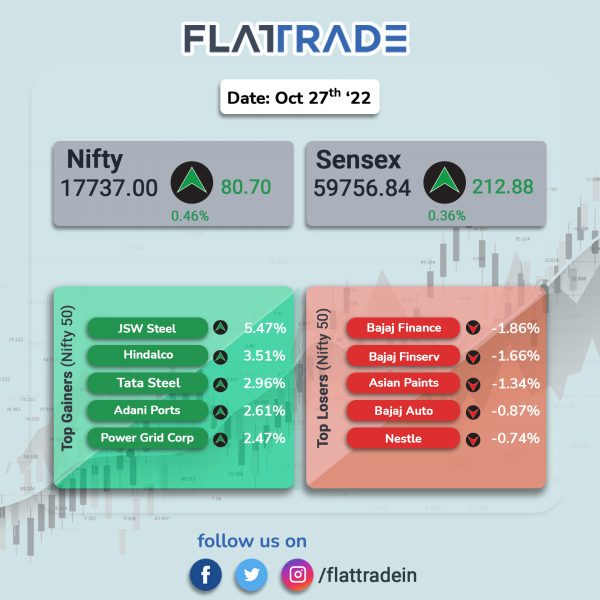

Benchmark equity indices ended higher in a range-bound trading session, helped by gains in metal, realty, pharma and public sector bank stocks. The Sensex rose 0.36% and the Nifty gained 0.46%.

Broader markets also closed with gains. The Nifty Midcap 100 index advanced 0.61% and the BSE Smallcap rose 0.41%.

Top gainers among Nifty sectoral indices were Realty [2.96%], Metal [2.71%], Oil & Gas [1.36%], Energy [1.31%] , Pharma [0.88%] and PSU Bank [0.80%]. Nifty IT was the sole loser with the index falling 0.52%.

PSU Bank [3.5%], Auto [1.24%], IT [0.66%], Metal [0.4%] and Pharma [0.39%]. Top losers were FMCG [-1.03%], energy [-1.01%], Private bank [-0.84%], Financial Services [-0.78%] and Realty [-0.62%].

The Indian rupee rose 24 paise to end at 82.48 against the US dollar on Thursday.

Stock in News Today

JSW Steel: The company’s subsidiary JSW Steel USA said it would partner with two Italian banking institutions, Intesa Sanpaolo and Banco BPM, to raise funds for plate mill modernisation project in Baytown, Texas. Out of the total financing required, $70 million is covered under SACE guarantee and the balance $112 million is a term loan. SACE is the Italian Export Credit Agency specialized in supporting businesses.

Bharat Electronics Ltd (BEL): The company’s consolidated net profit fell 0.11% to Rs 623.7 crore in Q2FY23 as against Rs 624.4 crore in the corresponding quarter last year. Its consolidated revenue rose 7.7% to Rs 3,961.6 crore in the reported quarter as against RS 3,678 crore in the year-ago period. EBITDA margin stood at 22% in the quarter under review compared with 23.5% in the year-ago period.

NMDC: The company demerged its steel business from the core mining business. The stock is currently trading on an adjusted basis. The record date for the demerger was fixed as 28 October 2022. The eligible investors will get one share of NMDC Steel of the face value of Rs 10 each, for each NMDC share held on the record date.

REC: The state-owned company said its consolidated net profit was up 1.5% at Rs 2,732 crore in Q2FY23 as against Rs 2,692 crore in Q2FY22. Consolidated revenue fell 1% to Rs 9,956 crore in Q2FY23 from Rs 10,048 crore in Q2FY22. The company’s board approved a dividend of Rs 5 per equity share.

PC Jeweller: The company’s consolidated net profit stood at Rs 86 crore in Q2FY23 as against a loss of Rs 79 crore in the same quarter last fiscal. Consolidated revenue was up 60.4% at Rs 897.6 crore in Q2FY23 from Rs 559.7 crore in Q2FY22. On a consolidated basis, margin was up 16.3% in Q2FY23 as against 7.1% in the year-ago period.

V-Guard Industries: The company’s consolidated net profit fell 26.6% to Rs 43.66 crore in Q2FY23 from Rs 59.4 crore in the corresponding quarter klast year. Revenue rose 8.67% YoY to Rs 986.14 crore in Q2FY23. EBITDA was down 23.5% to Rs 72.6 crore in Q2FY23. EBITDA margin stood at 7.36% in the quarter under review as against 10.5% in the year-ago period.

Tamilnad Mercantile Bank: The private sector lender said its Net profit was up 37.5% at Rs 262.3 crore in Q2FY23 as against Rs 190.7 crore in the same period last fiscal. NII rose 15.8% to Rs 508.6 crore in the quarter under review as against Rs 439.1 crore in the year-ago period. Net NPA declined to 0.86% for the quarter ended September 2022 as against 0.93% in the preceding quarter.

Veranda Learning Solutions: The company has signed an MoA with the Tamil Nadu Skill Development Corporation (TNSDC) to assist in the implementation of a scheme, which aimed at providing skill development and career guidance to students in government colleges. Under this partnership, Veranda will help students across various departments to acquire industry based skills and become job-ready.

Manappuram Finance: The NBFC announced that its board is likely to meet for considering to raise funds through debt securities in November 2022. The NBFC will consider various options for raising funds through borrowings including by the way of issuance of various debt securities in onshore/offshore securities market by public issue, on private placement basis or through issuing commercial papers.

Balaji Amines: The company’ consolidated net profit rose 16.08% YoY to Rs 92.58 crore on a 19.37% YoY increase in revenue from operations to Rs 627.55 crore in Q2FY23. Total expenses rose 14.02% year-on-year to Rs 468.57 crore in the reported quarter.

Indian Metals Ferro Alloys: The company reported its Q2 results on Thursday. The company’s net profit fell 88.7% YoY to Rs 16.3 crore as against Rs 143.6 crore in the year-ago period. Its revenue was up 3% YoY to Rs 672.5 crore in the reported quarter. EBITDA dropped to 69.2% YoY Rs 72.9 crore in Q2FY23 from Rs 236.5 crore in the year-ago period. EBITDA margin stood at 10.8% for the quarter under review as against 36.2% in the year-ago period.

Kaveri Seed: The company’s board has approved a proposal to buyback equity shares having face value of Rs 2 each for an amount not exceeding Rs 125.65 crore at a price not exceeding Rs 700 per share, payable in cash, from shareholders, from open market. The indicative maximum number of equity shares to be bought back would be 17,95,000. The maximum buyback size represents 9.85% of total paid-up capital.

Modis Navnirman: The company’s board has fixed 28 October 2022 as the record date for the purpose of ascertaining the eligibility of shareholders for issuance of bonus shares. The bonus shares will be in the proportion of three fully paid-up equity shares for every one existing fully paid-up equity share.