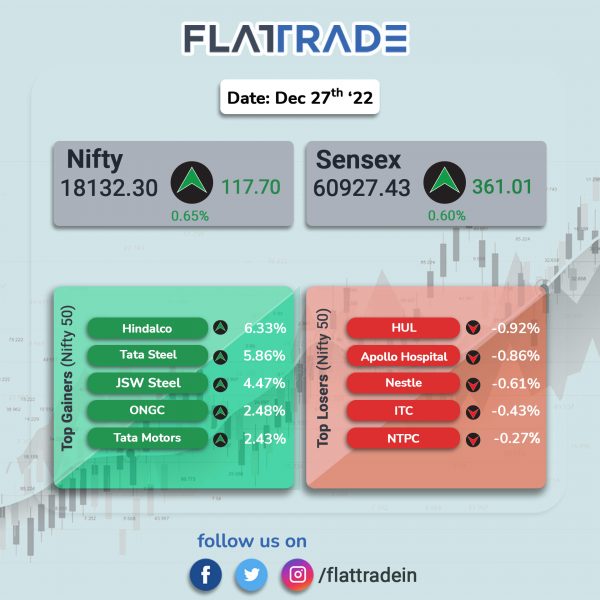

Dalal Street ended in the green, helped by gains in metal, public sector bank (PSB), realty and energy stocks amid investor optimism. The Sensex rose 0.6% and the Nifty 50 index advanced 0.65%.

In broader markets, Nifty Midcap 100 index jumped 0.99% and the BSE Smallcap was up 1.46%.

Top gainers among Nifty sectoral indices were Metal [4.23%], PSU Bank [1.29%], Realty [1.25%], Media [1.19%] and Oil & Gas [1.01%]. Nifty FMCG index fell 0.41%.

Indian rupee rose 20 paise to 82.85 against the US dollar on Tuesday.

Stock in News Today

Larsen & Toubro (L&T): The company said that the Power Transmission & Distribution Business of L&T Construction has secured multiple EPC orders in India and overseas. The renewables arm of the business has received an EPC order to establish a 90MW Floating Solar PV Plant at the Omkareshwar dam reservoir, a large water body without much change in the water level throughout the year, in the Khandwa district of Madhya Pradesh. This water body is emerging as one of the largest floating solar parks in the world.

Central Bank of India (CBI): The lender’s board approved acquiring full stake in Cent Bank Home Finance. The bank will acquire the remaining 35.60% stake from the existing shareholders namely National Housing Bank, Specified Undertaking of Unit Trust of India (SUUTl) and HUDCO subject to regulatory approvals.

Indian Energy Exchange (IEX): The company announced that it has incorporated a wholly-owned subsidiary, International Carbon Exchange (ICX) to explore business opportunities in the voluntary carbon market. IEX formed a new subsidiary with an authorized share capital of Rs 10 crore and paid-up share capital of Rs 5 crore each. International Carbon Exchange has been incorporated to establish and operate a platform for the trading of various types of green products including all other forms/types of carbon credits and certificates and various emission reduction products and other instruments and derivatives thereof, in ready, forward and futures markets in India and international markets, IEX said.

Bank of Maharashtra (BoM): The lender said that it has raised Rs 880 crore through allotment of Basel-III Compliant Additional Tier-1 (AT1) bonds to nine allottees upon receipt of application money. The bank said that these bonds will be listed on the wholesale debt market segment of the BSE.

Khadim India: The company said that said that its chief executive officer (CEO) Namrata Ashok Chotrani tendered her resignation. The resignation will be effective from the close of business hours on 23 March 2023.

NBCC (India): The company has secured orders for construction of new multi-storied quarter complex consisting of 100 units of quarters by demolishing the existing 224 units quarters at Bhoinager, Bhubaneswar, by Odisha Power Transmission Corporation (OPTCL) for a total value of Rs. 69.3 crore.

Capacite Infraprojects: The company company secured a construction order worth Rs 695 crore from Saifee Burhani Upliftment Trust (SBUT). The order is for construction of core and shell work at Bhendi Bazaar in Mumbai.

Aurobindo Pharma: The company announced that Subject Expert Committee (SEC) of the Central Drugs Standard Control Organization (CDSCO)has recommended grant of permission to its JV company Tergene to manufacture and market 15-valent Pneumococcal Polysaccharide Conjugate vaccine. Aurobindo Pharma holds 80% stake in the Joint Venture company, Tergene Biotech Pvt. Ltd.

Laurus Labs: The company said that a flash fire occurred in one of the rooms in one manufacturing block of its API manufacturing plant (Unit 3), Jawaharlal Nehru Pharma City, Parawada, Anakapally district, Visakhapatnam, Andhra Pradesh. It said the operations in the other production blocks are running normally. Further, it said the company’s two regular employees and two contract employees lost their lives after reaching hospital. One regular employee is in hospital and undergoing treatment. In an excahnge filing, the company said that it estimates no material impact on the operations.

Manappuram Finance: The NBFC is considering various options for raising funds through borrowings including by the way of issuance of various debt securities in onshore / offshore securities market by Public Issue, on Private Placement Basis or through issuing Commercial Papers. The company’s board shall consider the approval of issuances of debt securities in January 2023, subject to terms and conditions, and prevailing market conditions.

IRB InvIT Fund: The company announced that toll collection on IRB Pathankot Amritsar Toll Road, one of the Project SPVs of IRB InvIT Fund (Trust) has been temporarily suspended due to farmers’ agitation in Punjab. The Project SPV has taken necessary steps within ambit of the concession agreement to protect the interest of the Trust.

HEG: The company has incorporated a wholly owned subsidiary, TACC, which would manufacture graphite anode for Lithium-ion cells. The company plans to spend about Rs 2000 crore to complete the plant in two phases over a period of 5-7 years. The plant would catering to a total of 20-22 MWH of cell manufacturing capacity.

NIBE: Shares of the company hit an upper circuit of 5% after the company said its board will consider raising funds on December 31 2022. The company’s board will a proposal for fund raising by way of issue of equity shares/convertible warrants and/or any other instruments through preferential issue on a private placement basis, the company said in exchange filing.

Premco Global: The company announced that its subsidiary — Premco Global Vietnam Co (PGVCL) — has received revised investment licence from Government of Vietnam resulting in transformation of PGVCL from limited liability company with two members to one member limited liability.

Lemon Tree Hotels: The hospitality company has signed a franchise agreement for a 32-room property in Dehradun under the brand ‘Keys Lite by Lemon Tree Hotels’. The hotel is expected to be operational by December 2023.