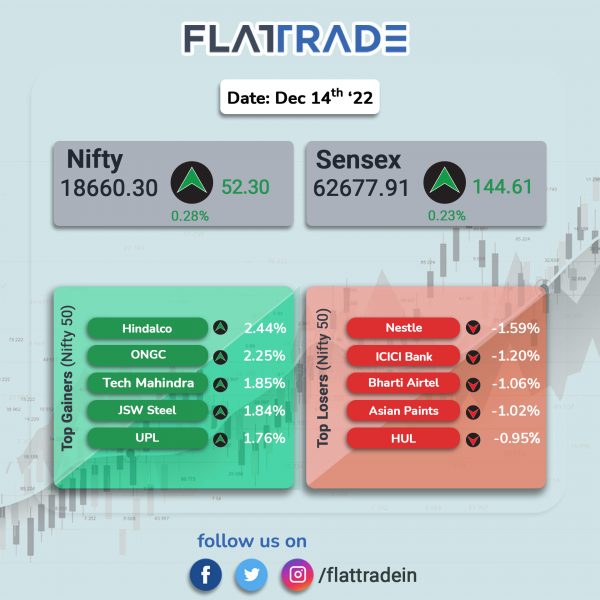

Domestic equity benchmarks ended higher, aided by gains in realty, metal and IT stocks. The Nifty traded above the 18,650-mark. The Sensex rose 0.23% and the Nifty 50 index advanced 0.28%

In broader markets, the Nifty Midcap 100 index rose 0.6% and the BSE Smallcap was up 0.68%.

Top gainers among Nifty sectoral indices were Realty [1.45%], Metal [1.25%], IT [1.15%], Media [1.05%] and Pharma [0.67%]. Top loser was FMCG [-0.43%].

Indian rupee gained 35 paise to close at 82.46 against the US dollar on Wednesday.

India’s wholesale inflation measured by the wholesale price index (WPI) declined to a 21-month low of 5.85% in November 2022, from 8.39% in October and and 14.87% in November 2021, data released by the Ministry of Commerce & Industry showed. The WPI remained below the double-digit mark for the second straight month.

Asian Development Bank (ADB) has kept its outlook for India’s economic growth unchanged at 7% percent for FY23. However, the growth rate is lower compared to 8.7% GDP growth in FY22. For FY24, the GDP growth has been kept unchanged at 7.2%.

Stock in News Today

Mahindra & Mahindra (M&M): The automaker plans to invest Rs 10,000 crore over 7-8 years for an electric vehicles manufacturing plant in Pune. The investment proposal has been approved under Maharashtra Government’s industrial promotion scheme.

State Bank of India (SBI): India’s largest lender has scaled a new 52-week high of Rs 626.75 in intraday trade on Wednesday. The shares opened at Rs 618.5 apiece continued with its upward momentum during the session. Shares closed at Rs 625.50.

HDFC Bank: The lender plans to buy a minority stake of 7.75% stake in fintech startup Mintoak Innovations for Rs 31.14 crore. Mintoak operates a payments-led platform in India, Kuwait and Mauritius. The deal transaction is expected to be completed by the end of January 2023.

Bharti Airtel: The telecom firm has announced the launch of its cutting edge 5G services in Lucknow. Airtel 5G Plus services will be available to customers in a phased manner as the company continues to construct its network and complete the roll out.

Coal India: The company has issued Letters Of Acceptance (LoAs) for seven coal projects to be pursued through the mine developers and operators (MDOs) model . The projects have a production capacity of close to 100 million tonne per year cumulatively. Coal India is tracking 15 greenfield coal projects through MDOs and its investment in MDO projects is estimated at Rs 20,600 crore.

IDBI Bank: The government has extended the deadline to submit expressions of interest for a stake in IDBI Bank to January 7. Earlier, the deadline was December 16.

Tata Communications: The company will transfer its non-network internet of things business comprising of device, application, platform and managed services components to its subsidiary, Tata Communications Collaboration Services Pvt. on ‘slump sale’ basis. The company expects to mop up Rs 42.34 crore from the said sale.

