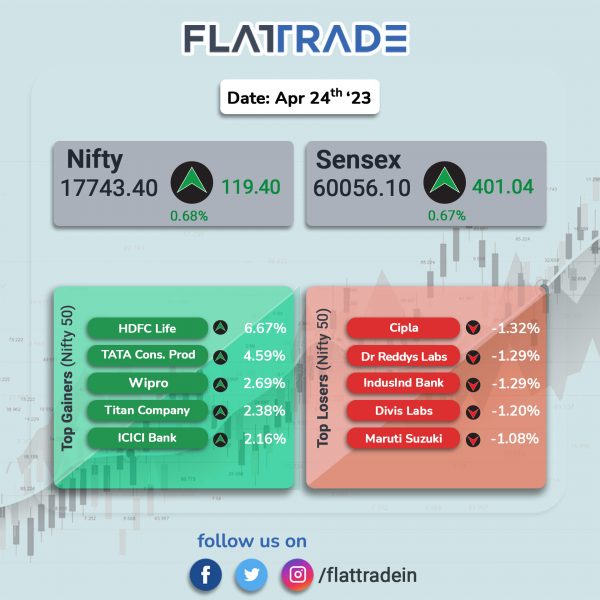

Benchmark equity indices ended higher, aided by gains in banking and technology stocks. The Sensex rose 0.67% and the Nifty gained 0.68%.

In broader markets, the Nifty Midcap 100 index rose 0.39% and the BSE Smallcap advanced 0.34%.

Top gainers were PSU Bank [2.61%], Financial Services [1.28%], Bank [1.23%], Private Bank [1.23%], Private Bank [1.1%], and Realty [1.06%]. Top losers were Media [-1.31%] and Pharma [-0.73%].

Indian rupee rose 18 paise to 81.90 against the US dollar on Monday.

Stock in News Today

IndusInd Bank: The private sector lender’s net profit for the quarter rose to Rs 2,043.36 crore, up 46% from Rs 1,400.52 crore in the year-ago period. Net interest income for the bank rose 17% year-on-year to Rs 4,669.46 crore. Total advances rose 21% year-on-year to Rs 2.9 lakh crore and the bank’s total deposits rose to Rs 3.36 lakh crore, up 15% year-on-year. Gross NPA ratio for the quarter fell 8 bps QoQ to 1.98% and net NPA ratio fell 3 bps quarter-on-quarter to 0.59%.

Wipro: The company announced that its board will meet on 26th and 27th of April 2023 to consider a proposal to buyback equity shares of the company. During that same period, the board will also consider and approve the audited standalone and consolidated financial results of the company for the quarter and year ended 31 March 2023.

Adani Ports and Special Economic Zone (APSEZ): The company commenced the cash tender offer to purchase up to $130 million in aggregate principal amount of the outstanding 3.375% senior notes due 2024. The purpose of the offer is to partly prepay the company’s near-term debt maturities and to convey comfortable liquidity position. After the completion of the transaction, it expects $520 million notes to remain outstanding.

Bharti Airtel: The telco has partnered with Secure Meters to deploy Narrow Band (NB-IoT) services that will power 1.3 million homes in Bihar through a smart meter solution. This will be India’s first NB-IoT service with a fall-back option of 2G and 4G to ensure continuous connectivity.

Union Bank of India: The lender said that its board will meet on Wednesday [26 April 2023] to consider raising funds through further public offer (FPO) /rights issue/private placements including qualified institutions placement / preferential allotment. The board will consider the issue of Basel III compliant additional tier 1 bonds and tier 2 bonds, including foreign currency denominated AT1/Tier 2 bonds, through private placements, subject to regulatory approval.

IIFL Finance: In an exchange filing, the Mumbai-based NBFC announced that it has fully repaid its maiden $400 million bonds issue on maturity this month. The NBFC had raised $400 million through a medium-term note (MTN) program in February 2020. Earlier this month, IIFL Finance also secured $100 million in long-term funding, jointly, from Export Development Canada (EDC) and Deutsche Bank.

Zydus Lifesciences: The drug maker said it has received final approval from the USFDA for Icosapent Ethyl capsules. Icosapent Ethyl capsules are indicated as an adjunct to diet to reduce triglyceride (TG) levels in adult patients with severe (≥500 mg/dL) hypertriglyceridemia. The annual sales stood at $1,316 million in the United States, according to IQVIA MAT February 2023.

Torrent Power: The company said that it has incorporated a wholly owned subsidiary named Torrent Urja 10 (TU10). Torrent Power incorporated the wholly owned subsidiary with a share capital of Rs 1 lakh. The purpose of the new firm is to carry out the business of generation, transmission, distribution, purchase, procurement, sale, trading, import, export or otherwise deal in all forms of electrical power and energy including non-conventional and renewable sources of energy.

Sun Pharmaceutical Industries: The drugmaker said that the US drug regulator has directed the company to take certain corrective actions at the Mohali facility before releasing further final product batches into US. The actions include, among others, retaining an independent certified good manufacturing practices (CGMP) expert to conduct batch certifications of drugs manufactured at the Mohali facility. The pharma major said that it is taking required corrective steps, but there will be a temporary pause in release of batches from Mohali until US food & drug regulator mandated measures are implemented.

Vedanta Ltd.: The company said Vedanta Resources reduced its gross debt from $7.8 billion to $6.8 billion. Vedanta Resources paid all its maturing loans and bonds due in April 2023. As per the filing, the company achieved 75% of its committed reduction of $4 billion in 14 months.

