Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.46% lower at 18,065, signalling that Dalal Street was headed for a negative start on Wednesday.

Most Asian equities were trading lower as investors were concerned over inflation amid China taking further measures to reopen their economy which was affected by Covid-19. Japan’s Nikkei 225 index fell 0.59% and TOpix was down 0.28%. The Hang Seng index jumped 2.18% and the CSI 300 index fell 0.40%.

Indian rupee rose 20 paise to 82.85 against the US dollar on Tuesday.

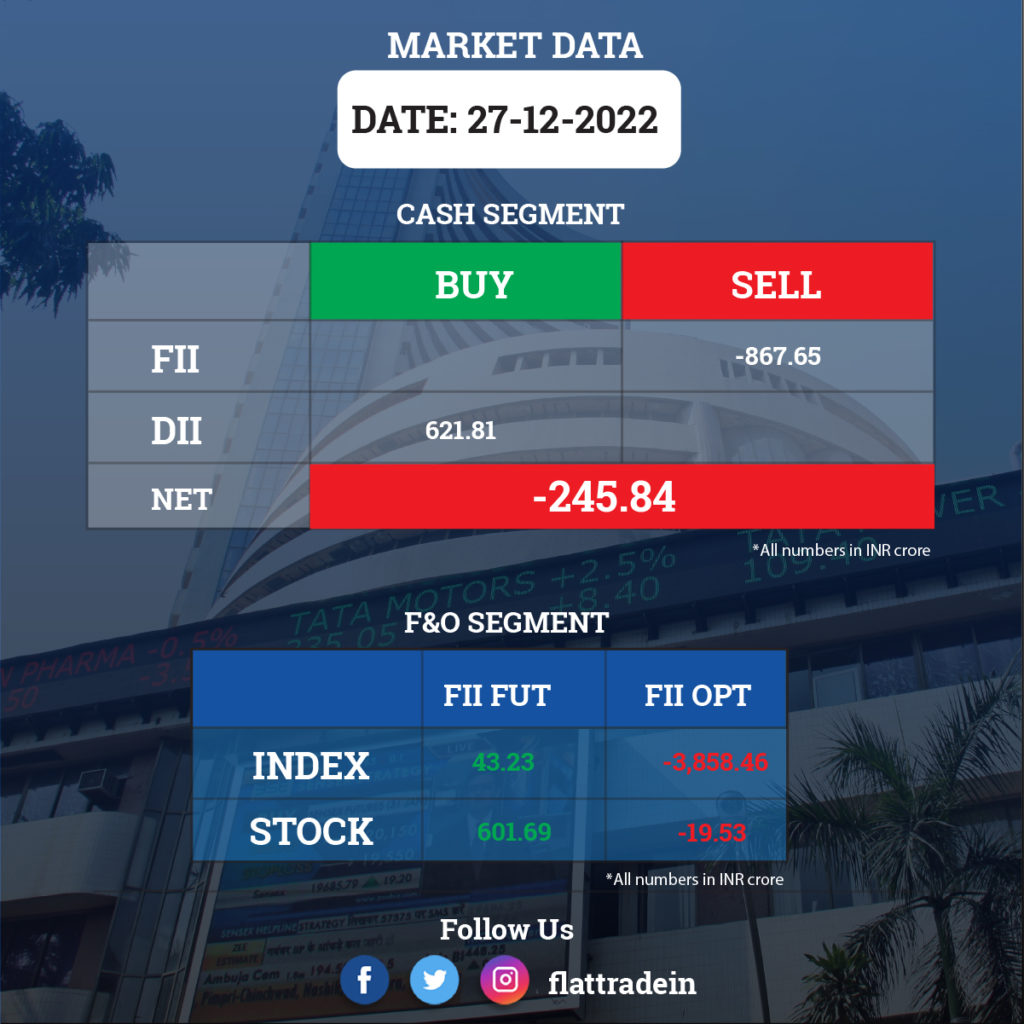

FII/DII Trading Data

Stocks in News Today

Reliance Jio: The telecom company has announced a partnership with Xiaomi India enabling Xiaomi and Redmi smartphone users to access seamless 5G connectivity. Smartphone models supporting Reliance Jio’s standalone (SA) network have received software updates to work seamlessly on Reliance Jio’s True 5G SA network, Reliance Jio said. Customers can use Reliance Jio’s True 5G service for connectivity and stream uninterrupted videos, enjoy high-resolution video calls, and play low-latency gaming.

Religare Enterprises: The company’s debt-ridden subsidiary Religare Finvest Ltd is planning to restart its business operation in 2023 following the company’s proposal of Rs 2,300 crore one time settlement (OTS) finding favour from most of the lenders. Once the OTS process is completed, Religare Finvest will come out of the corrective action plan imposed by the Reserve Bank of India in January 2018 due to its weak financial health.

Rail Vikas Nigam: The company has received letter of award for appointment as project implementation agency for implementation of the UTF harbor project in Maldives. This is a strategic project of government and the project cost is Rs 1,544.60 crore.

Hariom Pipe Industries: The company will acquire operating assets of RP Metal Sections. It has entered into asset transfer agreement with RP Metal Sections, the galvanized pipe and cold roll coil manufacturer, to purchase its operating asset. This unit is spread across 13.83 acres of land in Perundurai, Tamilnadu. The transaction cost is Rs 55 crore.

MOIL: Government of India has appointed Ajit Kumar Saxena as chairman and managing director of the mining company till 2025. Currently, Usha Singh is holding the position as an additional charge.

India Pesticides: Subsidiary Shalvis Specialities (SSL) has received an environmental clearance for setting up manufacturing plant of “agrochemicals & intermediates, API ingredients & intermediates and fine chemicals manufacturing unit in Sumerpur, Uttar Pradesh.

Kwality Pharmaceuticals: The company has received an acknowledgement from Bulgarian Drug Agency for carrying out an inspection of its cephalosporin and oncology plant in Himachal Pradesh. The company had made an EU Compliance application to Republic of Bulgaria for carrying out an inspection of Unit II in Himachal Pradesh, and Republic of Bulgaria accepted the application for EU Audit visit.

Indowind Energy: The wind turbine manufacturer has decided to open its rights issue on January 27, till February 10, 2023. The rights entitlement ratio is in the proportion 2 shares for every five shares held by eligible equity shares. The rights issue price has been fixed at Rs 12 per share.

Suryoday Small Finance Bank: The Reserve Bank of India has approved the reappointment of Baskar Babu Ramachandran as the MD & CEO of Suryoday Small Finance Bank. He will be MD & CEO for another three years, with effect from January 23, 2023.

Punjab & Sind Bank: The board will meet on Friday to consider and approve raising Rs 250 crore through equity and debt instruments. As on September 30, the public sector lender’s capital adequacy ratio was 15.68%.

IndoStar Capital Finance: The company has appointed Vinod Kumar Panicker as chief financial officer effective Monday. Prior to joining the company, Panicker was the CFO of Muthoot Capital Services for 9 years.

Sikko Industries: Shares of the company will trade ex-dividend for its interim dividend of Rs 0.15 per share. The company’s shares ended higher by over 2% at Rs 104.85 per share on Tuesday.

Advait Infratech: Shares of the company will trade ex-bonus as the company has received in-principle approval from the BSE for the proposed allotment of bonus equity shares in the ratio of 1:1.

Capri Global: The company’s board will meet to consider and decide the quantum as well as pricing of rights issue of shares.