GMR Airports Infrastructure: The company’s step-down subsidiary, GMR Hyderabad International Airport Limited (GHIAL), said that it has successfully raised funds through the issuance of 10 year listed, rated, redeemable, secured, non-convertible debentures (NCDs) amounting to Rs 11.50 billion, on private placement basis. The NCDs will be listed on BSE and it has been priced at an interest rate of 8.805 % per annum payable quarterly for an initial period of 5 years and thereafter interest rate will be reset for next 5 years. The proceeds from the NCDs will be utilized for partial refinancing of US$ 140 million of the existing ECB Bonds of 2024 and 2026.

Apollo Hospitals Enterprise: The company said that it will raise Rs 105 crore by allotting non-convertible debentures (NCDs) to ICICI Bank on private placement basis. The company’s committee of directors approved the allotment of 1,050 senior, unsecured, redeemable, rated, listed, non-convertible debentures having face value Rs 10 lakh each, aggregating to Rs 105 crore, subject to terms and conditions. The NCDs are likely to be listed on the Wholesale Debt Market (WDM) Segment of NSE.

NTPC: The company will issue NCDs worth Rs 500 crore on private placement at a rate of 7.44% annually. The maturity for these NCDs is April 2033. The proceeds will be utilized for funding capital expenditure, refinancing of existing loans and other general corporate purposes.

Jubilant Pharmova: The company received eight observations from the USFDA after an inspection of the company’s API manufacturing facility at Nanjangud, Karnataka. The company said it will submit an action plan on the observations issued by the USFDA.

Heads UP Ventures: Shares of the company hit an upper circuit limit of 20% after the company said it will sell its products under the brand name “HUP” on Reliance Retail’s e-commerce platform. Heads UP Ventures has entered into a contract with Reliance Retail, for sale of fashion apparels, accessories, bags, footwear etc. under the brand name “HUP”.

H.G. Infra Engineering: The company has has been declared as the L1 bidder by the National Highways Authority of India for Hybrid Annuity Mode Project. The 34.5 km long, 6-lane ‘Greenfield Karnal Ring Road’ project will be carried out in Karnal district, Haryana. The estimated cost of the project is Rs 743.74 crore.

Welspun Corp: The company has received the possession of moveable properties (partially built obsolete ships, metal and scrap) from the Liquidator of ABG Shipyard Limited . Further, the company’s wholly owned subsidiary, Nauyaan Shipyard, has received the possession of immovable property at Dahej, Gujarat from the Liquidator. With respect to the leasehold lands at Dahej Gujarat, the Liquidator (along with Nauyaan) are in the process of taking necessary steps with Gujarat Industrial Development Corporation and Gujarat Maritime Board for completion of substitution/ transfer formalities.

Lloyds Metals and Energy: The company’ shares advanced in intraday trade after the Maharashtra Government approved an investment of Rs 19,700 crore by the company in the Gadchiroli District of Maharashtra. The cabinet sub-committee approved two investment proposals by Lloyds Metals and Energy of Rs 14,000 crore and Rs 5,700 crore for Gadchiroli. The investments are likley for the establishment of a steel manufacturing project through mineral extraction & processing in the district.

Bank of Maharashtra: Shares of the lender surged 8.12% in intraday trade after the bank announced an increase in marginal cost of funds based lending rate (MCLR) by 20-30 basis points across different tenors, effective from 14 December 2022. The overnight MCLR increased from 7.30% to 7.50%; MCLR for one month rose from 7.50% to 7.70%; interest rate on the three month MCLR was raised from 7.60% to 7.90%; six month MCLR rate increased from 7.70% to 8.00%; one year MCLR rate was raised from 7.90% to 8.20%.

Equitas Small Finance Bank: The lender announced the revised interest rates for savings, fixed deposits as well as recurring deposits in Domestic and NRE/ NRO customers. The hike in interest rates will be effective from 14 December 2022. The hike will allow savings account customers to gain 7% interest who have a closing balance above Rs. 5 crore up to Rs. 30 crore. There is also an increase in interest rates on fixed deposits and recurring deposits with the peak rate being at 8% and 7.75%, respectively. Further, domestic senior citizens will receive 0.50% extra on FD and RD rates. The interest payouts will continue to be quarterly across all account types.