International: The company has secured new orders worth Rs 1,123 crore across its various businesses that includes transmission and distribution, railway, civil and cable businesses.

TVS Motor Company: The two-wheeler maker has announced the launch of TVS Apache 160 2V with ABS (Anti-lock Braking System) in Bangladesh. The new generation of TVS Apache RTR series motorcycles has been developed with a special algorithm, extensively derived out of the racing track. This new technology will enable the rider to find the quickest line around the corner without losing any speed.

RateGain Travel Technologies: The company said that it has been selected by Sonder Holdings, a leading next-generation hospitality company. Sonder has connected with RateGain’s Connectivity Switch Platform introducing its own dedicated chain code ‘SS’. With this, it will be faster and easier for agents to search for Sonder availability on industry leading travel reservation systems.

Info Edge: The company plans to invest Rs 80 crore in e-learning startup Adda247. Adda247 is run by Metis Eduventures and post the investment, Info Edge will hold a 23.01% stake in Adda247.

JMC Projects (India): The company’s board has approved fund raising up to Rs 200 crore by way of issue of listed, rated, secured/unsecured, redeemable non-convertible debentures (NCDs) of the company on private placement basis, in one or more tranches.

Aster DM Healthcare: The company has announced its entry into the Bangladesh market with Aster Pharmacy division and the pharmacy will be operated by GD Assist. With this franchise agreement, Aster DM Healthcare and GD Assist aim to bring Aster Pharmacy’s quality care products across various segments to Bangladesh.

Gateway Distriparks: Shares of the company rose over 8% in intraday trading after the company said it has completed the purchase of land near Jaipur and will commence construction of a new rail-linked inland container depot (ICD). This will be the company’s fifth ICD besides five container freight stations. The company has spent Rs 27 crore for the land acquisition and will spend Rs 50 crore further to develop the ICD.

Triveni Engineering and Triveni Turbine: Triveni Engineering will sell 11.85% stake in Triveni Turbine via block deal, according to a report by Moneycontrol.com. The company aims to raise Rs 875 crore via the deal. Shares of Triveni Engineering and Triveni Turbine jumped 5.9% and 8.7%, respectively, in intraday trading.

Intellect Design Arena: The company said that Cathay United Bank has chosen to implement its digital credit platform ‘iKredit 360’ to power the next growth stage of the bank. With iKredit360, Cathay United Bank will provide curated credit products across all business segments including Retail and SME, enhanced customer experience, increasing customer lifetime value and mitigate risks with a real-time 360 degree customer view.

JMC Projects (India): In an exchange filing, the company said that the board has approved raising of funds up to Rs 200 crore by way of issue of listed, rated, secured/unsecured, redeemable non-convertible debentures (NCDs) on private placement basis, in one or more tranches. The board further authorized the management committee of directors to take necessary steps in this regard, including finalization of the terms of issuance of NCDs.

Aurionpro Solutions: The company said it has bagged an order from one of the dominant public sectors banks in India to upgrade the bank’s Murex version from older to newer version. Murex is a treasury platform at the bank and the implementation will be spread over 18 months.