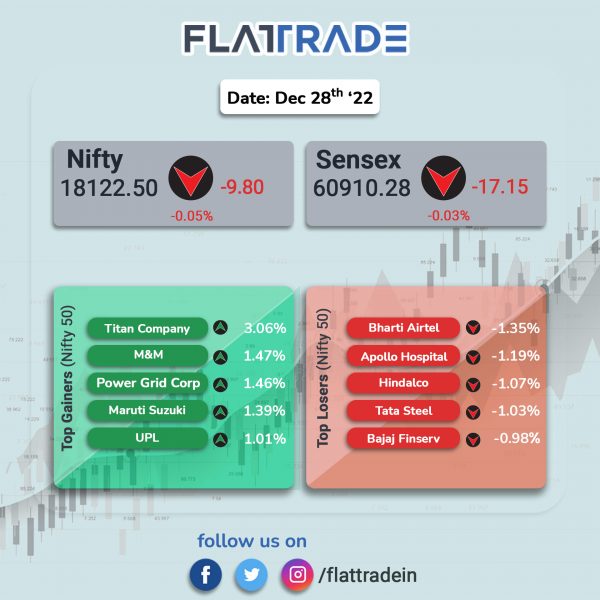

Benchmark indices closed nearly flat, tracking Asian peers, in a volatile session amid mixed global cues. The Sensex slipped 0.03% an the Nifty 50 index inched down 0.05%.

In broader markets, Nifty Midcap 100 index rose 0.13% and the BSE Smallcap advanced 0.45%.

Top gainers among Nifty sectoral indices were Oil & Gas [1.26%], Auto [0.66%], Media [0.62%], Realty [0.49%] and Energy [0.33%]. Top losers were Pharma [-0.56%], Metal [-0.27%], Infrastructure [-0.19%], IT [-0.18%] and Financial Services [-0.15%].

Indian rupee was little changed at 82.85 against the US dollar on Wednesday.

Stock in News Today

Adani Enterprises: The company said it has acquired 100% stake of SIBIA Analytics and Consulting Services (SIBIA) for Rs 14.80 crore. The acquisition is strategic in nature and will help Adani Group to enhance its artificial learning (AI) and machine learning (ML) capabilities. Its revenue for financial year 2021-2022 was Rs 1.34 crore.

Adani Transmission: The company said that it has incorporated a wholly owned subsidiary, BEST Smart Metering (BSML), with an initial authorised and paid-up share capital of Rs 1 lakh each. The power transmission company said that it has incorporated BSML for smart metering business. BSML is registered with the Registrar of Companies, Gujarat at Ahmedabad.

Aditya Birla Capital: The company announced that its board has approved the appointment of Sanchita Mustauphy, as the chief risk officer (CRO) of the company for five years. The current chief compliance and risk officer, A. Dhananjaya’s superannuation is due on 31 March 2023.

Dilip Buildcon: The company has incorporated a new SPV and wholly owned subsidiary named “Maradgi S Andola-Baswantpur Highways” for undertaking a project for development of six lane access controlled greenfield highway from Maradgli S Andola to Baswantpur section of NH-150C on hybrid annuity mode under Bharatmala Pariyojna. The company said the project cost stood at Rs 1,589 crore and construction period of the project is 30 months and operation period is 15 years from commercial operation date (COD).

Chalet Hotels: Shares of the company rose after a foreign broker initiated ‘buy’ rating on the stock with a price target of Rs 455 per share. The foreign broker reportedly said that CHL is best placed to ride industry upcycle. It has strategically located metro centric hotel portfolio with requisite pricing power amid affiliation with marquee global brands. The broker expects the company to register a revenue of 19% CAGR and profit of 68% CAGR over FY23-25.

IDBI Bank: The private lender announced that its board has approved the re-appointment of Suresh Kishinchand Khatanhar as deputy managing director (DMD) on the board of the bank for a period of one year with effect from 15 January 2023. The necessary approval from the Reserve Bank of India was received by the bank.

Strides Pharma Science: The company’s biologics arm, Stelis Biopharma, announced that its Contract Development and Manufacturing Organization (CDMO) partner has received approval for a key ANDA from the US drug regulator. Stelis will manufacture and commercially supply the product to its CDMO partner from its facility in Bengaluru, India.

Hester Biosciences: The company announced the acquisition of technology from ICAR – NIHSAD to develop a low pathogenic avian influenza (H9N2 strain) inactivated vaccine for poultry. The plans to launch this vaccine by the end of 2023 after completing the required field studies and obtaining regulatory approvals. Hester intends to export this vaccine to African and Asian countries through Hester’s own distribution network.

Birlasoft: The company has strengthened its relationship with Best Value Chem, a leading manufacturer of fragrance and flavour ingredients in India, by leveraging RISE with SAP to transform its digital landscape on the cloud. With this development, Best Value Chem achieved scalability, agility, flexibility and productivity in their daily operations and business performance. The entire migration was completed within five months.

Shriram Finance: The company said that the board is considering to raise funds via issuance of NCDs, including bonds in onshore/offshore market on private placement basis..

India Pesticides: The company’s subsidiary Shalvis Specialties received environmental clearance for setting up manufacturing plant of agrochemicals and intermediates, API ingredients and intermediates, and fine chemicals manufacturing unit in Hamirpur, Uttar Pradesh.