Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.28% higher at 17,852, signalling that Dalal Street was headed for a positive start on Friday.

Most Asian shares were trading lower as investors awaited a policy decision from the Bank of Japan amid mixed earnings reports from Japanese companies. Nikkei 225 index fell 0.35%, while Topix was 01.4% higher. Hang Seng dropped 1.65% and CSI 300 index was 1.22% down.

The Indian rupee rose 24 paise to end at 82.48 against the US dollar on Thursday.

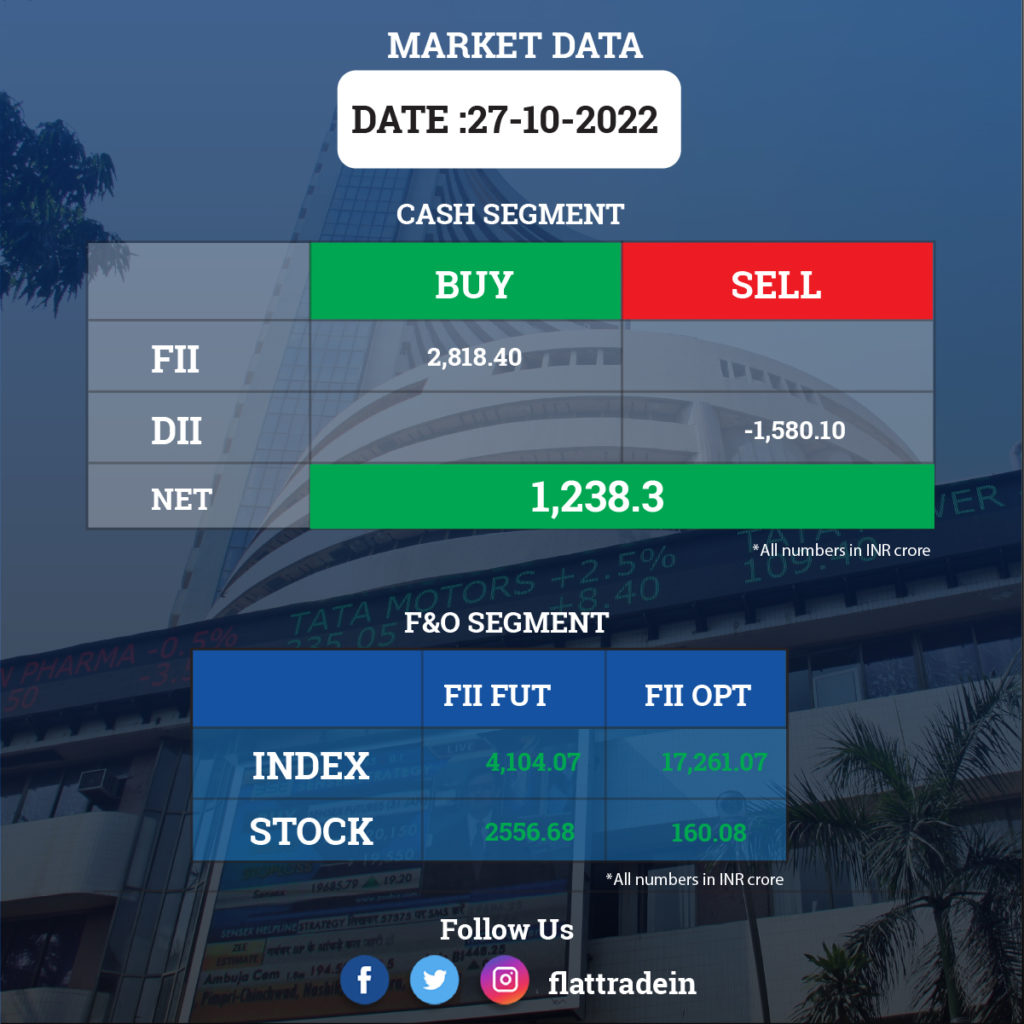

FII/DII Trading Data

Upcoming Results

Maruti Suzuki India, Dr Reddy’s Laboratories, JSW Energy, Vedanta, Tata Power Company, Bandhan Bank, Blue Dart Express, CCL Products (India), Dwarikesh Sugar Industries, Eveready Industries India, NIIT Ltd, Satin Creditcare Network, Sona BLW Precision Forgings, Sumitomo Chemical India, and TTK Healthcare will report quarterly earnings on October 28.