Maharashtra Seamless: The company received orders from Oil and Natural Gas Corporation (ONGC) with basic value of Rs 262 crore for supply of seamless tubing pipes. The scope of order includes supply of seamless tubing pipes to various locations including Gujarat, Rajasthan, West Bengal, Assam and Tripura as required by ONGC. The order will be dispatched gradually over a period of 42 weeks.

C.E. Info Systems (MapMyIndia): The company reported a 25% increase in net profit to Rs 28 crore on a 27% rise in revenue from operations to Rs 73 crore in Q4FY23 over Q4 FY22. EBITDA rose by 26% YoY to Rs 29 crore, EBITDA margin fell by 100 bps YoY to 40% during the period under review. MapmyIndia’s board has also approved a dividend of Rs 3 per equity share for FY23, subject to the approval of shareholders.

Gujarat Pipavav Port: The company said that its board has approved the capital expenditure for setting up a new liquid berth at Pipavav Port at an estimated cost of about $90 million. Gujarat Pipavav Port has been operating the Pipavav port in Saurashtra, Gujarat.

Tamilnad Mercantile Bank: The lender’s net profit jumped 11.45% to Rs 253.05 crore in Q4FY23 as against Rs 226.95 crore in Q4FY22. Total income grew 4.44% to Rs 1,254 crore in Q4 FY23 as compared with Rs 1,200.66 crore in Q4FY22. Net interest income increased by 7.99% YoY to Rs 527 crore in the quarter ended March 2023. Net interest margin stood at 4.49% in Q4FY23 as against 4.40% posted in Q4FY22. Net NPA ratio stood at 0.62% during the reported quarter as against 0.95% in the corresponding quarter last fiscal.

Macrotech Developers (Lodha): The realty firm said that the real estate developer’s consolidated net profit jumped 39% YoY to Rs 744.36 crore despite a 5.5% YoY decline in net sales to Rs 3,255.38 crore in Q4FY23. Collections increased 3% YoY at Rs 2,933 crore in Q4 FY23. Adjusted EBITDA stood at Rs 977 crore, sliding 20.5% YoY in Q4FY23. Adjusted EBITDA margin declined to 30% in Q4FY23 as against 35.7% posted in Q4FY22. Macrotech also announced a bonus issue of equity shares to investors in the proportion of 1:1.

Sunteck Realty: The realty firm announced that it has recorded 6.76% YoY increase in pre sales to Rs 537 crore in Q4FY23. Pre sales jumped 36% last quarter from Rs 396 crore recorded in Q3FY23. Collections stood at Rs 330 crore in Q4FY23, down 18.32% YoY. On a full year basis, pre sales stood at Rs 1,602 crore in FY23, registering the growth of 23% against Rs 1,303 crore in FY22. Collections jumped 19% YoY to Rs 1,250 in FY23. Additionally, collections efficiency for FY23 stood at 78%.

Ami Organics: The company’s board has approved the acquisition of a 55% partnership interest in Baba Fine Chemicals (BFC) from two partners Ram Bilas Sharma and Kavita Bhatia, for a total consideration of Rs 68.21 crore. The acquisition is in line with AMI Organics’ strategy of expanding its speciality chemicals division to focus on niche products manufactured using advanced technology with low competition and high entry barriers. The acquisition is expected to be completed within six months from the date of approval.

Dalmia Bharat: The company said that its wholly owned subsidiary, Dalmia Cement (Bharat) (DCBL), has commenced production at its second cement line at Bokaro, Jharkhand Cement Works (JCW2), with capacity of 2.5 million tonnes. With this addition, the total cement capacity of DCBL and its subsidiaries has increased to 41.1 million tonnes.

Ajmera Realty & Infra India (ARIIL): The company said its wholly owned subsidiary, Shree Yogi Realcon, has acquired a land parcel of 5,017 square meter for Rs 76 crore from Tata Communications located at Vikhroli, Mumbai. The acquisition is intended for the residential development offering 1/2/3 BHK, with an estimated gross sales value of Rs 550 crore. The land acquisition marks the first step in the project indicating a potential launch of this project in FY 2024, said the company.

Raymond: The company’s board has approved the appointment of K. Narasimha Murthy as an additional director categorised as independent director for a period of five years with effective from 21 April 2023.

Bank Of Maharashtra: The lender said its net interest income was up 35% YoY at Rs 2,187.22 crore in Q4FY23. Net profit rose 136% YoY to Rs 840.511 crore in Q4FY23. Gross NPA stood at 2.47% compared to 2.94% in the third quarter of FY23.

Shree Digvijay Cement Company: The company announced the receipt of environmental clearance (EC) from the Ministry of Environment, Forest and Climate Change for raising the capacities of its existing facilities. The Environment Ministry has granted EC to the company for the expansion of its cement plant (1.20 MTPA to 3.00 MTPA) and clinker (1.10 MTPA to 2.21 MTPA) with 8.5 MW waste heat recovery system (WHRS). Shree Digvijay Cement Company manufactures cement at the coastal township of Digvijaygram (Sikka) in Jamnagar District of Gujarat that has installed capacity of 1.2 MTPA.

Century Textiles & Industries: The company said that it subsidiary, Birla Estates, has acquired prime land parcel in South Mumbai’s upmarket residential area of Walkeshwar at Malabar Hill. The luxury project will hold a revenue potential of over Rs 600 crore.