Stocks in News Today

Indus Towers: The company will raise up to Rs 2,000 crore via non-convertible debentures (NCDs) through private placement basis, the company said. A committee of directors will finalise terms and conditions of these NCDs. Meanwhile, the company registered 44% YoY drop in consolidated net profit to Rs 872 crore in second quarter of FY23. Consolidated revenue for the period grew 16% on a year on year basis to Rs 7,967 crore but profit declined due to challenges in the recovery of dues from Vodafone Idea.

SBI Card and Payments Services: The company reported a 52% rise in net profit in Q2FY23 quarter to Rs 526 crore, helped by a spike in income and lower provisions. In the year-ago period, it had reported a net profit of Rs 345 crore. Its total income grew 28% year-on-year (YoY) to Rs 3,453 crore in Q2FY23. Net NPA was down 13 bps to 0.78% during the reported quarter. The company added 1.3 million new accounts in Q2, up 36% YoY

PNB Housing Finance: The company’s net profit rose by 12% year-on-year (YoY) to Rs 263 crore in second quarter ended September 2022 on the back of improved net interest income and margins. Its net interest income (NII) expanded by 29% YoY to Rs 649 crore in the reporting quarter. Net Interest Margin stood at 4.14% in Q2FY23, up from 3.01% in Q2 FY22 and 2.36% in Q1FY23.

Tata Chemicals: The Tata Group company recorded a consolidated profit of Rs 685 crore for the quarter ended September FY23, against Rs 248 crore in same period last year. Revenue from operations for the quarter at Rs 4,239 crore grew by 40% YoY. The higher operating performance was due to improved realisations and efficient cost management amid elevated energy and input costs.

SpiceJet: The airline received aviation regulator DGCA’s approval for wet leasing five Boeing 737 Max planes for up to six months and the airline has already deployed two of the aircraft on different routes, PTI reported citing sources. The sources said the remaining three aircraft will be inducted into SpiceJet fleet in the coming weeks.

Supreme Petrochem: The company has reported a 53% year-on-year decline in standalone profit at Rs 59.64 crore for the quarter ended September FY23, impacted by weak operating performance. Revenue from operations grew by 3.7% YoY to Rs 1,234.6 crore during the same quarter. The company has received board approval for sub-division of shares from one equity share (face value Rs 4 each), into two shares (face value of Rs 2 each), subject to approval of shareholders. The company declared an interim dividend of Rs 4 per share.

Aditya Birla Sun Life AMC: The asset management company has registered a 10.75% year-on-year increase in consolidated profit at Rs 191.68 crore for the quarter ended September FY23, driven by other income. Revenue from operations fell 6.3% YoY to Rs 311 crore for the quarter.

Anupam Rasayan India: The specialty chemical company has recorded a 15% year-on-year growth in profit at Rs 41.2 crore for the quarter ended September FY23 on healthy topline and operating performance. Operating revenues at Rs 310.7 crore grew by 25% YoY and EBITDA at Rs 89.8 crore increased by 29% YoY for the quarter.

CE Info Systems (MapmyIndia): The company recorded flat profit at Rs 25.37 crore for the quarter ended September FY23 against Rs 25.39 crore in same period last year, impacted by lower other income and weak operating performance. Revenue jumped to an all-time high of Rs 76.31 crore for the quarter, growing 35% YoY.

Infibeam Avenues: The company has received in-principle authorisation to operate as a payment aggregator, from Reserve Bank of India. Now the company is allowed to operate as a Payment Aggregator to provide digital payments services to any merchant(s) online or offline across the country.

Dhanuka Agritech: The company said its Board of Directors will consider the proposal for buyback of equity shares of the company through tender offer route, on November 1. The board will also consider un-audited standalone and consolidated financial results for the quarter and half year ended September 2022, on the same day.